According to Packaged Facts analysts, natural pet food sales reached US$8.2 billion in 2016 and now make up 25 percent of the total US pet food market. Natural pet food sales grew by a compound annual growth rate of 12.1 percent between 2012 and 2016.

That data was published in Packaged Facts sixth edition of “Natural, Organic and Eco-Friendly Pet Products in the US,” released in October 2016. In the report, sales data revealed patterns in natural pet food consumers’ demographics related to income and age. Survey results and other input allowed the analysts to forecast rising trends for new natural pet foods, particularly organic ingredients.

US natural pet food market leaders

Blue Buffalo was the most-purchased natural pet food brand, according to the Packaged Facts report. Blue Buffalo products were bought within the last three months by 35 percent of those dog and cat owners who buy natural, organic or eco-friendly products. AvoDerm Natural and Purina Pro Plan Natural came in second and third place with 19 percent and 18 percent, respectively.

Blue Buffalo also led the pet treat category with 18 percent of sales, according to Packaged Facts, while Natural Balance followed with 10 percent.

Consumers of natural pet food

Demographic patterns emerged among dog and cat owners who bought those pet foods and treats. For organic pet food, high-income households bought at higher rates. Market data collected by Simmons, a consumer research group, reflected that 6.3 percent of households with an income of US$100,000 to US$149,000 bought organic pet food, compared to four percent of all dog- or cat-owning households.

A different trend emerged among dog food owners who bought food marketed as natural, as opposed to organic. Pet owners over age 70 bought natural pet food at the highest rate, 11.6 percent. Baby Boomers, between ages 50 and 69, made up the majority of purchasers with 1.6 million individuals.

Trends driving natural pet food sales

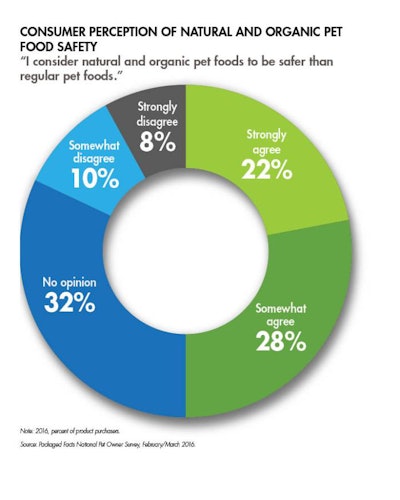

Safety and sustainability motivations tended to drive consumers’ attention to natural pet foods. Packaged Facts’ survey results revealed that half of pet product purchasers believe natural and organic pet foods are safer than conventional varieties (see Figure 1).

FIGURE 1: A significant number of pet food purchasers either "agree" or "strongly agree" that natural and organic pet foods are safer for their pets than regular pet foods.

"The natural category has been growing for twenty years but consumers now realize that just because a product is natural does not necessarily mean it is the best quality," said Joey Herrick, founder and president of Lucy Pet Products. “Today, good clean formulas with quality natural ingredients are a minimum requirement.”

As part of their food safety concerns, consumers increasingly want to know the history of their pet food ingredients and the effects they had on the Earth. The environmental sustainability of a pet food’s entire lifecycle matters to consumers who buy natural products, according to the report. That includes the packaging, transportation, production and agricultural techniques used to grow the ingredients.

Speaking of farming techniques, the report forecast that organic pet food sales are poised for growth. Reduced obstacles to producing organic pet food may allow organic to become the “next natural.” Offering an organic product can help a brand set themselves apart on the increasingly crowded natural pet foods shelf.

“We continue to see marketplace interest in the ingredients that are used, more so than even the nutritional aspects of the food,” said Mark Brinkmann, vice president of operations of Diamond Pet Food. “People are interested in the back story of the various animal ingredients. We get questions from customers concerned about the sustainability of our fish ingredients, about the care given to the animals that represent the protein portion of our formulas, and the recyclability of our packaging.”

As much as consumers want to know the details about ingredients in their pet’s food, they want to know what things aren’t in it, according to the Packaged Facts report. Non-GMO and grain-free are two popular examples of this. Grain-free pet foods became a major force in the natural market and are now spreading into conventional products.

Channels for natural pet food sales

When consumers go looking for organic, human-grade quinoa and alligator dog food, they may tend to frequent pet specialty stores. Packaged Facts analysts calculated that the pet specialty channel handles 70 percent of the natural pet food market. However, mass market retailers and pet specialty big box stores are increasing their share of sales. Walmart (35 percent) and PetSmart (33 percent) were the most likely places for dog or cat owners to buy natural/organic or eco-friendly pet food, according to Packaged Facts’ July/August 2016 National Pet Owner Survey.

Brands and the future of the natural pet food market

The mass market presence of natural pet food may grow as Nestlé Purina, Mars and J.M. Smucker acquire smaller organic and natural brands, according to Packaged Facts researchers. For example, purchasing Merrick Pet Care in 2015 gave Purina an established US natural pet food brand.

For other established pet food companies, expanding product lines or creating line extensions has allowed entry into the natural pet food market, setting up opportunities for the future. Some example of companies that have done this include: Ainsworth Pet Nutrition’s Rachael Ray’s Nutrish, Freshpet, Nestlé Purina’s Zukes, WellPet’s Wellness and Holistic Select lines, Fromm Family Foods and Barkworthies. And as always, consumer desires will continue to reign supreme in the continued growth of this pet food segment.

“I believe that consumers will continue to buy natural products from companies that they believe are truthful, transparent and put the health of animals first,” said Merrick.

Growing trends in natural pet foods

Follow the latest pet food trends