The global pet food market

www.petfoodindustry.com/pet-food-market-dataThe Asia-Pacific pet care market has seen slow but steady growth over the last several years. From roughly US$8.94 billion in retail sales in 2009 to about US$9.83 billion in 2014, according to Euromonitor International data, it’s clear that pets are becoming increasingly significant to this area of the world. Dog and cat food specifically made up US$6.12 billion of the Asia-Pacific pet care retail sales market in 2014 (compared to US$5.7 billion in 2009), with other pet products making up a further US$3.39 billion (compared to US$2.92 billion in 2009).

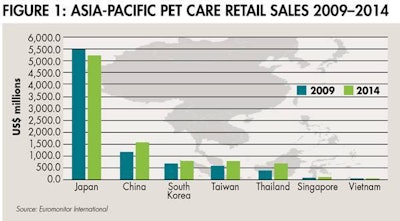

Japan and China in particular have been contributing significantly to these numbers, making up US$5.24 billion and US$1.56 billion of overall retail sales in the Asia-Pacific pet care market in 2014, respectively. Other Asian countries such as South Korea (US$839 million in pet care in 2014), Taiwan (US$782 million) and Thailand (US$665 million) have seen plenty of growth since 2009 and are making their own strides in the regional market, according to Euromonitor data (see Figure 1). Still other countries, such as Singapore (US$93 million in 2014 pet care sales) and Vietnam (US$19.1 million), remain the smallest contributors to the Asia-Pacific market, though they, too, continue to grow—Singapore saw US$76.6 million in pet care retail sales in 2009, while Vietnam saw just US$7.4 million.

Japan holds the top spot in Asia-Pacific pet care sales; however, as a more mature market its numbers actually declined slightly between 2009 and 2014. China and other developing-market countries in the region are expected to continue growing.

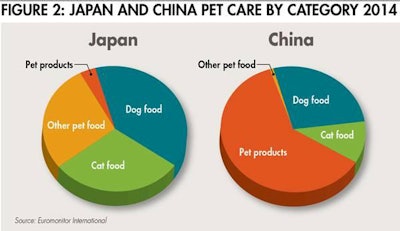

Japan and China have significantly different breakdowns of their overall pet care markets (see Figure 2). In Japan, pet food made up the vast majority (72.3%) of the country’s 2014 pet care retail sales, bringing in US$3.79 billion, according to Euromonitor. Of that, US$2.05 billion (39.1% of all pet care sales) was dog food and US$1.56 billion (29.8%) was cat food. Pet products brought in another US$1.46 billion (27.9%).

Japan and China have significantly different breakdowns with regards to pet care sales, illustrating a diversity of opportunities in the Asia-Pacific pet food market.

In China, on the other hand, pet products held sway over a majority (61.4%) of the country’s 2014 pet care retail sales, bringing in US$958.3 million. Pet food came in at US$603.2 million (38.7%), with US$421 million of that in dog food (27% of total pet care sales) and US$171.7 million (11%) in cat food.

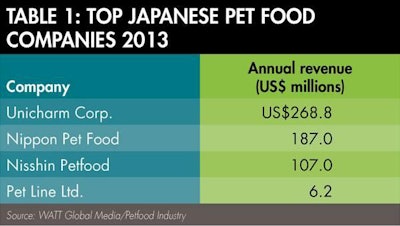

Japan, in spite of claiming the largest Asia-Pacific pet care numbers, has seen stagnant and even negative pet food growth since 2009 as a mature market. Three of the four top Japan-based companies, as compiled in Petfood Industry’s Top Companies Database, each bring in more than US$100 million in revenue annually (see Table 1).

Three of the four top Japan-based companies, as compiled in Petfood Industry's Top Companies Database, each bring in more than US$100 million in revenue annually.

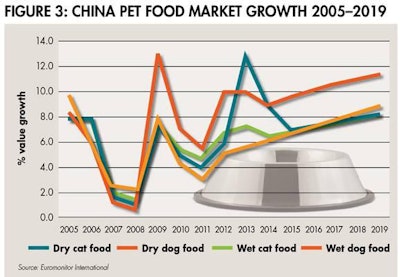

In contrast, China’s pet food market has been up and down since 2005 (with a significant drop during the weak global economy in 2008 and only recent re-stabilization), but is projected to continue growing through 2019 (see Figure 3). China’s projected growth is significant for a country that has been beset for several years by various domestic pet food safety woes. The most prominent of these are tainted jerky dog treats sourced from China, which have been linked to more than 1,000 US dog deaths since 2007. The US Food and Drug Administration (FDA) has received more than 4,800 complaints of pet illnesses linked to the same treats. In 2014, Petco became the first US pet food chain to stop selling pet treats made in China, and PetSmart soon followed suit. While these problems may have hurt China’s domestic pet food market, they have also opened the doors for expanded foreign market opportunities, as the country’s consumers seek to replace their local products with imports.

In spite of up-and-down pet food market growth over the last several years, China is expected to see steady growth in all areas of dog and cat food through 2019.

The Southeast Asia (SEA) segment of the Asia-Pacific market (which includes Thailand, Malaysia, Indonesia, Singapore, Philippines and Vietnam) has its own significant growth to look forward to, according to a recent report by Future Market Insights. “Pet Care Market: Southeast Asia Industry Analysis and Opportunity Assessment 2014–2020” says that SEA growth will hit 6.8% by 2020, driven largely by an increasing concern towards pet health and growing demand for luxury products.

Improving consumer lifestyles and increasing disposable income in Southeast Asian countries has resulted in a growing acceptance for pets, not only among the high-income population, but also the middle-income group, according to Future Market Insights. In 2014, Thailand was the dominant country in the overall SEA pet care market with a 43.62% share, followed by Malaysia and Indonesia, which accounted for 21.74% and 15.47% of the market, respectively. The pet care market in the Philippines is expected to register a significant compound annual growth rate (CAGR) of 8.4% through 2020. This is expected to be followed by Vietnam, with a CAGR of 8% during the forecast period.

Dog food is currently the primary segment in the region, accounting for 51.6% of the market in 2014. In terms of pet food distribution channels, consumers in SEA look mostly to supermarkets; however, veterinary clinics are anticipated to exhibit the fastest CAGR at 7.1%, followed by supermarkets at 6.8%. This growth is attributed to a shift in consumer buying habits and an increasing inclination of pet owners to purchase health and wellness products from sources seen as knowledgeable and reliable, such as veterinarians, says the report.

Unsurprisingly, as in other regions of the global pet food market, innovation and a focus on consumer desires will remain key to gaining ground in the Asia-Pacific segment. As the more mature markets slow their growth, developing areas of the market will become a more significant focus for both domestic companies and foreign entities looking to expand their reach over the next several years.

The global pet food market