In the pet food market, as in the processed food market for humans, product trends are defined by positive and negative ("free-of") attributes, variously embodied in brand/product names, product formulations and flavor varieties, product information and positioning claims, and packaging choices and imagery. This flows from the duality that while the core pet food function of nourishment is positive, commercial food processing inherently triggers concerns about product integrity. And even the core nourishment function is hardly without its quandaries, as evident in the coexistence of caveman and culinary enthusiasms, of grain-free alongside ancient grain product varieties.

The sets of attributes that make for successful products morph over time, and not necessarily neatly or even coherently, in keeping with the untidiness of consumer attitudes and behaviors. That caveat notwithstanding, natural-positioned products are firmly at the core of pet food trends, especially in the specialty pet channel. A Packaged Facts survey in February/March 2016 showed 48% of pet owners agreeing that natural/organic brand pet products are often better than standard products, a percentage up markedly from 38% in an August 2012. The recent survey also showed 54% of pet owners placing a “high priority” on buying pet food with natural ingredients.

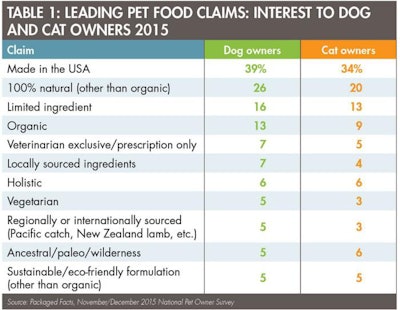

Natural, organic and related product claims are, correspondingly, among the most important and effective in the pet food market. In a November/December 2015 Packaged Facts survey, 26% of dog owners and 20% of cat owners indicated that they currently buy natural (other than organic) pet food formulations (see Table 1).

“Made in the USA” dominates when it comes to what claims pet owners look for on their pet food bags—more than even “100% natural” claims, a staple of the market.

In a related “whole foods” trend, pet food purchasers have placed the quantity and quality of protein ingredients at center plate. Here, as elsewhere, pet market trends are being energized by the human food market, in which protein is the hottest functional food ingredient. Per Packaged Facts’ February/March 2016 survey, 65% of dog owners and 62% of cat owners agree that their pet needs a high-quality protein diet. The quest for higher-quality protein tilts in the direction of the “human-grade” trend, a claim that continues to advance in the pet food aisle.

Poultry is the most common protein ingredient in dog food as well as cat food. With dog food, red meat comes next, while fish comes next with cat food. While traditional options such as beef, lamb, chicken, turkey, salmon and white fish continue to make up the bulk of pet food proteins, exotic sources are increasingly in evidence, upping the primal and/or culinary ante. Terms such as ancestral, paleo or wilderness describe pet food formulations reminiscent of how dogs and cats ate before they were domesticated, taking inspiration from the corresponding human dietary trend. This nutritional philosophy can also lead down the road to “raw” food, which, though a niche, is becoming increasingly influential.

The ancestral nutritional profile dovetails with grain-free formulations, which account for nearly half of dog food sales in the specialty pet channel and are a must-have component for natural pet food lines. Mirroring trends in the human market, grain-free aligns with the philosophy of seeking out processed foods with a limited number of ingredients, leaving less room for allergens and artificial ingredients.

Product safety more broadly speaking looms behind many of the trends in pet food. For example, given the widespread concerns about Chinese-sourced pet food and ingredients since the recalls of 2007, 39% of dog owners and 34% of cat owners buy pet foods with “Made in the USA” claims. If natural and high-quality protein are tops in positive pet food attributes, product safety is the ultimate in “free-of.”

Further pet food market information

For more Market Reports by David Sprinkle: www.petfoodindustry.com/authors/145

Pet food in the US

For information on the newest edition of Packaged Facts’ report on Pet Food in the US (March 2016), please see https://goo.gl/edHIEH.