Pet food market growth in Europe has shifted gears. In Western Europe, volume growth is at a standstill (and even negative in some countries) due to market maturity; nearly all growth that does exist is being driven by retail value (i.e., price increases). Eastern Europe is a different story: With both retail volume growth and value growth, there’s a lot happening to drive this developing segment of the pet food market. A growing pet population, an increase in the demand for prepared pet foods and economic recovery are all playing roles in ensuring Eastern Europe isn’t forgotten in the battle for pet food growth.

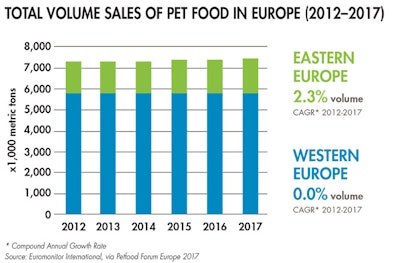

That’s not to say that Western Europe isn’t holding up its end of the market. The estimated total volume sales of pet food for 2017 is 5.834 million metric tons in that area, while Eastern Europe’s estimate is 1.642 million metric tons, according to Euromonitor International data (see Figure 1). But Eastern Europe’s volume has increased every year since 2012, while Western Europe’s has, at best, stagnated within the same time period.

FIGURE 1: The total volume sales of pet food in Europe is heavily skewed to Western Europe. However, Eastern Europe has seen the greater compound annual growth rate (CAGR) in the last several years, at 2.3 percent between 2012 and 2017 (compared to Western Europe’s 0 percent).

Further, there’s no denying that, in some countries, Eastern Europe is holding strong with Western Europe in terms of pet ownership. Fifty-seven percent of Russians, for example, have cats, according to GfK — the highest percentage of any country-specific population surveyed (see Figure 2) and among the highest in the world, keeping company with Argentina, Mexico, Brazil and the United States. Forty-five percent of Poland’s population and 38 percent of the Czech Republic’s population own dogs, holding pace with or even beating more developed countries like Italy (39 percent own dogs) and Spain (37 percent).

FIGURE 2: Russia’s cat ownership is the highest in the world, at 57 percent. Another notable number is Poland’s dog ownership, which stands at nearly one in two homes (45 percent).

Western Europe: a mature pet food market with slowed growth

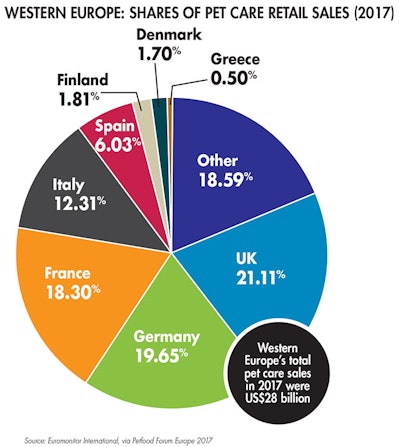

Europe’s pet food market was valued at US$23.74 billion in 2016, according to Mordor Intelligence data, and the vast majority of that continues to come from Western Europe. Further breaking it down, a significant part of the region’s pet care market is concentrated in four countries: the United Kingdom, Germany, France and Italy (see Figure 3), according to Euromonitor International data. Overall, Western Europe has seen a 2 percent compound annual growth rate in value sales between 2012 and 2017.

FIGURE 3: The UK, Germany, France and Italy take up the majority of Western Europe’s pet care retail value sales.

Unsurprisingly, dog and cat food make up the majority of pet care sales (totaling roughly US$28 billion) in Western Europe: US$9.74 billion and US$9.98 billion, respectively, according to Euromonitor data. “Other pet food” brings in another US$1.80 billion, while other pet products make up the remaining US$1.80 billion.

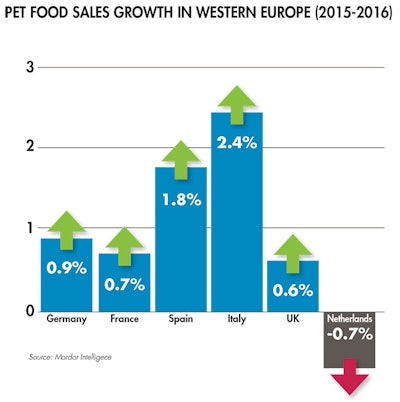

The numbers are significant, but they’re also largely unchanging: Pet food sales between 2015 and 2016 remained mostly stagnant, with minor exceptions (see Figure 4). While Italy saw the most sales growth in the region (2.45 percent), countries like the UK, France and Germany — the major players in Western Europe’s pet care market — didn’t even grow by 1 percent. And the Netherlands market actually dropped by 0.70 percent, according to Mordor Intelligence data.

FIGURE 4: Western Europe’s pet food sales are fairly flat — Italy comes in with the most growth, 2.45 percent, while Netherlands is actually experiencing negative growth, at -0.7 percent.

So, where is the growth in Western Europe? Currently, premium pet food is driving sales, according to Euromonitor data. While economy and mid-priced pet foods had negative compound annual growth rates (GAGRs) between 2012 and 2017, premium pet food had a CAGR of 1.7 percent during the same time period. Interestingly, pet treats are experiencing significant growth on both the dog and cat side. Dog treats make up the bulk of pet treat sales, and experienced 5.1 percent CAGR between 2012 and 2017. Cat treats, while the lesser of the two main treat market options in terms of sales, is showing even higher growth with an 8.6 percent CAGR.

Eastern Europe: A developing market with growth opportunities

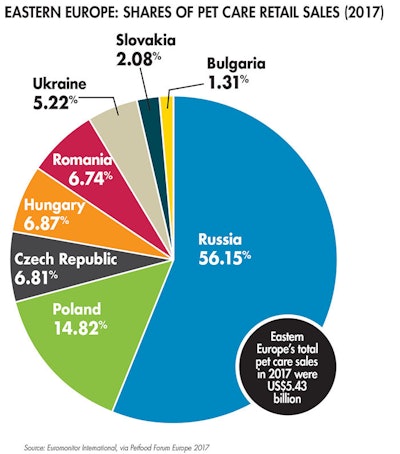

Eastern Europe’s pet care value sales come out to roughly US$5 billion, according to Euromonitor data, with Russia by far the most dominant player bringing in US$3.05 billion (see Figure 5). But while Eastern Europe’s contributions to the larger European pet food market are significantly smaller than Western Europe’s, the region’s growth shows promise: 4 percent CAGR between 2012 and 2017.

FIGURE 5: Russia makes up the largest piece of the Eastern European pet care pie (more than half of sales), with Poland coming in a fairly distant second.

Russia’s influence on the Eastern Europe pet food market is clear. The country is first in the world for cat ownership, according to GfK, with 57 percent of households including a feline companion. For comparison, the next largest cat-owning country is France, where 41 percent of people keep a cat. This influence is also in spite of a significant economic recession that caused Russia’s retail value growth to begin dropping in 2013 and plummet between 2014 and 2015 — the country’s economy is beginning to recover, and with that recovery comes increased buying power. In fact, Russia’s retail value growth is expected to be the highest of the Eastern European countries in 2017, according to Euromonitor data.

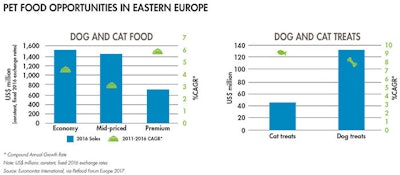

That being said, there is opportunity everywhere in the Eastern European pet food market. The CAGR for all three major pet food segments — economy, mid-priced and premium — saw growth between 2011 and 2016, with the premium segment coming out on top at 5.8 percent, according to Euromonitor (see Figure 6). Dog and cat treats are also growth opportunities, with CAGRs of 8 percent and 9 percent, respectively, between 2011 and 2016. Penetration into the prepared cat and dog food markets are increasing among several countries, with Bulgaria, Poland, Russia and Slovakia all posting higher market shares in both categories in 2016.

FIGURE 6: Eastern Europe’s pet food market opportunities span all the primary segments and include both dog and cat treats, making the region an interesting market segment for those looking to grow their hold in that area.

Europe: A market with continuing potential

While Western Europe is forecast to see continued slow growth focused in the premium segment, there is always room for expanded market penetration. Eastern Europe shows its potential clearly, be it through Russia’s recovering economy and increasing middle class, or through other developing countries seeing significant growth in prepared pet food sales as their disposable incomes rise.

Global trends: pet food e-commerce in Europe