Petfood Industry (PI): With all the changes WellPet has experienced over the past couple years, what do you think have been the most important changes for the company's future success?

Tim Callahan (TC): I'd start by saying in addition to the things we changed, it's probably good to say one of the things we didn't change. I think that's really important.

When I spoke with the people from both companies, both Wellness and Eagle legacy companies, both had had great success. We talked about the entrepreneurial founders, the passion folks those had for pets, pet nutrition and how they really transmitted that, really got people in both companies committed to that. And I think it was an important first step to reaffirm that.

So frankly, the first thing we really focused on was making sure we don't lose the essence, the foundation of what has made both companies great. And the reason this is also important is because to me that's a common link. When you bring two companies together, as you know, it can be a challenge. We had that common heritage, even though different companies and different brands and products, there was a similar path in terms of how we got to where we are today, and people could relate to that, and that brought some connection to the company.

As far as the things that changed, just the things we focused on, we're now a house of brands, so we had some situations where Holistic Select and Wellness were competing with each other in the marketplace. So one of the very first things we did was doing some consumer research and making sure we were very clear on how we positioned our products, how we talked to consumers about our products, made sure the distinctions and messages about our brands were very clear. So there was a tremendous amount of effort around that, and I think we sharpened some of the communications, some of our marketing efforts around Holistic Select and Wellness because of that research.

I think another thing we found is that we've got a brand like OMH, which is a great brand, very long history, but one that never really got the attention it deserved in terms of relaunch and focus. So we've got a whole team of people planning a relaunch for that product this year. That's probably something that would have been a challenge but now, being a bigger company, we have more resources around that.

From our sales team, we talked earlier about bringing two teams together-a lot of our company, we have a little over 200 people, a big chunk of that, almost 90 people, are salespeople. They interface, obviously, with our distributors and retailers. We got them together as a team, and we've invested significantly in tools to help them work with our retailers, work with our distributors, to not only build our business but to build the industry at large. I think that's something we've done in the past but not to the extent in terms of the investment that we've put in our people and giving them the tools to work with our retailers.

Another piece is training. We've put a tremendous amount of effort into taking some of the learning from the research we had done and not only sharing that with our sales team so they're more knowledgeable about the industry and what consumers are telling us but also sharing that information with our retailers and distributors. We do a variety of town hall meetings, training sessions and things of that nature, so there's a lot of work around there.

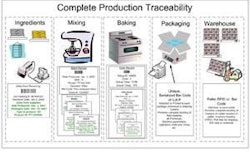

And then I'd say from just a supply chain standpoint, you know, we really take pride in the fact that it's not just a product but there's a service that comes with it. So we've worked very hard. We've made a substantial investment, we made over a $1 million investment over the past six months in Mishiwaka to continue to make sure that facility has outstanding product quality and continues to make a very, very high-quality product. We've made investments in our customer service end as well so we're just easy to deal with and able to fulfill high service standards that our customers demand of us.

It's a variety of those things I think in total that have kept us pretty busy in the last year but hopefully have done well to keep us a strong presence and a strong partner for our customers.

PI: What was the name of the facility?

TC: That's our Mishiwaka plant, which is where we make all the Eagle product and Holistic Select. So as we've relaunched that product-you know, we've recently relaunched Holistic brand with some new packaging and some new marketing efforts. That product has historically grown very well, we anticipate and are seeing continued growth. Some of the investments I've referred to allow us to continue from a capacity standpoint to be able to support that brand and provide that service for our customers.

PI: So now you get to breathe, huh?

TC: Well you know, it's funny. I think, this is an organization-I call it 'constructive dissatisfaction.' I've been here long enough now to be accountable for things, but a lot of great things were built, were here before I showed up. And sometimes companies that are successful can get complacent, and one of the best things you can be, I call it constructive dissatisfaction, which is, in a constructive way, challenging what we're not doing well. And I think that there's still very much that mentality here. It keeps everybody energized. We celebrate the success that we've enjoyed, but we know there's a lot to do.

The good news is that we've done a lot to bring the companies together, so we're able to focus even more now on some of the external things like relaunching some of our product lines, bringing innovation to the market, sitting with our customers, listening to them, seeing what we can do to help them build their businesses. It is fast paced, but generally I think if people enjoy what they're doing, fast paced is a good thing.

PI: And it's always good to be busy and working, especially in this economy.

TC: I think that's very true, and people are very appreciative of it here, and we don't take it for granted. It's something you have to earn.

PI: Anything else in terms of new product development besides relaunches?

TC: There are some things that we're doing, and some of that is proprietary, just given that's in more concept stage. For us, we take a great deal of pride in bringing some innovation around our current lines, so we're introducing, for example, a weight management product that's part of our Holistic Select line, and we're going to launch a kind of a stews line as well. But we're also looking at some things farther down the road that are rooted very much in natural nutrition that are at this point more in the concept or beta stage.

But typically, that challenge you know of how do we-I'll go back to what's made the company great, and it's been a company that's been on the leading edge of good natural nutrition, so we're looking at some interesting areas there as well. There will be more exciting things coming from the company on that front.

PI: Are you launching any of these new products at Global Pet Expo?

TC: There are a variety of things we'll be launching this year, but then we're also looking at things that are a year or two out, that are more emerging, more breakthrough, I'll call them. Not so much as with Jobs and the iPad, but more step-function type innovation as well. You know, it's a balance. It's a balance of things we need to do to as a good vendor partner. So we're clearly doing some things that keep our brands very relevant, we've got a good stream of innovations coming, but we're also looking at some things that are more step-change as well.

PI: We sort of segue-wayed into the next question, in terms of what you think sets your company apart, is it the nutrition?

TC: It's a couple things. One is, I really believe for a company of our size, we do a tremendous amount of research. And I don't mean academic, brainy research; I'm talking about real world talking to consumers, talking to customers, thinking about how people shop this industry, this category, what's on their mind, what are their unmet needs. I think we take a great deal of pride in it; it focuses our company on things that matter and things that are really true to consumer needs and understanding.

That research I talked about earlier, I'm really hard pressed-I'm sure Procter might do it or a Nestle might do it, you know on a very, very large scale. But for a company of our size, and focused very specifically on this superpremium, natural space, I'm hard pressed to see anyone who does as much as we do. And we do it for the reasons I talked about. From an R&D standpoint, product development, I think because we do that, and because that's the heritage of this company, we have an enviable track record there.

Clearly, I think on the quality front, I believe we continue to push a quality agenda that not only influences our own manufacturing but also within our co-manufacturers as well. We constantly here that do challenge them and we bring further insight to keep stepping that up. I think that the folks that we have here and the culture we have here and the way that we push that in our system, I think makes us distinctive

So in terms of what we're known for, I think within this superpremium, natural space, we are an innovative force, and we provide very reliable, high quality products to the marketplace, and with our sales organization, a support that's really unmatched in the industry.

No one has as large a sales force as we have. And you when you call it a sales force, it sounds like it's selling; obviously, that's part of what they do, but there's also a service aspect in terms of sharing the insights that we've learned and helping our customers build out their businesses, not just our brands.

PI: On that note, I know you sell your brands in both the large pet retail chains as well as pet specialty?

TC: Well, we sell to what we refer to as pet specialty. So that would be the independent pet channel, and we sell to Petco. We do sell our OMH line to PetSmart, and we are in very selective natural stores, so Whole Foods is probably the biggest representative there.

PI: Because some brands/companies that are in the superpremium and natural categories tend to limit themselves to independent pet stores, but it seems to me that you're having success in the larger chains such as Petco.

TC: Yes, we have had success at Petco. I think the broad message is, instead of going down the path-if you're not careful, you can lose the specialness of a brand. We're very thoughtful about where we sell our products. So there's a lot of discussion both in terms of channel and even within channel, you know, the stores and the chains that we have discussions with, because it's not just putting the product on the shelf, you also hope there's knowledgeable staff and the commitment to really help the consumers. So those elements all come into play and we're very mindful of that.

We also want to be mindful that in the end, we all owe our jobs to the consumer. So in the instance of Petco, Wellness was the #1 requested food that they did not have. So there's instances where, you know the big theme is we're very thoughtful about where we go, and at the end of the day, we'll probably always be selling to a more limited number of retailers than retailers that want to sell our brand.

But by the same token, we have consumers who look for our product, and we want to make it reasonably expedient to get the product. In the case of Petco, they made a very significant commitment to natural products, there are a variety of other brands there as well, and we think they've done a very nice job. But our roots are with the indies and we've got a very large dedicated sales organization to support them, and we continue to see them as very important for us.

PI: You mentioned a company of your size-where are you relative to the rest of the industry?

TC: We're probably north of $200 million in sales, wouldn't go more than that. You know, it's an interesting industry. You have the major players, I'd say at some point we're almost a rounding error. It's all a matter of perspective. Depending on where you are in the industry, you know you could have a different point of view.

I like to think that we have critical mass that allows us to have the resources to hire good people, to support the sales team, do consumer research, invest in rpdouct development and those types of things; yet we're small enough that we're nimble, we don't have a lot of layers in our company. We're very focused in terms of the areas where we put our efforts around petfood. We like to think we have the best of both worlds of sorts. In general, I think people think we're in a good place because we have the size that affords certain resources and by the same token we're small enough to be nimble and responsive.

PI: Are you comfortable saying how much growth you're experiencing per year?

TC: Historically I'd say we've been around about 20%+ growth. That's generally a target we go for, though generally, I like to think we've been more thoughtful, meaning rather than to just throw a target out. It's interesting on some level because it's more concrete. But I think it's important to say, look at the industry, see where the opportunities are and really build a plan around that, rather than having some arbitrary growth target. I think companies get into trouble when they do that.

I just go back to first principles, and say, it's a great industry, and where we are in particular in the superpremium arena is growing, there's a lot of opportunity there, so we feel we're in a good place. Hopefully with some of the initiatives we're doing, we have a lot of confidence in our future growth, and we believe we can do it being true to what's made this company great in the past.

PI: Have you seen any slowdown because of the recession?

TC: You know, we have not. I mean, we certainly, as a company, I wouldn't say it's had no impact. But we've continued to do very well. We had certain targets coming into the year, and we achieved those. What we've done internally is talk about that it is a challenging environment, and we need to be particularly mindful of where we focus our efforts. The good news is that because we have this portfolio of brands, and they're in different parts of their lifecycles, and there are different opportunities, we've been able to grow through a balance of those brands.

We've also had the good fortune, given the nature of where we compete, in that superpremium arena, the products do work, they do make a difference, and I think that people-I know it's not universal, some people need to make trade-offs-but by and large people see that it's money well spent. So we've been fortunate. But some of that is that we do put out a good product, it lives up to its expectations. And again, the variety of brands that we have, we have a variety of ways to grow our business.

PI: Right, and I think that most pet owners who normally buy superpremium have been able to weather the recession OK or have cut back in other places.

TC: I talked to the guy I work for; he's always worried about the economy in general. I tell him that I think if it's fashion items-you know, someone just said the days of $800 jeans being interesting just because they're $800 are probably gone. So I think that what it really gets down to for items that really deliver and really make a difference, and I think these products really do, people see that. I think this economy kind of stripped away a little bit of this stuff that was just frothy, chasing badge products and things of that nature.

I think in some ways people are just refocusing around things that are really good value and people don't mind spending money when there's something really there, something of substance. I think that helps our industry. I talk all the time with people who feel these pets are part of their family, and when times are tough, pets bring an enormous amount of happiness and joy, and I don't want to compromise on that.

PI: We tend to look at the global picture, and things definitely did slow down globally, but North America has held its own and is projected to keep growing. Some people are trading down to more value priced brands, and even private label is making more of a push than it ever has in the US, but for that superpremium customer, they haven't been impacted as much.

TC: Yes, it's a very different-that's some of the research we had done too, is just how people think about their pets, and at the end of the day, they just are different consumers.

PI: I think we've probably covered the next questions, but just in case, do you have any other things you're looking at for your company, any other new directions?

TC: Yes, going back to our sales organization that we have in place, we have really invested heavily in the last six to eight months to give them more tools to be more effective business partners with our independent pet specialty channel. I think that's very important, because if you look at the last couple years, there's been tremendous price inflation in the industry that has helped folks. Now we're saying those days of tremendous price inflation are largely over; not that there won't be more price inflation, but not at the historic levels. And I think there's also been a lot of brands coming into the space. So going forward, I think it's more important to become sound businesspeople.

So how do we as a company help work with independent pet specialty retailers to be better businesspeople? That's not just understanding our brands but also understanding the industry, working with them in terms of promotional programs, assortment questions, things of that nature. That gives our company a tremendous amount of focus and thought to bear there. I think that will make a difference and will make good use of the resources that we have on hand. So there's a tremendous amount of effort going on on that front as well.

You know we preach all the time-I'm sure you've seen the Wal-Mart advertising, there's so much of it now saying we carry all the brands that pet specialty does, and they're more convenient and cheaper. I think that it's important for the pet specialty channel to rededicate itself to what they do. There are great examples of retailers that compete very effectively against Wal-Mart. How do we work with them around that knowledge of the industry, knowledge of pets, knowledge of the food?

It's an industry where I think people would be receptive to that, and that would help address what I see as a looming threat out there. Because I think that message distorts some of the reality of what's out there in terms of available offerings and knowledge that you get at a local pet store vs. a Wal-Mart. It's that type of thing of where we think we can do more than just, clearly our offerings could be available in the mass channel, but I think there are other things we think we could to help them manage this threat.

PI: Have you talked with any groups like APPA about partnering with them, or is this something you think you'd do on your own?

TC: We have, we've talked to them a little about it, and actually, as we've talked to some of our retailers trying to get more of a groundswell in terms of where you're going, get a little bit more of a momentum behind it. Right now it's discussions with our retailers. That's one of things we're looking at doing this year, perhaps get together a retailer council, where we could actually formulate something.

Recently I was up in Canada, and an individual was saying, can we work with a group of independents who could do some education pieces in the marketplace. A very bright person who said I'm willing to [cooperate with?] the competition, yes we compete with each other at some level, but there's a more important message we should be getting out about the value of these specialty, natural products, could we put some consumer education out there? Could you work with us-us meaning WellPet-and maybe have a variety of us at the bottom saying, "Brought to you by …" So it's more of some industry education.

I think that's a really interesting approach. You're always going to have the competitive side of doing what you do promotionally, you're want to build your individual retailer brand, but there's some bigger opportunities and messages.

We've talked, we've seen in our research, we hear it from retailers, too: there's a lot of confusion about natural, holistic-so how do you ladder it up? That's probably more of a progressive retailer at the end of the day who's comfortable doing that, but I think we've talked internally about getting some retailers together from certain geographies to see if we can't do something like that and elevate the conversation, if you will, because there are probably some things that can be done from a channel and pet specialty channel that go beyond what an individual store would do.

PI: That's very interesting. I agree there needs to some consumer education done by the industry as a whole. That's me on my soapbox, but I think it's important.

TC: I think you're spot on. The more I talk to people, it resonates the question, how do you bring it to life? I think the question becomes, can we be an enabler, because we're a company that has resources around marketing and consumer messaging. I think that there's really something here, where we could really help do it. Maybe we even pilot it in a couple areas and people can see what impact that has, and then it could be rolled out more broadly.

PI: Any other opportunities or keys to your growth?

TC: I think largely we've covered it. What I would just say is that because we have a balanced number of brands, because we've invested in our sales team, I actually feel we have multiple avenues of growth. And the industry at large is very healthy, at least on a relative basis, and that's where a lot of confidence comes from.

PI: What about challenges-what keeps you up at night?

TC: Well, I generally sleep well. I think the challenge is, as you mentioned before, do you get to rest? You know, it's the pace. We're a rapidly growing company, and we have a lot on our plate, in terms of things that we want to do. You just want to make sure that we do that in a quality way-both companies have executed well over time; in other words, when we bring a product to market, it's a really high quality product and our service behind it is good. We just want to make sure that we step back and always make sure that we have really good strategies. We've had a history of very good growth, and we just want to make sure that as we do grow, we've got a lot of initiatives to be a better company, that we're very thoughtful that we resource these well and we continue to execute with quality.

One of the biggest things we talk about as a senior leadership team is how do we make sure we do that and continue to attract and find good talent as we continue to grow our company as well. I guess in a lot of ways it's a high-class challenge relative to some of the other companies out there in the marketplace, but that's one of the challenges we face.

PI: Who is your senior leadership/executive team?

TC: Mark Shuster, head of marketing-works very closely in terms of developing marketing campaigns with sales team. Very consumer focused, but he's also very good about getting out into the retail community to find out what works and doesn't work.

Jean Lizotte, head of product development-we've elevated product development to a very senior role because it's so strategic and critical. So Jean does a lot of work around new products, obviously, but she also does a lot to make sure we're seeing the industry, how it's shifting, what the voice of the consumer says.

Greg Kean, head of R&D-he does a couple of very critical things, one related to current products, quality assurance reports up to him, so making sure we have the right procedures and protocols around quality, continue to lead that and realize it's the bedrock of our brands. He's also involved in the development of our products, so he and Jean work not only in the extension and opportunities to build our current brands but also step-change things as well.

Nick Delton, CFO-make sure they have the right controls in place.

Steve Harris, head of sales-responsible for our sales organization and all channels report up to him, and he's a good resource and helps with voice of the customer.

Beth Wilson, head of operations-involved with making sure from a procurement/customer service perspective that we meet customer expectations.

PI: Have they all been with the company, or one of the original companies, for a while?

TC: Yes, actually, they've been with Wellness largely, and they've been there multiple years. I inherited that team, they're a very good team, a good leadership team. A combination for any good team, you need people who are skilled in their positions and people who appreciate they need to work as a team and they're respectful of what everyone's trying to do with the company. I think I'm very fortunate to have a very good team. They bring a lot of passion.

We have people who are very passionate about what we do. It's not just making bolts, it's something that makes a difference in pets' lives. They take what we do very seriously, they understand that kind of complete package, it's not just a nice ad campaign, it's how we present our products, how we support them with service that matters.

I think I told you that when we first came together, a lot of our time unfortunately had to be internally focused because when you bring two companies together it takes a fair amount of effort. But on a go-forward basis, and we get through a lot of the integration things, more and more, all of my team gets out and tries to listen to the market so we're appropriately prioritizing what we need to do and make sure that we're really hearing from the outside. We're letting the outside world in, if you will, to make sure that helps shape our priorities and what we need to do going forward.

PI: With the 2007 recalls-WellPet had no direct involvement, but the whole industry has experienced some fallout. Is there anything your company did then or is doing now in regard to safety or new legislation coming down the pike?

TC: A couple things. One is, it was a reaffirmation of the emphasis on quality. It predated my involvement with the company, but I think it gave a further validation that you know what, all this effort we're putting into it is time well spent.

I don't know that we changed anything. I do know that when I came on board, I made sure our protocols were all very clear and that I reiterated the commitment to quality, which is a good thing. Toyota is an example where I think they're doing a very good thing with the quality issues they're having. I said look, we're going to be very up front, and this is very critical, and we want to make sure that in the event if we ever were to have something happen, what is our protocol, and make sure we're all aligned on what we'd do.

So we've had conversations about those things, and I think people feel very, very good that we're monitoring quality as we have, and that we believe we need to be forthright should an issue ever come up, because that's how brand value and brand trust are established. So those things, I think that's sort of reaffirming that's the right path.

I know the FDA has recently added the Reportable Food Registry. We've taken a very active role and position on that, and we've pushed very hard into factories and our full manufacturing world and have taken a very clear and direct stance about quality, what we can do, how we're going to be proactive. There's no ambiguity about that. We take all those steps. I think by and large these are good things. Some of these regulations come in, I don't think they're necessarily thought through in terms of all the consequences, but the spirit of what they're trying to do, we generally support. In addition to the Reportable Food Registry, we have some additional things we're doing as well and pushing those standards and expectations into our system.

PI: As for the overall industry-any further thoughts on where it is, where it's heading?

TC: It's a great industry, and we're seeing that in a very challenging time. I think there are some challenges. Not picking on Wal-Mart per se; there are some things I think the industry needs to be attentive to, particularly the retailers and distributors and industry members we work with. I so see there's confusion between natural and holistic and some of those descriptions and I think there's an opportunity to reinforce what they mean and bring more clarity to consumers.

I believe we're in a bit of a dampened state right now because of the uncertainty with the economy. I mean, people can tell you the recession's over, but people are still very concerned about their own welfare. But, I think the underlying growth drivers, the things that make these premium products and natural products grow are very much there, and I think there's an opportunity when this lifts, which it will, to see more of a tail wind.

But having said that, I do think there are some things around education we could do, and I think there's the opportunity we had talked about with retailers to ladder up, do some messaging, go beyond promotional communications about the industry, what's going on and do some education pieces. I think it would be time and money well spent.

The other thing, I know I'm being vague, but I do think there are some advances in nutrition, both in the human world and the pet world. I think there are some very interesting things, as people get older, there's an ability to understand certain conditions with more specificity. You know people have different nutritional profiles, different needs, and I think there ways to build on that I think, so I think there are some very interesting opportunities down the road as well in terms of petfood innovation.

PI: I would agree. The more researchers understand nutrigenomics …

TC: Exactly.

PI: Is there anything else about your company you wanted to talk about?

TC: We're at a point where we've spent a lot of time bringing these companies together, we put a lot of focus around that. I think we're at a point now where, between some of the things we're bringing to market and other things we've talked about, there will be a great opportunity for us to engage even more substantially with our retailer communities, with our distributor communities, on the marketing end, we're doing some very interesting things with pet communities, reaching out to folks. I see the collective effort of what we're doing is a more substantial effort than even last year because a good part of our efforts were bringing the companies together.

I think it will be a very interesting year, we'll have a lot to talk about, and we'll continue to earn the retailers' and consumers' trust.