During the “new normal” of ongoing economic sluggishness, US petfood consumers are coping in a number of ways, including shopping around more for bargains and charting out grocery visits in advance. According to Packaged Facts’ September 2011 Pet Owner Survey, 74%Â of US pet product buyers agree they look for lower prices, special offers and sales on pet products.

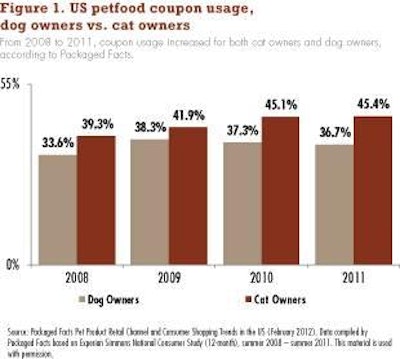

Another way petfood shoppers have been managing during the new normal is rather old-fangled: coupons. From 2008 to 2011, the percentage of dog owners who used petfood coupons rose from 34%Â to 37%, with the cat owner number rising from 39%Â to 45%, according to Experian Simmons consumer survey data. Dog owners declined slightly in coupon usage from 2010 to 2011, while cat owners picked up a bit. In both groups, the usage levels remain elevated compared with pre-recession 2007, when the figures were at 33%Â and 28%, respectively (Figure 1).

Not surprisingly, petfood coupon usage is higher among dog or cat owners who consider themselves worse off financially than they were a year ago. Whereas 37% of dog owners and 45%Â of cat owners use coupons, the percentages rise to 42%Â and 49%, respectively, among the segment that identifies itself as significantly worse off. Usage is also above average among dog or cat owners who are female (index 111, with an index of 100 representing the norm), age 18-24 or homemakers.

On the other hand, it’s somewhat unexpected to see coupon usage rise up the income ladder, with dog or cat owners living in households earning US$75,000–$99,000 the most prone to use petfood coupons (Figure 2). In the case of dog owners, the rate rises from 32% in the under US$75,000 household income group to 53% in the US$75,000–$99,000 group; with cat owners, the rate rises from 44% to 52% in those segments.

This trend carries through when looking at individual retail channels and pet superstore chains. While usage of petfood coupons by dog or cat owners is about average in the under US$75,000 household income segment (index 108), it’s above average in the US$75,000–$99,000 group (index 128), with supermarkets indexing at 123, discount stores at 115, PetSmart at 111 and other channels at a chart-topping 153. For dog and cat owners alike, however, coupon usage falls off in the highest household income group of US$100,000 or more to 36% of dog owners and 45% of cat owners.

In addition to reflecting the mood of pet owners, increased coupon usage is a function of heightened promotional activity among major marketers and retailers. During 2008 and 2009, pet product retailers began employing a variety of promotional strategies to draw shoppers into the store, including cooperative programs with vendors.

As would be expected, mass retailers including supermarkets and discount stores are big on coupon usage, but coupons also have the power to draw shoppers into the pet specialty channel. Shoppers at other pet stores are 14% above average (index 114) for agreement with the statement, “Coupons draw me to stores I don’t shop.” And while shoppers at pet superstores are only average in this regard, during 2009, PetSmart jumped to number two among retailers most active in promotion pages circulated, second only to Target, according to TNS Media Intelligence.

Given marketers’ and retailers’ growing reliance on Internet marketing, expect to see coupons continue to grow in importance. The Internet is an ideal venue for coupon distribution directly into consumers’ hands, and more marketers are fielding coupons that can be redeemed immediately via online purchasers, eliminating even the need to print out the coupon and take it into the store.

At a time when pet owners continue to look for deals wherever they can find them, something as basic and familiar as a coupon can help them feel proactive, not to mention better able to afford the foods and treats needed to keep their pets happy and healthy no matter which way the economic winds blow.