The specialty segment of the global pet food industry is the one area seeing growth across the board: mature markets, developing markets, places where growth in all areas is a given and places where other parts of the pet food market are stagnating or even losing ground; it seems that whatever the larger economic or market situation, pet owners everywhere are paying more attention to what their pets are eating.

Specialty pet food as a category covers a lot of ground. Products falling under that particular banner can be found in dry, wet and semi-moist pet food, as well as the smaller but ever-growing raw, refrigerated, frozen and freeze-dried pet food segments.

How do some of these subcategories stack up globally? Petfood Industry compiled data from our Top Pet Food Companies Database, an exclusive database of top companies within the pet food industry with information about annual revenue, brands, geographic markets served, key product categories and milestones. We took a look at the top 102 companies for which 2013 revenue data was available to get an idea of how the specialty pet food trend is playing out among the largest pet food companies, as well as how it looks across several regions.

The top 11 global raw pet food manufacturers made a combined US$576.98 million in 2013, according to Petfood Industry’s database (see Table 1). Most of the companies hail from the US, though the top company, V.I.P. Petfoods, is based in Australia. V.I.P., founded in 1994, is currently in the middle of expanding its business through its acquisition by Quadrant Private Equity, a US$317.8 million deal. Quadrant will partner with the founders of V.I.P. to back the existing management team, including Rex Devantier and Kent Quinn, to grow the business domestically and internationally, according to reports. Founders Tony and Christina Quinn will remain significant shareholders and continue to provide ongoing support to the business.

While the US dominates in raw pet food production, several other countries (including the home base of the top raw producer in our database) are represented, including Australia, the United Kingdom and New Zealand.

“Over the past two decades, V.I.P. has grown to become a leading Australian manufacturer of pet food and one of the largest manufacturers of pet food in the world,” said Tony Quinn. “Christina and I are proud of what we and our team have achieved in building V.I.P. into a world class pet food manufacturing business and we believe Quadrant is the right partner to assist the team over the next phase of growth, which we look forward to being a part of.”

V.I.P., by far the largest company, revenue-wise, on the raw pet food list, made US$324.45 million in 2013. US-based Nature’s Variety and Freshpet, companies two and three on the list, made US$80 million and US$70 million, respectively, in 2013.

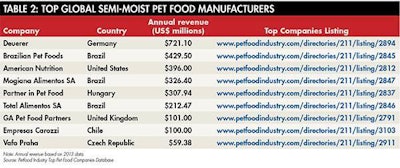

Semi-moist pet food is another subcategory that covers a lot of ground, but many products in the category fall into the specialty segment. The top nine companies manufacturing semi-moist pet food are a diverse group, based in Germany, Brazil, the US, Hungary, the United Kingdom, Chile and the Czech Republic (see Table 2). Combined, their annual revenue hit US$2.65 billion in 2013, with Germany-based Deuerer leading the pack at US$721.1 million.

Semi-moist pet food has a global scope, including producers from North America, Western Europe, Latin America and Eastern Europe.

In the latter part of 2013, Deuerer was bought out by UK-based pet food manufacturer Pets Choice, which Deuerer had previously been a supplier for.

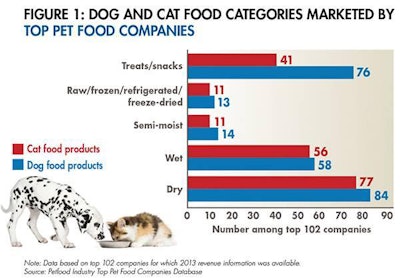

Among the top 102 companies in the Top Companies Database, dry and wet pet food of all types reign supreme. However, semi-moist food, raw/frozen/refrigerated/freeze-dried products, and pet treats all show up as products being manufactured by these primary companies in the global industry. Fourteen of the companies produce semi-moist dog food products, and 11 produce semi-moist cat food products (see Figure 1). Thirteen of the companies produce dog food that falls into the raw/frozen/refrigerated/freeze-dried category, and 11 produce cat food calling into the same category. Significantly, 76 of the 102 companies produce dog treats and 41 produce cat treats, making pet treats a significant focus for top pet food companies around the world. Our list of top companies includes 46 North American companies, 36 companies from Western Europe, nine from Latin America, five from the Asia-Pacific, two from Eastern Europe, two from Australasia and two from Africa.

Of the 102 top companies appearing our database (based on 2013 revenue), the majority deal in dry pet food and treats. However, more than half of them deal in wet pet food, 13% produce raw/frozen/refrigerated/freeze-dried dog food and 11% produce cat food in the same category.

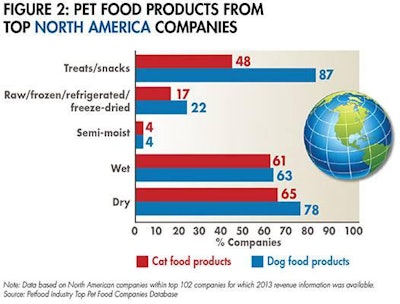

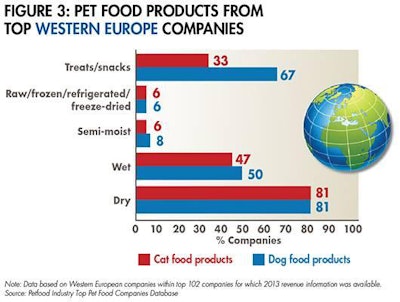

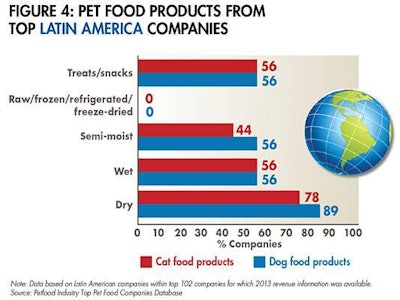

Perhaps predictably, North American companies are overall most likely to delve into the more niche specialty categories such as raw or refrigerated pet food. Twenty-two percent of the North American companies within the top 102 deal in raw/frozen/refrigerated/freeze-dried dog food, and 17% deal in the same for cat food (see Figure 2). This compares to just 6% of Western European companies for both dog and cat food (see Figure 3) and 0% in each category for Latin American companies in the top 102 (see Figure 4).

Of the North American pet food companies appearing in the top 102 list, 22% produce products in the raw/frozen/refrigerated/freeze-dried dog food category, while 17% produce food in the same category for cats.

Of the Western European countries in our top 102 list, about half deal in wet pet food of either dog or cat type. The numbers for more specialty subcategories, such as semi-moist or raw/frozen/refrigerated/freeze-dried, are fairly low—between 6% and 8% dog and cat food producers in each category.

While the actual number of Latin American companies appearing in the top 102 is small (nine), those companies dominate in the semi-moist pet food category—56% of the companies produce semi-moist food for dogs, while 44% produce the same for cats, compared to the much smaller percentages of North American and Western European companies.

Latin America, however, dominates in the semi-moist pet food categories for both dogs and cats. According to Top Companies data, 56% of Latin American top companies produce semi-moist dog food, and 44% produce semi-moist cat food. These numbers far exceed North America’s 4% of companies in each semi-moist category and Western Europe’s 8% and 6% for semi-moist dog and cat food, respectively.

As the popularity of specialty pet food continues to grow globally, there’s plenty of room for companies around the world to make their marks. Analysis of the top companies in the industry can provide solid indicators of just which way the trend will flow.

Top Pet Food Companies Database