The recently announced pause and easing of the U.S.-China trade war likely offers at least temporary relief for concerned pet food companies and suppliers. Especially considering that in a poll posed during a May 14 webinar on tariffs presented by the American Pet Products Association, China was the country of most concern for participants from the U.S. pet industry.

In a second poll, the webinar participants identified pet food/treats as the product category that is or could be most impacted by tariffs; it was named by 37%, compared to just 25% for pet toys and training products.

Yet another poll, an informal one posted on this website (PetfoodIndustry.com) from April 18 to May 3, showed 40% of the more than 200 respondents saying they thought tariffs would have a significant impact on the pet food industry overall. Another 20% though tariffs would have a severe impact, and 27% said some impact. Just 13% responded that tariffs would have very little to no impact on pet food.

How trade policy affects pet food and animal feed

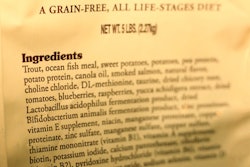

The 90-day lowering of reciprocal tariffs between the U.S. and Canada announced on May 12 was welcome by the pet food and feed industries because of potential financial benefits. The overall animal food industry exported US$1.27 billion in goods to China in 2024, according to the American Feed Industry Association (AFIA), while importing about US$549 million in animal food products and ingredients from China, including key items like vitamin E, amino acids and pet food.

“China is a top destination for many U.S. animal food products and provides many essential ingredients, like vitamins, not produced elsewhere globally that allow U.S. animal food manufacturers to produce complete and balanced animal food,” said AFIA president and CEO Constance Cullman. “We are hopeful that the 90-day tariff pause will provide the breathing room needed for Chinese and U.S. trade officials to reach a mutual agreement that benefits the U.S. animal food industry and agricultural economy.”

Obviously, 90 days is not permanent, and given the constantly changing levels of tariffs announced by President Trump, no one can breathe easy yet. In fact, when Ernie Tedeschi, director of economics for the Budget Lab at Yale Law School, began his opening keynote address at Petfood Forum 2025 on April 29, he said he had revised his presentation the night before to reflect the latest data and analysis, then joked that things could be different by the end of the day. (And look how much the situation has changed even since then! If you want to follow up-to-minute updates, the Budget Lab provides those at https://budgetlab.yale.edu/.)

Good-bad-good-bad news for pet food

Tedeschi painted a pretty stark picture in terms of the outlook for the impact of trade policy on the U.S. economy, GDP and consumers, especially those in lower income brackets. Specific to pet food, his data and analysis presented both good news and bad news:

Good news: Pet food is acyclical, “meaning its demand remains relatively steady regardless of macroeconomic conditions,” wrote my colleague Lisa Cleaver in an article about Tedeschi’s presentation. “Among 180 consumer spending categories, non-veterinary pet products showed minimal correlation with the business cycle, right alongside essentials like eggs. In contrast, veterinary care is highly procyclical, with demand dropping off quickly in recessions.” Tedeschi commented that pet food’s status reflected the emotional commitment pet owners have to their furry family members.

Bad news: Both pet spending and tariffs skew toward the bottom, or households with the lowest income levels. That means the effects of tariffs will hit those households the hardest and possibly affect their pet food spending habits, likely in the types of products they’ll buy (they’ll trade down).

Good(ish) news: The U.S. pet industry imports relatively little. Outside the AFIA data regarding China, in total trade with all countries, only 3 to 4% of pet products are imported into the U.S. The highest levels of imports do come from Thailand, China, Canada and Mexico, all currently affected by tariffs, so this could affect pet food prices, Tedeschi said; he calculated an overall 19% average tariff on imported pet food, resulting in a .75% increase in prices.

Bad news: The U.S. is a net exporter of pet food, exporting US$2.5 billion annually vs. $1.5 billion imported, with 50% of exports going to Canada and 10% to Mexico.

Impact on pet food producers: Small ones hurt the most

This situation is having real-world effects, especially on smaller pet food companies. During Global Pet Expo 2025 in March, Jeremy Peterson, founder, president and CEO of Identity Pet, said his small pet food company does a lot of business with Canada, both in terms of imports (aluminum cans for wet pet food) and exports of finished products. He also has used contract manufacturers in Canada, Peterson said, adding that his costs were rising, and obtaining enough capital was a significant concern. “Small businesses don’t have the capital to withstand” the chaos and uncertainty wrought by ever-changing tariffs, he added.

His company is not alone. In the April-May poll on PetfoodIndustry.com, 42% of respondents named increased costs as their greatest concern regarding tariffs. Supply chain disruptions and long-term uncertainty both received responses of 22%, followed by limited access to global markets (6%) and competitive disadvantage (4%). Another 4% said they have no concerns. (Lucky them!)

The good-ish news here is that nearly half, 49%, of respondents reported feeling at least somewhat prepared to manage the potential consequences of tariffs. Just good-ish, because 31% said they were not very prepared, with 9% feeling not at all prepared. Only 11% said they felt well prepared.