The term "recession-proof" is often applied to the pet products market, and it now appears "disaster-resistant" may join the list. Following the biggest pet food recall in history, the North American market has snapped back, with both retail sales and new product introductions exceeding pre-recall levels.

But not everything is positive. During the 52 weeks ending April 20, 2008, sales of dog food in mass-market outlets tracked by Information Resources Inc. (IRI) - supermarkets, drugstores and mass merchandisers excluding Wal-Mart - rose just 2.5%. This is not exactly stellar, even less so given that poundage declined by the same amount.

With cat food, dollar sales rose 3.2% while volume sales fell 4.1%. These figures clearly illustrate that dollar sales gains are coming from higher prices rather than incremental growth, which has been the case for some time. What may be surprising is just how quickly and steadily prices have been going up.

Paying more than ever

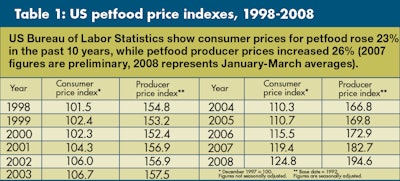

Trends in consumer price indexes bear out that US consumers are paying more for pet food than ever before. According to the US Bureau of Labor Statistics, the consumer price index for pet food has risen 23% from 1998 to 2008, with the majority of this increase in 2003. Though some manufacturers claim they've been absorbing higher production costs, government data show the increases have been passed on to consumers almost point by point, with the producer price index for pet food rising 26% during the 10 years (Table 1).

With high energy costs and pet food increasingly competing with human food for ingredients, production costs can be expected to continue to increase for the foreseeable future. Add in the ongoing focus on ingredient sourcing and traceability spurred by the recalls, and one can rest assured that pet food prices will continue to rise.

Sharp contrasts

For the premium demographics many companies now consider their base Americans with high household incomes and intense pets-as-family proclivities all this may not mean much. These are the pet owners least likely to feel the economic pinch or cut back on indulging their "kids."

In sharp contrast, a fair number of economically challenged consumers may drop out of the pet market, at least temporarily. Already, dozens of US shelters have reported a spike in consumers' dropping off pets because they can no longer afford their care.

That leaves all those pet owners in the middle. After the recalls, some may have switched to higher priced foods, but as the going gets tougher, many may be considering moderately priced options.

A prime example is Mars' Goodlife Recipe, launched a few months before the recalls. The dry dog food and treats had sales of US$15.3 million during the first two quarters of 2007, according to IRI. During the 52 weeks ending April 20, 2008, sales rose 365%.