Digital media usage continues to command the attention of Americans of all ages. Analysts might debate how much time per day Americans spend with digital media, the implications of multi-screen multi-tasking and whether smartphones have overtaken desktop/laptop usage. But it’s clear that digital media usage makes up a major part of how Americans spend their day, get things done and sort out their shopping.

Pet owners are no different. In fact, according to new Packaged Facts survey research, pet owners are even more likely to use digital devices and technologies than their non-pet owning counterparts. For example, 74% of pet owners report using a smartphone (such as an iPhone, Android or Blackberry) in the last 30 days, compared with 64% of non-pet owning adults. Similarly, 48% of pet owners have used mobile apps in the last month compared with 36% of the petless.

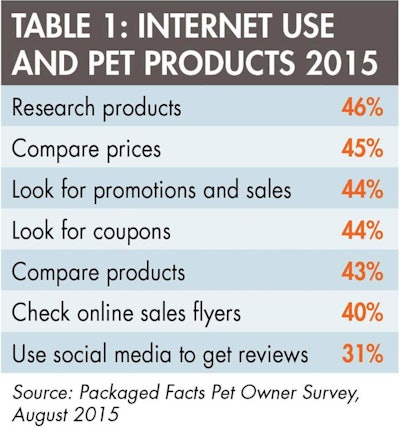

When it comes to using the Internet in relation to pet products and services, the most common activity is researching pet products online, which 46% of pet owners have done within the last 30 days (see Table 1). More specifically, 27% researched pet products using a PC/laptop, 19% by smartphone and 8% by tablet. Following closely behind are various forms of price shopping and sale hunting.

According to Packaged Facts data, 46% of pet owners used the Internet to research pet products. Pet owners were asked in August 2015 about their use of the Internet in relation to pet products in the last 30 days.

Among pet owners who have used mobile apps in the last seven days, more than half have done so for various pet product shopping activities, or would be interested in using apps for this purpose in the future. The most common pet product shopping activity that mobile apps are already being used for is to make shopping lists.

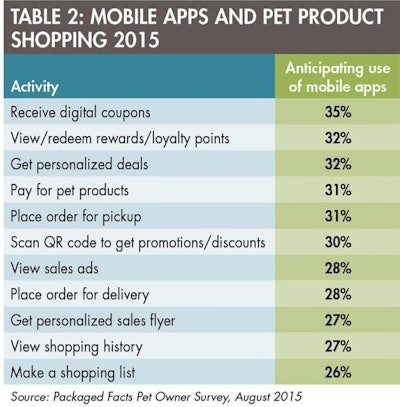

Shopping list functions are of less interest in terms of broadening pet owners’ use of apps. Topping the list of anticipated future uses among those who are already using apps for pet product shopping, are receiving digital coupons (35%), viewing/redeeming rewards points and getting personalized deals (see Table 2).

Among those consumers already using mobile apps for pet product shopping, a good number anticipate using them for money-saving purposes: 35% surveyed anticipate using apps to receive digital coupons, 32% to view or redeem rewards or loyalty points, and 32% to get personalized deals.

Emphasis on loyalty programs and shopping experience personalization is vital to marketers and retailers, given the growing realization that mass coupons and discount deals can merely trigger a short-term spike in sales, and fail to build (or even work against) long-term customer and brand loyalty. Moreover, nearly a quarter of pet owners indicate that when shopping for pet products, loyalty/rewards programs are especially important to them.

As pet parents and pet product shoppers continue to rely more heavily on digital media technologies, manufacturers and retailers must follow suit. Dog owners in particular over-index in mobile lifestyle behaviors, compared to the overall US population. For example, dog owners are 21% more likely than average to often use their mobile or handheld device to search for local deals, according to Simmons data from Experian Marketing Services. Similarly, dog owners are 16% more likely to purchase products advertised on their mobile phone.

Packaged Facts report

Pet Product Marketing Trends in the US: Technology, Mobile and Social Media