According to Euromonitor International, established petfood markets in the US, Japan, Brazil and the UK continue to rule with their retail dominance, but newcomers like Russia, Italy and India are lining up for their very own share from the global petfood bowl. Rising disposable incomes in emerging markets like India and China, coupled with rapid growth in Russia, Ukraine, Indonesia and Vietnam have these regions ready to play a much bigger role in the worldwide petfood and treat market in the upcoming years. Euromonitor predicts that priorities will shift between 2011 and 2016 for emerging and developed markets with 66% of global GDP growth generated in emerging markets and 88% of the global population living in these areas.

With the help of an international team of editors, let's focus in on several of these emerging markets, what they're up to and where they're going in the near future.

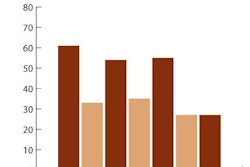

Eastern Europe continues to grow their fledgling pet market with exports and a healthy economic segment. In 2013, the volume of the Russian petfood market should reach 585,000 tons in natural volume and exceed US$1 billion in monetary terms, estimate experts of the State Statistic Service of the country (see Figure 1). The pace of industry growth is going to rise in coming years following the increase of the purchasing power of the Russian population.

According to analysts of Research Techart, the level of sales of industrial feed for cats and dogs in the Russian market will rise 10%-15% annually in monetary terms. Currently this figure amounts to about 7%-8%. This trend is contributed to not only by the increase of the total number of pets, but also by the growth of the number of pet owners who use ready-made food for feeding their animals, as well as the increase of the share of the premium and superpremium types of petfood in the total structure of sales.

Today the undisputed market leaders are the brands of the economy segment (priced from RUB18-75, or US$1.6-$2.5, per kg), in particular Kitekat and Chappi. Second place is occupied by the brands of the premium segment (average price RUB170, or US$5.7, per kg). Here Whiskas and Pedigree are the main leaders. The economic segment accounts for 65% of the market, while premium accounts for only 30%-33%. The share of the superpremium segment in Russia is estimated to be only about 1%. In coming years all analysts predict that the share of sales of petfood in the economy segment will gradually reduce, and by 2020 it will account for only about 45% of the total market.

According to official statistics, in 2012 the average pet owner in Russia spent about US$530 on petfood, which is US$22 more than in 2011. This figure is also predicted to grow by at least US$20-$30 per year until 2020, so Russians could be closer to the level of money spending on petfood in Western Europe. According to experts, as the result of all these trends the volume market of petfood in Russia may rise to US$1.7-$1.8 billion by 2020.

In recent years, Ukraine has been actively developing the export of petfood to the markets of CIS (Commonwealth of Independent States) and Eastern Europe. Currently, about 10% of all petfood produced by local manufacturers are exported to other countries. This figure is projected to double until 2015 following the development of new export opportunities in the region. In 2012, Ukraine exported about 2,500 tons of petfood-a record number for the country. Ukraine currently supplies petfood to Russia, Belarus, Hungary, Moldova, Kazakhstan and Azerbaijan. In the coming year this list could soon include markets in the Czech Republic, Slovakia and the Baltic States (see Figure 2).

While growing their export business, Ukrainian petfood producers have also strengthened their position in the domestic market. The Ukrainian petfood market is currently dominated by international groups such as Mars (Pedigree Petfoods, Royal Cannin, Nutro), which accounts for 70% of the market, and Nestle (Carnation, Spillers Petfoods, Ralston Purina), which hold 15% of the market. In the premium segment, about 50% of the market belongs to Royal Cannin (Mars), 30% to Hill's, 10% to Purina Pro Plan (Nestle) and 10% to local companies. The total share of the domestic Ukraine petfood market is estimated to be 80,000 tons in 2012, which is equivalent to about US$200 million. Domestic production is estimated only at 17,000 tons.

The Indian pet industry has come a long way in the past decade. It has now evolved into a US$800-million-plus industry. At the top of the food chain rests petfood, with 24% annual growth. Continuing its growth trend, the petfood segment in India is expected to register strong double-digit retail value growth in 2013 and beyond (see Figure 4). This growth will be driven by several factors-an increasing number of pet adoptions, rising disposable income, higher awareness of the dietary needs of pets and benefits of petfood, and the booming population of the Indian middle class.

According to Euromonitor International, the pet population in India (including all species) in 2011 was approximately 10 million. Approximately 600,000 pets are adopted every year on average. In most Indian homes, roti (Indian bread) and milk initially comprised the staple diet of pets. However, dog and cat food is now increasingly been perceived as a staple diet for pets. Again, many factors contribute to this change in perception-dual-income couples do not have the time to prepare home-cooked meals and prefer the convenience of commercial food. Further, people are becoming aware of the positive qualities of petfood and the fact that roti and milk do not meet the dietary requirements of pets.

All pet products in India, including petfood, were sold at pet shops or veterinary clinics. That has changed now, as supermarkets, mom-and-pop grocery stores and e-commerce websites have jumped into the fray by stocking petfoods and treats, allowing for wider availability and increased sales. International brands hold a strong presence in India, with the top three players (Mars International Pvt Ltd, Royal Canin India Pvt Ltd and Provimi Animal Nutrition India Pvt Ltd) all being multinationals. Compared with local brands, multinational players have more resources to invest in new product development and prolific marketing. Despite the entry of several indigenous dog food brands into the market, such as Drools and Harley's Corner, none have yet displaced Pedigree (Mars) as the king of dog food in the country since it entered the Indian market in 2001.