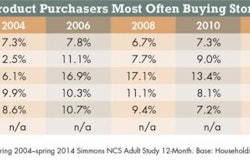

Let’s start with the less than great news: Petfood sales in the US are expected to grow only 1.1% this year, according to the latest report from Packaged Facts, Pet Food in the US, 11th edition (September 2014). Perhaps even more troubling, sales for dry dog food in mass market outlets, one of the largest petfood categories, have fallen 1.4%.

In fact, the mass market channel—supermarkets, drugstores, mass merchandisers, military commissaries and select club and dollar stores—is the main drag on US petfood sales overall, showing only 1.2% growth while comprising 24% of all US petfood market sales. And, because dry dog food makes up so much of mass market sales, its decline is barely offset by strong growth rates for other categories, such as 27.3% for frozen/refrigerated dog food, 4.5% for dog biscuits/treats/beverages, 8.5% for cat snacks/beverages and 8.3% for frozen/refrigerated cat food, Packaged Facts says.

But there is good news. The main reason the US petfood market will register any positive growth this year is because of the strength of the pet specialty channel, which accounts for a total of 29% of US petfood market sales: 20% for pet specialty chains and 9% for independent pet stores. According to data from GfK (cited in Packaged Facts’ report), petfood sales in that channel increased 6.5% from 2012 to 2013, including a 7.2% rise for dog food overall and a 6.7% gain for dry dog food. That type of healthy growth is expected to continue.

Treats also remain strong players in pet specialty, with dog treat sales growing 10.3% in 2013 and cat treats, 7.9%. The categories really shining in pet specialty are, no surprise, ones such as natural (11.7% growth), grain-free (32.4%), limited ingredient (26.6%), freeze-dried (50.9%) and frozen/refrigerated (16.6%). Many of those categories fall under the umbrella of premium petfoods, and for the overall US petfood market, premium products account for 42% of sales.

Thanks at least partially to expanding market share of premium petfoods, particularly superpremium dog food products, Packaged Facts projects that US petfood sales will end up at US$28.5 billion this year, up from US$28.2 billion in 2013. Though not as healthy as the 4.7% rise from 2012 to 2013, the growth rate is expected to rebound in 2015, to 3%, then range from 3.5% to 4.5% from 2016-2018.

However, Packaged Facts offers some warning signs, factors that could derail future growth. A key factor is that one of the main drivers behind sales growth for several years now—getting pet owners to trade up to higher-priced foods—may have hit a ceiling this year. (Volume sales of petfood in the US and other developed markets have seen flat to little growth for some time; the volume of petfood sold in US mass market outlets has declined by 0.8% this year and by 1.5% in pet specialty from 2012 to 2013.) So, while premium petfoods are projected to continue to sell strong and drive growth in the market, they “can no longer be expected to do all the work,” the Packaged Facts report says.

“The biggest threat, in our opinion, is the erosion of the distinction between value, regular, premium and superpremium brands,” the report adds. “More moderately priced premium products continue to infiltrate the petfood market, giving pet owners at all income levels more price point options in products that are increasingly looking alike.”

Another concern is that, while pet ownership in the US is increasing, “at its current pace, pet population growth is not sufficient to drive higher levels of market growth,” says David Sprinkle, research director for Packaged Facts. As of 2013, 56.5% of all US households owned some kind of pet—only a slight increase from 55.9% in 2011.

Yet, there is still a bright spot among these warning signs: Pet ownership among lower-income households (defined as learning less than US$60,000 a year) is rising, with an 18% gain from 2009 to 2013. “What’s more, by virtue of simple math, the lower-income group harbors far more potential pet owners since it accounts for a majority of the US population,” says David Lummis, lead pet market analyst for Packaged Facts, writing in Pet Product News International.

That may mean petfood manufacturers and marketers will need to rely even less on premium products to drive sales and growth. “Non-affluent consumers are typically more value focused, so relying on this demographic for dollar gains—not to mention the volume growth so sorely needed—will be challenging, even risky,” Lummis continues. “But as premium products approach saturation among higher-income pet owners, a large part of the market’s future fortunes might lie in the yet-to-be-tapped potential of their less flush counterparts.”