Over the past decade, Hispanics have become increasingly likely to own pets. In the 2007–08 period, just 43 percent of Hispanics owned pets, compared to 58 percent of non-Hispanics. The percent of Hispanics owning pets jumped to 55 percent in 2015–16. During the same period, Hispanics grew from 10 percent to 15 percent of all pet owners, as the number of Hispanic pet owners grew from 11.4 million to 20.4 million, for an increase in pet ownership greater than that among non-Hispanic whites.

Shopping patterns among Hispanic pet owners

In terms of shopping patterns, the retail channel choices of Hispanic and non-Hispanic pet owners are similar in that both segments are most likely to purchase products for their pets at PetSmart, Petco or supermarkets (see Table 1). Nonetheless, several differences hold in the retail shopping patterns of Hispanic versus non-Hispanic pet owners:

- Hispanic pet owners are more likely than average to purchase pet products at PetSmart or Petco, or at drugstores/convenience stores.

- Hispanic pet owners are less likely to buy pet products at wholesale membership clubs, online (at 7 percent vs. 10 percent, respectively), veterinarians, pet stores other than Petco or PetSmart, or discount stores (at 16 percent vs. 25 percent, respectively).

Table 1: Hispanic pet product purchasers are more likely to shop at PetSmart or Petco than their non-Hispanic counterparts.

Acculturation levels play a major role in Hispanic pet owner patterns. For example, the percentage of Hispanics owning pets rises from just 48 percent of foreign-born, Spanish-dominant Hispanics to 64 percent of US-born, English-dominant Hispanics with at least one parent born in the United States. Similarly, English-dominant Hispanic pet owners are much more likely than Spanish-dominant pet owners to have bought any type of products online (33 percent vs. 17 percent), or to have used a smartphone to buy any type of products online.

Brand loyalty, price and the Hispanic pet product shopper

In general, Hispanic pet owners are less attached to brand-name products than are their non-Hispanic counterparts. Packaged Facts survey data show that Hispanics are, for product shopping in general, less likely to always look for a brand name on a package (28 percent vs. 32 percent) and less likely to agree that it’s important to have the brand they like, regardless of price (29 percent vs. 33 percent). Hispanic pet owners also are more fickle when it comes to brand loyalty. For product shopping in general, a significantly higher proportion of Hispanics like to change brands often for the sake of novelty (24 percent vs. 18 percent).

One result of this reduced affiliation with brand names is that Hispanic pet owners have a higher likelihood of buying store-brand dog and cat foods. Although the absolute percentages are relatively small, Hispanic dog owners are more likely than non-Hispanic dog owners to choose store brands when they buy wet/moist dog food (10.9 percent vs. 7.9 percent) or packaged dry dog food (10.7 percent vs. 7.5 percent). Similarly, Hispanic cat owners are more likely than their non-Hispanic counterparts to purchase store-brand packaged dry cat foods (10.4 percent vs. 7.5 percent).

In addition, Packaged Facts survey data show that, compared to their non-Hispanic counterparts, Hispanic pet owners are more price-conscious about pet products:

- Hispanic pet owners are more likely to agree that many pet products are becoming too expensive (72 percent vs. 63 percent).

- Hispanic pet owners are more likely than average to look out for lower prices, special offers and sales on pet products (75 percent vs. 71 percent).

The impact of pet health on Hispanic shopping patterns

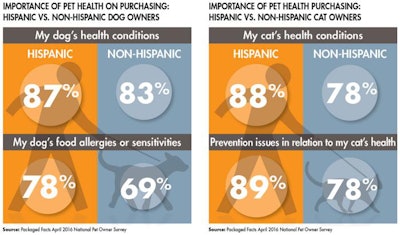

Although product prices may be more strongly front-of-mind for Hispanic pet owners, health considerations remain a major component in their selection of pet foods (see Figure 1). Specifically, Hispanic dog owners are more likely than non-Hispanic dog owners to agree that their dog’s health conditions are important to them when buying dog foods (87 percent vs. 83 percent), and to consider their dog’s food allergies and sensitivities when purchasing dog foods (78 percent vs. 69 percent).

Figure 1: Hispanic dog owners show a higher propensity for taking their pet’s health into consideration when purchasing pet products.

Hispanic cat owners are even more concerned about health issues when purchasing pet food (see Figure 1). Compared to their non-Hispanic counterparts, Hispanic cat owners are significantly more likely to agree that their cat’s health conditions are an important consideration when buying cat foods (88 percent vs. 78 percent), and to be concerned about prevention issues in relation to their cat’s health (89 percent vs. 78 percent).

Of course, this dynamic of being budget-conscious about price yet finicky about product benefits is hardly unique to Hispanics or to the pet products market. With Hispanics accounting for the majority of new pet owners in the US, marketers would be foolish not to pay close attention to the Latino pet parent’s progress.

The Hispanic pet product market

More on pet shopper demographics: www.petfoodindustry.com/articles/5636.

More on Packaged Facts’ report, “Hispanics as pet market consumers” (November 2016): https://goo.gl/UEoTPL.