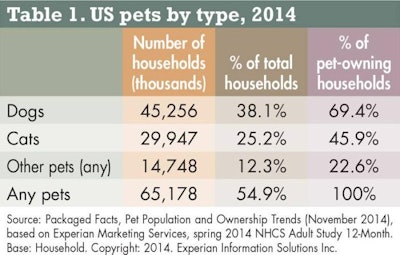

Packaged Facts’ new study on Pet Population and Ownership Trends reports that 65 million American households have pets of any type, for an overall total of over 200 million pets. Pet owners make up roughly 55% of households, including 45 million households with dogs and 30 million with cats (see Table 1).

Dogs (especially) and cats have kept their special place in American culture. The vast majority of dog and cat owners consider their pets to be members of the family, and most consider their dogs or cats to be integral to their lifestyles and vital to their mental and physical health. As of 2014, pet dogs in the US numbered approximately 80 million, compared with 61.5 million for pet cats.

From a bird’s-eye view, pet population growth over the last decade has been robust, fueled by an impressive 20 million gain in the pet dog population between 2004 and 2014 (see Table 2). Nonetheless, storm clouds may be brewing for pet industry growth. Factoring in the most recent data, Packaged Facts estimates that the pet dog population increased by only 3 million over the five-year 2009–2014 period, compared with a 17 million growth spurt in the 2004–2009 period.

The pet cat population similarly grew by 3 million for the 2009–2014 period, down somewhat from a 4 million gain for 2004–2009. Of overall dog and cat population growth across the last decade, therefore, less than one-fourth occurred in the last five years. Since 2011, moreover, the overall percent of households owning pets has remained flat at around 55%.

The economic doldrums from which we are only now emerging have, of course, played their role in this slowdown in pet population growth, given that households with incomes below US$50,000 are less likely to own pets.

In addition, demographic trends are weighing in heavily for pet market growth. Between 2015 and 2020, as the boomer cohort continues its numerical stampede, the 65+ age group will increase nearly four times faster than the US adult population as a whole. This graying of America has raised an alarm for the pet industry because pet ownership drops off with age. While 53% of 65- to 69-year-olds own pets, just 34% of Americans in the 70+ age group have a pet in their home.

One of the most significant questions facing the pet industry has been whether boomers will follow in the footsteps of previous generations in relinquishing pet ownership in their senior years. Given that boomers have been a generation that makes its own rules, however, and the preoccupation of boomers with keeping fit and keeping time on their side, boomers should prove more likely than previous generations to keep pets well into their later years.

Hispanic pet owners are also key to pet population and pet industry sales growth. Households with children are more likely to own pets, and Latinos now account for 25% of all children under the age of five. Latinos are already disproportionately important as owners of pet birds, and the most acculturated Latinos are slightly more likely than US adults on average to own dogs. As US-born generations of Latinos grow in numbers and economic heft, dog ownership rates are likely to increase significantly among the burgeoning Latino population.

A third market growth factor to watch is an uptick in multiple-pet households (see Table 3). Most notably, the share of dog-owning households with only one dog fell from 64% in 2004 to 56% to 2014. Multiple-cat ownership has also notched up, though to a less marked degree, due to an uptick in households with 2–3 cats.

Additional factors will also keep driving pet industry growth—most importantly the growing understanding of the mutual benefits of human-animal bond, which will continue to drive the humanization of pets and the associated premiumization of pet products and services.