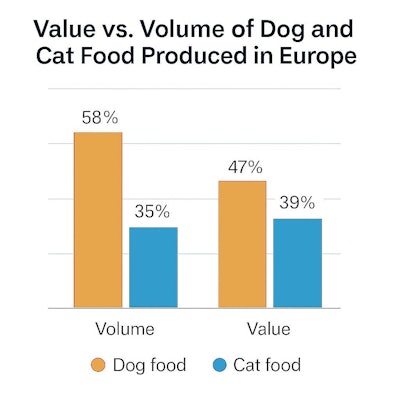

The value-to-volume ratio of some pet food formats exceeds that of others in the European dog and cat consumables markets.

In 2023, 58% of pet food produced was for dogs, while 35% was for cats. However, 47% of the total retail value of pet food came from dog food, while 39% of the value was from cat food. The Fédération Européenne de l'Industrie des Aliments pour Animaux Familiers (FEDIAF, European Pet Food Industry Federation) released that data in their 2025 Facts and Figures report.

Cats were the most populous pets in Europe in 2023, but they are generally smaller and eat less than dogs. However, their food may be most expensive at a price per pound level. Cats lived in 26% of European homes in 2023, with 108 million cats in total. In comparison, dogs dwelt in 25% of European domiciles with a population of 90 million.

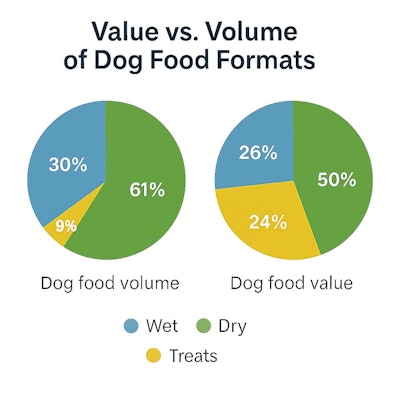

Dog food production value vs. volume by format

Just as the value per volume of cat food exceeded that of dog food produced by the European market, some pet food formats were more profitable than others within dog and cat foods.

While the volume of dry dog food sold exceeded the volume of treats by more than sixfold, treats had a value approximately half that of dry dog food.

Dry dog food held the dominant share of dog food by volume at 61%, yet it represented only 50% of the total retail value. This disparity indicates that dry food, while being the most commonly purchased by weight or quantity, generates less revenue per unit compared to other formats. The lower value-to-volume ratio suggests dry food is often sold at lower price points, possibly due to its availability in bulk packaging.

Wet dog food, by contrast, accounted for 30% of the volume but only 26% of the value. Like dry food, wet food's share of retail value trails its production volume. This may reflect price sensitivity in this category compared to treats. While wet food is often marketed for palatability and is typically more expensive per kilogram than dry food, the data suggest it may not command sufficient pricing power to outpace its volume share.

Dog treats show a markedly different trend. Though they constituted only 9% of the volume, they made up 24% of the total value. This indicates that treats deliver a significantly higher value per unit of volume, pointing to their premium positioning and higher margins. Treats are often purchased in smaller quantities and at higher price points, especially those marketed for health, functional benefits or as indulgences, reflecting strong consumer willingness to pay more per unit.

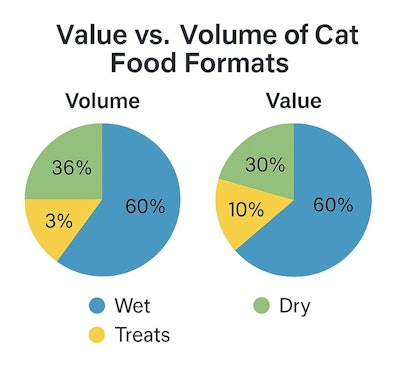

Cat food production value vs. volume by format

The difference wasn’t as great in the European cat food market, although cat treats had a higher value compared to the volume.

Wet cat food accounted for 60% of both the volume and the retail value of cat food sold. This parity indicates a stable price-to-volume ratio, suggesting wet cat food maintains consistent pricing per unit across the market.

Dry cat food, on the other hand, made up 36% of the volume sold but only 30% of the retail value. This gap suggests dry cat food is typically sold at a lower price per unit compared to wet food. The disparity may reflect cost efficiencies in production, longer shelf life, and price-sensitive consumer segments that gravitate toward dry formats for affordability and convenience.

Cat treats showed the most significant divergence between volume and value. Although they comprised only 3% of the volume, they contributed 10% of the total value. This disproportion indicates that treats are sold at a significantly higher price per unit. This may be due to premium positioning, smaller packaging, specialized formulations, or higher margins associated with occasional-use products.

Although both dog and cat treats had higher price-to-volume ratios, pets cannot live on treats alone. Kibble still holds an important place, especially in the dog food market. Even as pet owners gravitate towards smaller dogs and cats, dry pet food’s convenience and affordability will likely keep it a mainstay of pets’ diets.