American shoppers are not yet willing or able to throw their wallets open, and this reality has been evident in pet market performance. PetSmart is estimating comparable store sales growth of 3%-3.5% for fiscal year 2013. As reported in Packaged Facts' upcoming Pet Market Outlook 2014-2015, IRI's multi-outlet (MULO) tracking in the mass market indicates 3.2% growth for cat food and treats in 2013 and only 1.4% growth for dog food and treats.

Even that 1.4% growth in dog food and treats, however, attaches to a $4.4 billion category in IRI's MULO-tracked sales, for $59 million in sales growth. The $4.5 billion cereal category, in contrast, lost $156 million in MULO-tracked sales, and the $4.3 billion frozen dinner category lost $118 million. So the grass is still greener on the pet side of the fence.

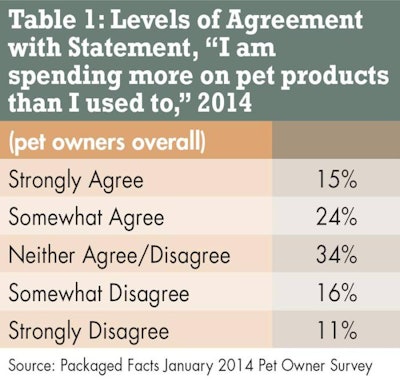

That's because pet owners continue to tilt toward higher levels of spending on pets and more purchasing of premium pet products. According to Packaged Facts' January 2014 pet owner survey, 39% of pet owners somewhat or strongly agree that they are spending more on pet products than they used to, compared to 27% who somewhat or strongly disagree (see Table 1). This doesn't make for a sales growth revolution, but the evolution lives on.

This evolution stems from several factors: the humanization of pets (which, as Petco's co-pilot campaign observes, simultaneously humanizes people); the growing attentiveness of Americans to health issues; and an aging and sometimes ailing pet population. According to Packaged Facts' most recent pet owner survey, 46% of dog owners have pets age 7 or older, as do 50% of cat owners. In addition, 19% of dog owners have overweight pets, as do 17% of cat owners (see Table 2).

The growing population of older pets means more companion animals are suffering from age-related conditions including joint, coronary, cognitive and immune-system-related, as well as diabetes and cancer. Senior-targeted pet products cover all of these needs as well as routine daily concerns, and because of their more specialized health focus, senior products and services are typically priced well above the market average.

And although not always with the steadfastness that doctors and veterinarians would prefer, consumers have made the link between health and nutrition, and in turn between nutrition and food ingredients. Only 15% of dog owners and 17% of cat owners somewhat or strongly disagree that they pay attention to the main (first) ingredient of the petfoods that they buy, according to Packaged Facts' recent survey.

On the other side of that coin, fully half (50%) of dog owners and 44% of cat owners purchase one or more types of specialty pet nutrition/ingredient products (see Table 3). Among dog owners and cat owners alike, moreover, specialty nutrition/ingredient petfoods or treats take the cake over petfood add-ins or supplements.

In the dog food and treat category, specialty nutritional formula petfood is the top specialty pet nutrition/ingredient product type, measuring by percentage of pet owners who purchase (18%), followed by dog treats with specialty nutrition ingredients (17%). Among cat owners, petfood targeting specific health concerns takes the lead (18%), with specialty nutritional formula petfood sliding into second place (14%).

Given this high level of interest in specialty nutrition, the premium share of petfood sales has expanded on both the dog and cat sides of the pet food market, mostly as a result of growth in the superpremium segment. Treats have also grown their share of the market, primarily due to the robust interest among dog owners in treats with specialty nutrition. Although cat owners have not yet proven as likely to indulge their pets in superpremium fare, and have also been slower to embrace functional treats, they are catching up to the canine crowd, creating a key area for sales growth as cat food and treat marketers trend into more premium and functional fare.