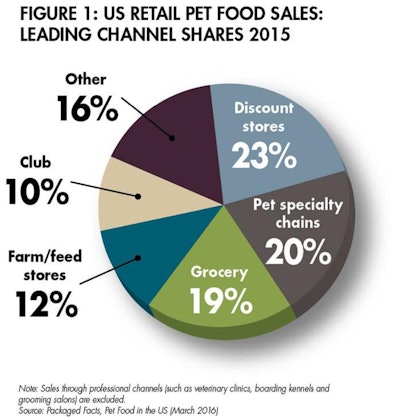

Combined sales of large pet store chains PetSmart (including Canadian revenues) and Petco closed in on US$12 billion in 2015. The two companies share a number of similarities: their targeting of pet parents, their dual focus on national (and especially natural) brands and private labels, their emphasis on higher-margin products and services, and their leading e-commerce websites. As the dominant pet specialty chains, PetSmart and Petco account for nearly one-fifth of pet food product sales in the US—equivalent to the overall supermarket channel share (19%) and only somewhat behind the discount store channel share (23%) dominated by Walmart and Target (see Figure 1).

PetSmart and Petco together hold nearly one-fifth of US retail pet food sales, via the dominant “pet specialty chain” channel.

In the face of competition from both pet superstores and discount-driven Walmart, supermarkets are fighting to retain their share of the pet market, increasing the size and scope of their pet care departments, sponsoring pet contests, running promotions with animal rescue groups and filling pet prescriptions at stores with pharmacies to help lure pet owners into the store. Store-brand pet foods also play a key role, with progressive supermarket retailers jumping on the latest pet food trends. They are also using their online presence to build interest in their pet departments, featuring pet-oriented websites and blogs and using pet-related events to connect with shoppers.

With over 5,000 retail units in the US, Walmart would be a formidable pet market competitor simply by virtue of its scale and money-saving appeal. However, Walmart ups the ante by making the pet category high priority, with most Walmart stores fielding a pet supplies section that far surpasses that of most supermarkets, sometimes including dedicated sales associates.

Among these three leading pet product channels, nonetheless, time has been on the side of the pet superstores. Since 2010, according to Simmons Market Research data, only PetSmart/Petco have gained in draw among pet product shoppers—from 38% to 43%, compared with a fairly steady 40% draw for supermarkets, and a drop from 26% to 22% for discount stores (reflecting, in part, undercutting by deeper-discount dollar stores).

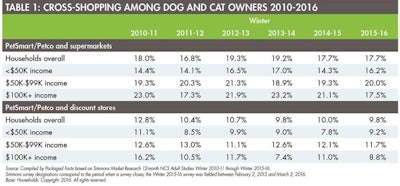

Cross-shopping patterns—and cross-shopping is the norm among pet product shoppers, of whom only about a fifth are channel loyal—tell a similar tale. The overall share of pet owners who buy pet products at PetSmart/Petco as well as at supermarkets has held fairly steady since 2010 at around 18% (see Table 1). This cross-shopping pattern has recently edged up among households earning under US$50,000 in income, though decreasing (from 23% to 18%) among households earning US$100,000 or more.

Cross-shopping among pet consumers is a fairly common occurrence, with many choosing a combination of PetSmart/Petco and supermarkets or discount stores to find the products they’re looking for.

In contrast, the overall share of pet owners who buy pet products at PetSmart/Petco as well as at discount stores is edging downward across the board among lower-, middle- and upper-income households. Most dramatically, the share of upper-income households who shop at PetSmart/Petco as well as discount stores has fallen from 16% in 2010 to 9% as of the most recent Winter 2015/16 Simmons survey.

The share of 18- to 34-year-old pet owners who buy pet products in supermarkets has edged down from 41% in 2010 to 37% as of Winter 2015/16, while the share who buy pet products through discount stores has fallen from 20% in 2010 to 14%. Conversely, the share of pet owners age 18-34—the current Millennial generation—who shop at PetSmart/Petco has jumped from 42% in 2010 to 46% currently.

Time, upper-income households and Millennials are, therefore, all tending to favor pet superstores, among the leading brick-and-mortar channels. And that’s not a bad supporting cast.

US pet food market information

For more Market Reports by David Sprinkle: www.petfoodindustry.com/authors/145

For information on Packaged Facts’ report on Pet Food in the US (March 2016): https://goo.gl/edHIEH.