As reported in Packaged Facts’ recently released Pet Food in the US (September 2014), overall sales patterns have been unprepossessing for private label petfood and treats. Petfood and treat dollar sales were down 3.6% overall for the 52 weeks ending March 23, 2014, according to IRI multi-outlet tracking, including sales losses in dog food (down 4%) and cat food (down 5%).

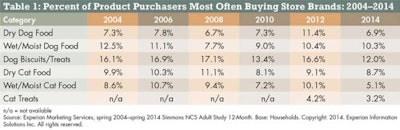

Consumer survey data from Simmons (Experian Marketing Services) tell the same general tale. Despite some ups and downs over the last decade by petfood or treat category, the percent of consumers who report most often buying “store brands” has generally fallen between 2004 and 2014, and over the last couple of years (see Table 1).

With these consumer survey data—unlike with retail sales scanning data—there is certainly room for confusion by consumers in recognizing which brands are “store brands,” particularly in the case of private labels that do not simply fly under the store name banner (which is more often the case in petfood than in human food, and across pet product retailing channels). Even so, the topline data from Simmons point in the same downward direction as the IRI.

The Simmons data also, however, indicate some bright spots for store brands. Dog owners who shop for pet supplies at discount stores, for example, are almost twice as likely as average to buy store brand dry dog food (an an index of 191, or 91% above the overall average rate for purchasing of store brand dry dog food). This finding is hardly surprising since Walmart’s Ol’ Roy dog food brand, launched in 1983, has grown to be the largest selling dog kibble by volume.

Significantly, however, there are pockets of success across retail channels (see Figure 1). Other standouts for store brand product success include dog biscuits/treats at wholesale clubs (at an index of 180, or 80% above average), dry cat food at discount stores (index of 157) and wet/moist dog food at supermarkets (index of 153). Costco, of course, is widely acknowledged for the quality of its Kirkland Signature store brand, and supermarkets such as Hy-Vee and Publix have rolled out high quality, on-trend private label petfoods.

In addition, store brand dry cat food is a success for Petco, as are dog biscuits/treats for PetSmart. This private label strength in pet superstores, with their premium-to-superpremium petfood assortments, underscores the point that store brand success has long been about value, broadly defined, rather than simply about rock bottom price points vis-Ã -vis mass-market name brand leaders. Even with its laser focus on lower prices, Walmart itself launched its first “ultra premium” dry dog food, Pure Balance, in 2012.

To a significant degree, the jury is still out on private label petfoods. Packaged Facts consumer survey data show that, when asked their opinion on whether store brand petfoods are as often good as national name brands, over a third (36%) of pet owners are neutral or undecided. Even so, consumers hardly look on store brands with a jaundiced eye (see Table 2). A fourth of dog or cat owners at least somewhat agree that store brand petfoods are often as good as national brands, and the block of consumers who are somewhat or strongly sold on the quality of store brands is twice as large as the block of consumers who are not.