Pet food sales in the US pet specialty channel reached US$13.1 billion in 2015, or about 43 percent of the overall US$30.27 billion pet food market, according to data from GfK and Packaged Facts. With sales growth of only 1.2 percent in mass market outlets (supermarkets, mass merchandisers, some club and dollar stores), the US pet food market’s overall 3 percent increase was driven mainly by the robust 4.7 percent growth in pet specialty.

GfK tracks US pet food sales in three sub-channels: pet retailers (chain stores and independent pet shops), veterinary clinics, and farm and feed. By far, pet retail stores account for the majority of those sales: US$8 billion, a 60 percent share of pet specialty and 26 percent of the overall US market.

In an October 2016 webinar, “Emerging pet food specialty retail trends to watch,” Maria Lange, business group director of GfK’s pet specialty practice, presented US pet store data for pet food sales as well as trends driving those sales. (She’ll provide an update during Petfood Forum 2017.)

Premium pet food all the way

It’s no surprise that the trends and product categories getting the most buzz – natural, grain-free, limited ingredients, raw frozen, freeze-dried, dehydrated, novel proteins, small breeds, mixers and toppers – all fall under the premium pet food umbrella. Indeed, as part of a particularly beneficial and symbiotic relationship, the rise of premium pet food in the US over the past five to 10 years has helped grow the pet specialty channel and vice versa.

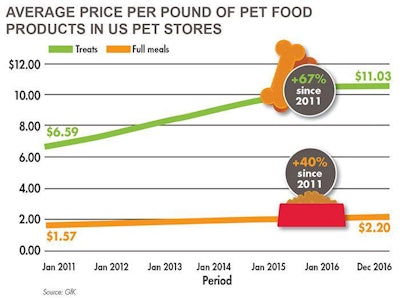

Lange’s data show that from 2011 to 2016, pet food sales in US pet stores increased 29 percent, from US$6.2 billion to today’s US$8 billion, and the average price per pound rose 34 percent, up to US$2.40. That comes from a 40 percent increase in the average price per pound for complete pet diets and a 67 percent rise for pet treats (see Figure 1). There are now 559 pet food brands on the market in that channel, an increase of 52 percent since 2011, and they launched 2,880 new products from 2015 to 2016 (up 12 percent).

The average price per pound of pet foods sold in US pet stores rose 34 percent from 2011 to 2016, including a 40 percent increase for complete pet diets and a 67 percent rise for pet treats.

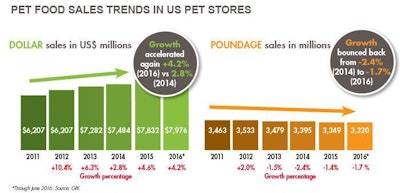

The other side of premiumization also stands out in GfK’s data: As pet food sales and the average price of products have gone up, volume (poundage) sales have declined, a total of -4 percent from 2011 to 2016 (3.5 billion pounds down to 3.3 billion) and -1.7 percent just from 2015 to mid-2016 alone (Figure 2). Lange attributed this disparity to several factors, including the increase in small dogs and foods for them, as well the growing popularity and sales of higher density products, such as freeze-dried and dehydrated pet foods.

Showing the premiumization trend in US pet stores, dollar sales have grown steadily since 2011, while volume sales have slowly declined.

Hot pet food categories

Leading the way to higher sales and paving the path for the newer, fast-growing product categories, natural and grain-free pet foods are still juggernauts in US pet stores. “Natural has become the basis, the foundation of pet food in the pet specialty space,” Lange said, citing its 70 percent market share. Its sales are still growing at 4 percent year over year, now reaching US$5.6 billion. Similarly, grain-free has a 37 percent market share, reaching US$3.1 billion and enjoying 13.9 percent annual growth.

Natural and grain-free often overlap within the same products; 54 percent of the natural category is now comprised of grain-free pet food, Lange said. In fact, grain-free is the driver of growth for natural; without it, the natural category would be declining in pet store sales. Still, the average price per pound for all natural pet foods has hit US$2.77, with grain free at US$3.07.

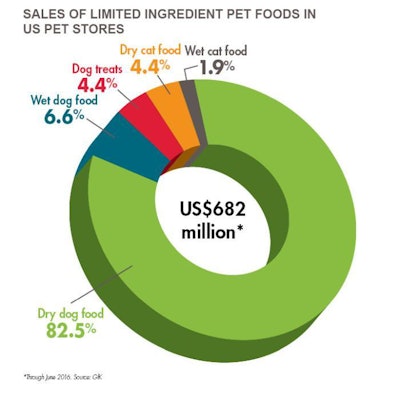

Smaller segments are also making their mark. For example, Lange cited the rapidly growing category of limited-ingredient diets, which now total US$683 million in sales, accounting for a 6.8 percent market share in US pet stores and increasing year over year at 12.5 percent. Dry dog food makes up the majority of the category, 82.5 percent, and is growing 13 percent a year (Figure 3). Wet cat food is also increasing rapidly, at 26 percent, albeit from a much smaller base. Lange predicted this category will continue to grow, possibly abetted by or expanding into the concept of ingredient transparency, in which a product’s packaging prominently displays the low number of ingredients.

Though still a small category, limited ingredient pet foods now account for a 6.8 percent market share in US pet stores, with much of that in dry dog foods.

Raw frozen, freeze-dried and dehydrated pet foods count as other fast risers. Frozen sales are increasing nearly 27 percent a year, though from a total of only US$97 million and a 1.2 percent share of pet specialty. Lange commented that this category probably would be growing even faster if not for all the recalls of frozen pet foods in 2015. Still, the number of pet stores selling frozen has increased from 38 percent in 2011 to 63 percent today.

Freeze-dried pet foods have increased their distribution even further, with more than double the number of pet stores carrying them in 2016 versus 2011. Lange attributed the wider adoption to the rise of “kibble plus” products: dry pet food mixed with freeze-dried or dehydrated bits. Overall, whether comprising part or all of complete pet diets, the freeze-dried and dehydrated formats now total US$236.4 million in sales, with freeze-dried accounting for $US204.5 million and freeze-dried full meals growing 45.5 percent a year. There were 75 new freeze-dried pet foods launched in 2015, compared to only 37 in 2014.

Venturing even farther into newer formats, the meal enhancer category – mixers and toppers, whether preserved, wet or liquid – is another rapid riser, with more than 10 times growth (US$3.5 million to US$27.8 million) in just the past three years. The number of items launched has nearly tripled, from 66 in 2013 to 164 in mid-2016, most of them for dogs.

Though GfK has not yet released data, Lange also mentioned the increasing popularity and appearance of the label claims "humane," "sustainable," and "family owned and operated." She pegged these as the next step in the evolution of the natural, holistic trend, which is now starting to encompass social awareness.

A note of caution

Lange did note the growth rate of pet food sales in US pet stores slipped in the second quarter of 2016, down to 2.8 percent after a healthy 4.6 percent earlier in the year. Sales increased 4.6 percent in 2015 after a similar dip (also 2.8 percent) in 2014, compared to heady growth of 10.4 percent in 2012 and 6.3 percent in 2013.

One reason for the slowing growth, Lange said, could be the rise of “value natural” and private-label pet foods in US pet stores. The former segment is growing at 12.3 percent and private label at 8.9 percent, and together, the segments account for 7 percent of pet food sales in pet stores, up from 2 percent in 2011. These products are priced 20 percent lower than premium pet foods, which not only affects dollar sales growth but also bears watching in terms of premiumization’s continuing strength and influence.

Tracking pet food trends

For 2017: www.PetfoodIndustry.com/articles/6172

Global pet food sales: https://goo.gl/he8Vkk

Freeze-dried pet food: www.PetfoodIndustry.com/articles/6213

For small breeds: www.PetfoodIndustry.com/articles/6216

10 pet food trends that pet retailers are following

Pet Product News asked its audience of US pet retailers which trends they are following in 2017. Many involved pet food (https://goo.gl/r8KUZN):

- Semi-moist or baked products

- Interactive, fun and functional pet treats

- Pet foods with novel proteins or superfoods

- More holistic, natural products

- Treats with ingredients such as hemp, kale and coconut

- Sustainable and humane pet food practices

- Raw pet foods and “kibble plus” products (dry kibble with freeze-dried bits)

- Toppers, especially freeze-dried, dehydrated or raw

- “Soft” treats, with just enough preservatives to ensure stability and shelf life

- Continued pressure from online pet food sales as well as expansion of large chain stores