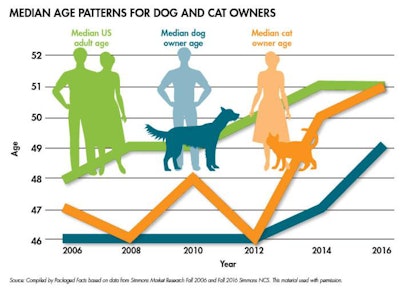

Taking a look backward at the last decade of pet owner demographics, dog and cat owners have gotten somewhat grayer, in keeping with the US national population overall. Between 2006 and 2016, according to the most recent survey from Simmons Market Research, the median age has edged up from 46 to 49 among dog owners and from 47 to 51 among cat owners (see Figure 1).

FIGURE 1: The median age of pet owners has increased in the last decade, keeping in line with the overall aging of the US population.

Even so, the median age of 49 among dog owners (that is, the mid-point age at which there are as many dog owners who are younger as dog owners who are older) is somewhat younger than the national median, while the cat owner median age of 51 hews to the national pattern.

This variation reflects a disproportionate uptick in dog ownership among today’s millennials. The 18- to 35-year-old share of the overall population dog owners up edged up from 25 percent in 2006 to 27 percent in 2016, while the pattern for cat ownership took the opposite bent, with this age group dipping slightly from 23 percent to 22 percent of the overall cat owner population.

Income patterns and pet ownership

The real drama, however, plays out in income patterns (see Figure 2). Cat owners on average are somewhat more prosperous than the national population, while dog owners are considerably more prosperous, in keeping with the significant discretionary expense involved with keeping pet dogs.

FIGURE 2: Both the median and the mean annual household income of pet owners has increased in the last 10 years, providing potential opportunities for pet food manufacturers producing more expensive pet foods.

As of 2016, the median (midpoint by distribution) US annual household income was US$60,400, while the mean (or what we commonly mean by average) was US$85,500. Both figures reflect a significant increase since 2006, despite a temporary dip in both measures during the period of the Great Recession. Compared to the national median household income, the median notches up to US$63,300 among cat owners and jumps to US$69,900 among dog owners. Compared to the national mean household income, similarly, the mean edges up to US$86,900 among cat owners and jumps to an impressive US$96,700 among dog owners.

As of 2016, to glance at another household income metric, nearly two-thirds (64 percent) of dog-owning households earned US$50,000 or more, and a third (34 percent) earned US$100,000 or more, compared with 60 percent and 30 percent, respectively, of cat-owning households.

A positive sign for future pet industry growth, correspondingly, is that pet owners increasingly see themselves as better off economically, relative to previous years. According to the Simmons Fall 2016 survey, 31 percent of dog owners and 29 percent of cat owners considered themselves either somewhat or significantly better off financially than they were a year ago. These figures are up from 20 percent of dog owners and 18 percent of cat owners five years ago in 2011, and double the rates of 14 percent among dog owners and 15 percent among cat owners in 2009, when the US remained in the grip of the Great Recession.

Implications for the pet food industry

What are the implications for the pet products market? Channel wise, the prosperity of pet owners will continue to favor retail shares and shopping rates for pet specialty chains, as well as other upmarket channels and retailers — including the internet — at the expense of mass-market or discounter growth. Product-wise, in tandem, pet owner prosperity will continue to give the edge to premium and superpremium pet food brands, especially for products making a distinctive case for pet care and pet wellness.

Packaged Facts' National Pet Owner Survey data for 2016 already show 32 percent of dog owners and 28 percent of cat owners classifying the pet foods they buy as somewhat or significantly higher-priced that average, outweighing the 22 percent of dog owners and 19 percent of cat owners opting for pet foods that are lower-than-average priced. With this larger share of pet owners (and especially dog owners) primed to purchase higher-quality products to nurture and pamper their pets, the bowl is in the pet food industry’s court.

More Packaged Facts research on pet owner demographics

The latest pet food market trends