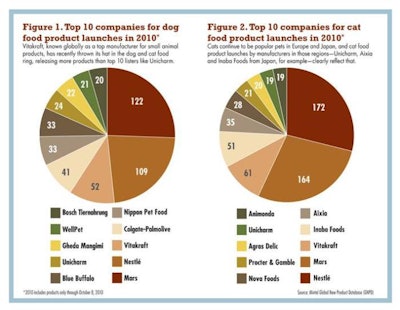

The names in our annual list of the top 10 petfood manufacturers (Figure 3) may remain the same as in years past, but not all global petfood giants have escaped the effects of the economic meltdown, according to data from Euromonitor. Some companies gained, others lost and others managed to maintain, but all have had to learn to adapt and rebound in this difficult economy.

The following is a breakdown of the highest grossing petfood manufacturers internationally, based on 2009 data provided by Euromonitor International. Please refer to Figures 1-5 for more specific information such as the fastest growing companies and the top companies for dog and cat food launches in the past year.

1. Mars Inc.

- World headquarters: McLean, Virginia, USA (Mars Petcare: Franklin, Tennessee, USA)

- Approximate 2009 global retail sales: US$13.3 billion

- Officers: Pierre Laubies, global president of Mars Petcare; Luc Mongeau, president of Mars Petcare US

- Top brands: Advance, Cesar, Dentabone, Dentastix, Exelpet, Greenies, Jumbone, Natural Choice, Nutro, Pedigree, Royal Canin, Sheba, Temptations, The Goodlife Recipe, Ultra, Whiskas

- Websites: www.mars.com

- Vital stats: Mars Petcare launched the Power of Pets program in 2010, a new community-focused initiative. The company is collaborating with YMCAs in cities across the US to bring pet-friendly health, education and programming to communities.

2. Nestlé SA

- World headquarters: Vevey, Switzerland (Nestlé Purina PetCare: St. Louis, Missouri, USA)

- Approximate 2009 global retail sales: US$12.9 billion

- Officers: W. Patrick McGinnis, CEO of Nestlé Purina PetCare; Terrance Block, president of PetCare North America

- Top brands: Alpo, Beneful, Cat Chow, Dog Chow, Fancy Feast, Felix, Friskies, Gourmet, One, Pro Plan, Waggin' Train

- Websites: www.nestle.com; www.purina.com

- Vital stats: Nestlé announced in September 2010 that it had agreed to acquire the Waggin’ Train dog snacks business based in the US. Waggin’ Train has been the dog treat segment’s fastest growing leading brand with annual growth rates of around 30% over the last three years.

3. Colgate-Palmolive Co.

- World headquarters: New York, New York, USA (Hill's Pet Nutrition: Topeka, Kansas, USA)

- Approximate 2009 global retail sales: US$3.4 billion

- Officers: Neil Thompson, Hill's Pet Nutrition president and CEO; Suzan Harrison, president; Janet Donlin chief of the Veterinary Business Channel

- Top brands: Hill's Science Diet, Hill's Prescription Diet

- Websites: www.colgate.com; www.hillspet.com

- Vital stats: Hill's Pet opened a new petfood manufacturing facility in HustopeÄe, Czech Republic, in October 2010. The new plant is now producing Hill's Prescription Diet and Hill's Science Plan petfood for Western Europe, Central and Eastern Europe and Russia.

4. Procter & Gamble Co.

- World headquarters: Cincinnati, Ohio, USA (P&G Pet Care: Dayton, Ohio, USA)

- Approximate 2009 global retail sales: US$3.3 billion

- Officers: Robert McDonald, CEO; A.G. Lafley, chairman; Euka, a Golden Labernese and VP of canine communication

- Top brands: Eukanuba, Iams

- Websites: www.pg.com; www.eukanuba.com; www.iams.com

- Vital stats: Procter & Gamble accelerated its commitment to sustainability in 2010 by unveiling a long-term environmental sustainability vision. As part of P&G's strategy to grow responsibly, P&G Pet Care will work towards a long-term environmental vision that includes only sourcing sustainble fish for cat foods. The company also acquired Natura Pet Products to strengthen its holistic portfolio.

5. Del Monte Foods Co.

- World headquarters: San Francisco, California, USA

- Approximate 2009 global retail sales: US$1.8 billion

- Officers: Richard G. Wolford, chairman, president and CEO; Jeff Watters, Del Monte Pet Products senior VP

- Top brands: Meow Mix, Kibbles n' Bits, Milk-Bone, Snausages, Nature's Recipe (Cat and Dog)

- Websites: www.delmonte.com

- Vital stats: In late November 2010, Del Monte Foods agreed to an acquisition deal with Kohlberg Kravis Roberts & Co., Vestar Capital Partners and Centerview Partners for US$5.3 billion. The pet products segment of the company recently announced an increase of 2.6% over net sales in the same period (second quarter) last year.

6. Agrolimen SA (Affinity Petcare SA)

- World headquarters: Sant Cugat del Vallés, Spain (main plants/facilities: El Monjos, Spain and La Chapelle Vendomôise, France)

- Approximate 2009 global retail sales: US$0.74 billion

- Officers: Xavier Serra, CEO; Joan Morcego, chief marketing & innovation officer; Salvador Campana, CFO

- Top brands: Ultima, Brekkies, Brekkies Excel Cat, Advance, Advance Veterinary Diets

- Websites: www.affinity-petcare.com

- Vital stats: Affinity Petcare is setting out to conquer the European petfood market. The company has acquired a number of leading European brands, including Advance, Brekkies, Royal Chien, Premium, Play Dog and Play Cat, Repas Complet and Repas Equilibré. Affinity has an 11% market share of the dry petfood sector in the EU, behind Nestle (29%) and Mars (18%).

7. Uni-Charm Corp.

- World headquarters: Tokyo, Japan

- Approximate 2009 global retail sales: US$0.42 billion

- Officers: Toshio Takahara, chairman; Gumpei Futagami, president/CEO

- Top brands: Aiken Genki, Neko Genki, Gaines

- Websites: https://www.unicharm.co.jp/ja/home.html; www.uc-petcare.co.jp

- Vital stats: According to Uni-Charm's website, the company has released over 20 new products for dogs and cats over the past year. The Japanese company also makes both lists for the top 10 cat food and dog food launches for 2010, according to data from Mintel.

8. Nutriara Alimentos Ltda.

- World headquarters: Arapongas, Parana State, Brazil

- Approximate 2009 global retail sales: US$0.34 billion

- Officers: Marcos Calsacara, president Brazilian Pet Foods; Marcelino Bortolo, technical and product development

- Top brands: Br4Dogs and Cats, Dog Show, Foster; Freddy's, Pitty; Bybos, Blog Dog

- Websites: www.brazilianpetfoods.com.br

- Vital stats: This Brazilian manufacturer diverged into two companies, Brazilian Pet Foods and Nutriara, in January 2010. Nutriara is the holding company in the agreement and the company name will be used for several years until Brazilian Pet Foods is well established. The company recently released several new lines of treats for dogs and cats and an innovative line of "soup meals" for pets.

9. Total Alimentos SA

- World headquarters: Três Corações, Brazil

- Approximate 2009 global retail sales: US$0.32 billion

- Officers: Antônio Teixeira Miranda Neto, president; Paulo Tavares, financial director; Anderson Duarte, technical director

- Top brands: FamÃlia Max, Big Boss, Lider, K&S, EquilÃbrio, Naturalis, Natural treats

- Websites: www.totalalimentos.com.br

- Vital stats: Total Alimentos announced during Interzoo 2010 that ANFAL-PET, the petfood trade association in Brazil, was working with Brazilian petfood companies to develop a new sustainability program that will be part of a certification program. Total Alimentos hopes to lead the way in this green movement.

10. Nisshin Seifun Group Inc.

- World headquarters: Tokyo, Japan

- Approximate 2009 global retail sales: US$0.26 billion

- Officers: Osamu Shoda, chairman; Hiroshi Hasegawa, president

- Top brands: Run, Carat, Lovely, JP-Style

- Websites: www.nisshin.com; www.nisshin-pet.co.jp

- Vital stats: Nisshin Pet Food Inc. broadened its JP-Style brand of premium dog foods, adding dog treats and products for puppies, bringing the company's lineup to 27 products. The new JP-Style products are sold exclusively by mail order.