We were wondering, in a climate of economic uncertainty, are new pet food products moving forward or being shelved? Petfood Industry's November poll on innovation has revealed a cautious approach to new product launches heading into 2026.

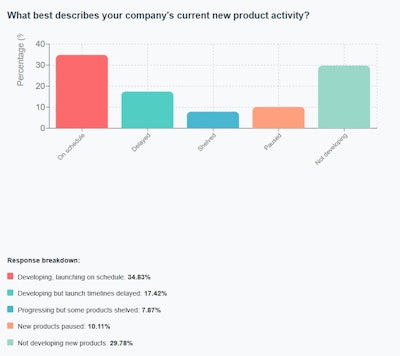

Current new product activity

Only 35% of respondents reported developing and launching products on schedule, while 30% indicated they are not developing new products at all. Another 17% said they're still developing products but facing delayed launch timelines, and 8% have progressed with innovation but shelved some products. An additional 10% have paused all new product activity.

What this means: These results may signal a retreat from the aggressive product development cycles that characterized the industry in recent years.

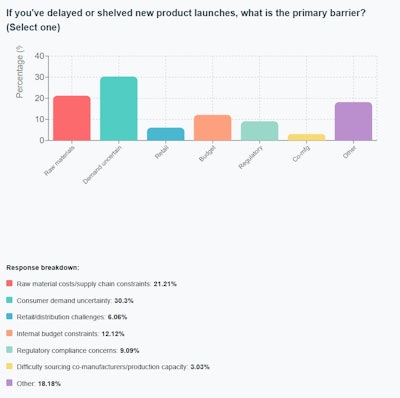

Primary barrier for delays

Among those who have delayed or shelved launches, consumer demand uncertainty emerged as the primary barrier, cited by 30% of respondents. Raw material costs and supply chain constraints came in second at 21%, followed by internal budget constraints at 12% and regulatory compliance concerns at 9%. Retail and distribution challenges affected 6% of respondents, while only 3% pointed to difficulty sourcing co-manufacturers or production capacity.

What this means: Pet food manufacturers seem primarily concerned about whether consumers will purchase new products rather than whether they can produce them.

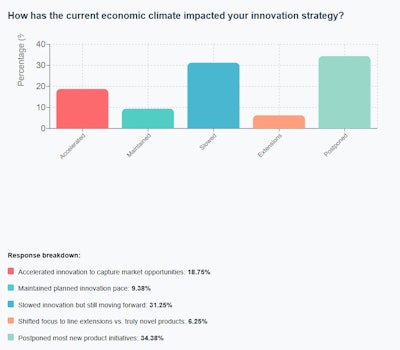

Current economic climate impact

The economic climate has reshaped innovation strategies. More than one-third of respondents (34%) said they've postponed most new product initiatives, while 31% reported slowing innovation but continuing to move forward. Nearly 19% accelerated innovation to capture market opportunities, and 9% maintained their planned pace. Only 6% shifted focus specifically to line extensions versus truly novel products.

What this means: While many have adopted defensive strategies by slowing or postponing launches, nearly one-fifth of pet food producers have accelerated innovation suggests some manufacturers view the current environment as an opportunity.

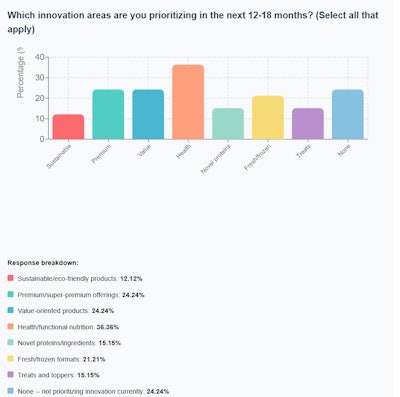

Innovation priorities moving forward

For those still pursuing innovation over the next 12 to 18 months, health and functional nutrition topped the priority list at 36%, followed by premium and super-premium offerings and value-oriented products, each at 24%.

Fresh and frozen formats garnered 21% interest, while novel proteins and ingredients and treats and toppers each attracted 15%. Sustainable and eco-friendly products ranked lowest among active innovation areas at 12%. Notably, 24% selected "none," indicating they're not prioritizing innovation currently.

What this means: The strong emphasis on health and functionality alongside equally weighted interest in both premium and value segments reveals manufacturers hedging their bets across price tiers, while sustainability's relatively low priority may suggest science-backed benefits currently trump environmental messaging.

2026 market outlook

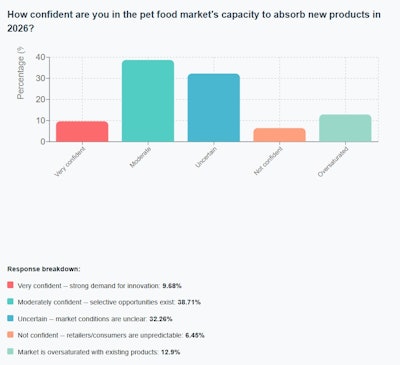

Looking ahead to 2026, confidence in the market's capacity to absorb new products remains mixed. Only 10% expressed strong confidence in demand for innovation, while 39% felt moderately confident that selective opportunities exist.

Nearly one-third (32%) reported uncertainty about market conditions, 13% believe the market is oversaturated with existing products, and 6% lack confidence due to unpredictable retailers and consumers.

What this means: With only half of respondents expressing any level of confidence, combined with nearly one-third uncertain about market conditions, the industry may be anticipating a prolonged period of cautious, selective innovation in the year ahead.

Survey methodology: Data collected November 17-December 5, 2025, from pet food industry professionals via Petfoodindustry.com polling platform.