Currently, Petfood Industry’s Top Petfood Companies Database compiles comprehensive information on over 300 international petfood and treat manufacturers. Our industry is now making a significant influence in almost every country and every continent and, most importantly, nearly every home with a family pet. Even markets like Eastern Europe, Africa and the Middle East are seeing less table scraps and more packaged petfoods in dogs' and cats' bowls, while mature markets like Western Europe and the US are continuing to innovate and adapt to a demanding pet parent-influenced marketplace.

Let’s take a closer look at some key areas across the globe and spotlight the movers and shakers in our database that are truly making an impact.

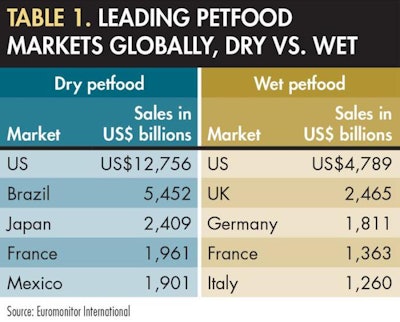

According to a recent report by Euromonitor International, Brazil, Mexico and Japan are poised to make the most growth by volume (in tons) based on 2013–2017 data and projections. Looking to capitalize on the rapid growth in Brazilian petfood markets, in July 2014, Brazil-based Mogiana Alimentos and Barcelona, Spain-headquartered Affinity Pet Care joined together in a 50/50 partnership that included the transaction of all petfood categories as well as the Campinas and Bastos plants. All brands of Mogiana Alimentos currently marketed in Brazil have been maintained.

Affinity, in its international expansion plan, was looking for petfood market opportunities in Brazil. Mogiana Alimentos' main competitive advantages that were decisive for this joint venture with Affinity were the full product portfolio and the company distribution capacity in Brazil. This joint venture has strengthened both companies, mainly to compete more vigorously in a market that is increasingly competitive. There are plans for the business expansion and growth in the petfood and pet care Brazilian markets.

Brazil the fastest-growing pet market globally and is now the second-largest petfood market (behind the US), according to Euromonitor. Petfood sales reached US$5.8 billion in 2012, a figure even Euromonitor hadn’t projected Brazil to hit until 2015. Now the research firm says Brazil owns 8% of the global pet market and will add more than US$2 billion in total pet care sales by 2017. The overall pet market is 31% of the country's GDP, sixth after textiles, machinery, beauty/personal care, telecom and electronics. Petfood comprises 53% of that pet market, and more people are buying petfood online.

For database information on Mogiana Alimentos: www.petfoodindustry.com/MogianaAlimentos.html

For database information on Affinity Pet Care: www.petfoodindustry.com/AffinityPetcare.html

Vitakraft, manufacturers of an extensive line of petfood products for dogs, cats, rodents, birds, fish, reptiles, hedgehogs and ferrets, is currently streamlining its logistics in Europe. The Germany-based company has already slimmed down its logistics center for Holland and Belgium as well as Poland and the Czech Republic. In Croatia and Slovenia, the company is now working with general forwarding agents that have their own warehousing for Vitakraft products.

Following the arrival of Deuerer as the main shareholder, Vitakraft has trimmed its range considerably in 2014 to around 2,000 instead of 3,000 articles. However, the company intends to continue operating as a full range supplier. In October 2012, Vitakraft announced an agreement with Wanpy, a Chinese manufacturer of dog and cat treats, to expand its petfood offerings into the Asian market. As part of the cooperation, a new petfood factory in Yantai in Shandong province was to begin production at the end of 2012. The newly established distribution company, Vitakraft China, markets the new range of dog and cat food, as well as distributing pet products from the other segments of Vitakraft to the east and southeast Asia-Pacific region.

For database information on Vitakraft: www.petfoodindustry.com/Vitakraft.html

Historically, Africa has remained a relatively untapped market for petfoods and treats, but according to recent reports, all of that may very well soon change. Kenya's petfood market is poised for growth as the country's wealthy catch up with the global trends of increased pet ownership and pet humanization.

According to the US Department of Agriculture Foreign Agricultural Service, Kenya’s petfood market grew 27% in 2006–2010, and Kenya’s petfood imports totaled about US$960,000 in 2010. “People are now busier and wealthier," said Riaz Gilani, director of Kenyan petfood manufacturer Gilani Gourmet. "They have children whom they cannot spend time with [compared] to previous generations. So there are a lot of instances where a parent would be arm twisted into buying a puppy for their child. You have situations where people would rather have dogs for security, especially if they have a big compound. You also have the growing class of people who buy dogs for status [and] this is a growing trend in Kenya.”

Barriers such as high taxation, prohibitive permit requirements, fears of terrorism and high electricity costs make it difficult to do business in Kenya, said Gilani. His fastest-moving item today is fortified dog rice, a dry product that serves as the staple in a pet’s meal. “When we started out, we’d be lucky if we sold a ton a month, but now we are selling about 30 tons a month,” says Gilani.

In late 2013, Gilani Gourmet diversified into cooked beef and chicken mince, which meet the needs of owners who don’t have time to cook for their pets or who prefer not to store beef in their freezers. He predicts it will become his best-selling product. Gilani’s next idea is to further reduce the burden of owning a pet by making home deliveries that will make him less vulnerable to the unpredictability of consumer purchasing behavior and guarantee him a customer base.

For database information on petfood companies who serve Africa and the Middle East: www.petfoodindustry.com/TopCompanySearch.aspx?MarketsServed=Middle%20East%20and%20Africa

Eastern Europe may be right in the middle of the pack when it comes to regional market performance in the petfood industry—US$5.3 billion in 2012 according to Euromonitor International, ahead of Australasia and the Middle East and Africa. Eastern Europe is edging out Asia Pacific (US$1.4 billion) in terms of absolute retail value gains through 2017 (US$1.6 billion), also significantly beating out MEA (US$200 million) and Australasia (US$100 million).

Cat food sales in Russia are also the country's best-growing pet market, up from US$1.49 billion in 2011. Dog food grew as well, though not as significantly, from US$706.7 million in 2011. Pet products inched up from US$327.9 million in 2011, while the fairly stagnant "other pet food" category increased very slightly from US$18.9 million.

Russia may have the most prominent expected growth, but the smallest markets within Eastern Europe are making headway of their own. Armenian feed company Manana Grain intends to launch a production line of petfood for cats and dogs—the first such line in Armenia. The company launched a line of fish food in October 2013, and plans to produce cat and dog food in the same plant. According to statistics, in 2012 Armenia imported about 355 metric tons (US$770,000) of food for dogs and cats. The total volume of the market in 2013 is estimated between 380 metric tons and 450 metric tons.

Belarusian producers control up to 40% of the national petfood market, a substantially higher percentage than Russia controls of its own market (10%). Belarus' largest petfood manufacturer, Zhabinka Feed Mill, holds up to one-third of the country's market. The worth of Belarus' petfood market currently comes in at US$18 million, and is expected to reach US$22 million by 2020.

The Czech Republic's new pop-up restaurant, Pestaurace, caters to canines, adding itself to the list of growing global pet-based dining experiences. Pestaurace launched a cross-country tour in July 2014, hoping to appeal at a time when petfood is a fast-growing market in the Czech Republic. According to Euromonitor International, there is a significant trend to high-quality dog food in the country, and the sector is posting constant growth.

For database information on companies who serve Eastern Europe: www.petfoodindustry.com/TopCompanySearch.aspx?MarketsServed=Eastern%20Europe