Overall US pet care spending is projected to grow nearly 5% this year, topping out at US$58.5 billion, according to the American Pet Products Association (APPA). Of that, US petfood spending is expected to reach US$22.62 billion by the end of 2014, after increasing 4.5% in 2013 to a total of US$21.57 billion, APPA said.

Interestingly, in presentations given during APPA's Global Pet Expo in March and also at Petfood Forum 2014, David Sprinkle, research director for Packaged Facts, pegged US petfood spending for 2013 at US$26.1 billion; he said the figure had been adjusted upward from earlier projections because his firm's data sources now include sales from Walmart and other outlets previously not covered. However, that represented only 3.7% growth from 2012. (APPA does not divulge its data sources, so it's difficult to explain the discrepancy between its figures and Packaged Facts'.)

Whichever set of data you use, petfood spending is still growing, at least in the US and many other markets around the world, and even the lower growth rate is one that most other consumer product goods industries would die for. Fueling the growth are the same drivers that have benefited our industry for several years now: continuing humanization of pets and consumer focus on health and well-being, for their pets even more than for themselves.

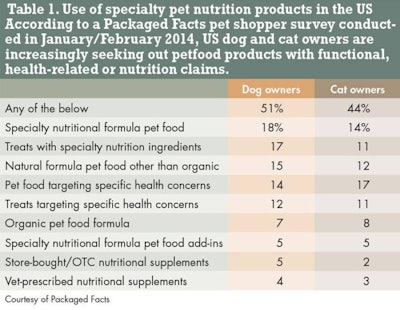

Sprinkle presented data from a Packaged Facts pet shopper survey, conducted in January and February of this year, showing that 51% of US dog owners and 44% of US cat owners purchase at least one type of specialty pet nutrition product. And these types of purchases are increasing; when Packaged Facts asked a similar question in 2013, 41% of US dog owners said they purchase one or more types of specialty ingredient formulation dog food. (A corresponding 2013 data point was not given for cat owners.)

When you dive into the types of products this category encompasses (Table 1), note the prevalence of treats, add-ins and supplements. Sprinkle also discussed the rising interest in treats especially that follow the ongoing natural, functional and humanization trends-and that interest is now extending to cats. While dog owners have long been heavy purchasers of treats, with 81.6% of US dog-owning households doing so in 2013, cat owners are finally starting to treat their cats in a similar fashion. The percentage of US cat-owning households buying cat treats soared from only 39.6% in 2006 to 52.8% in 2013 (for dog owners, it was already at 79.1% in 2006).

Sprinkle called this the "dogification" of the cat market-yet another new trend to follow.