In this episode of Trending: Pet Food, Lindsay Beaton speaks with Charlie Nelson, CEO of KLN Family Brands, and Kyle Gallus, co-founder of Finley's brand and vice president of brand development for Tuffy's Pet Food & Treats, about how mergers and acquisitions can happen without losing brand mission and purpose. The conversation explores KLN's unique acquisition philosophy, which prioritized Finley's mission to create jobs for people with disabilities over immediate financial benefit.

We want to thank AFB international for sponsoring this podcast. AFB is the premier supplier of palatants to pet food companies worldwide, offering off the shelf and custom solutions and services that make pet food treats and supplements taste great.

Lindsay Beaton, editor, Petfood Industry magazine and host, Trending: Pet Food podcast: Hello, and welcome to Trending: Pet Food, the industry podcast where we cover all the latest hot topics and trends in pet food. I'm your host and editor of Petfood Industry magazine Lindsay Beaton, and I'm here today with Charlie Nelson, CEO of KLN Family Brands, and Kyle Gallus, co-founder of Finley's brand and vice president of brand development for Tuffy's Pet Food & Treats. Hi guys, and welcome!

Kyle Gallus, co-founder of Finley's brand and vice president of brand development for Tuffy's Pet Food & Treats: Hey Lindsay, happy to be here.

Beaton: In case you're unfamiliar with Charlie, Kyle, or their companies, here's what you need to know.

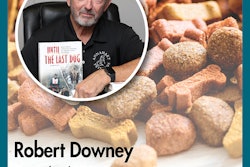

KLN family brands was founded in 1964 by Charlie's Grandpa Darrell "Tuffy" Nelson. Charlie is a Perham, Minnesota native where the company is headquartered today. Charlie attended the University of Minnesota on a baseball scholarship and graduated in 1995. After playing baseball professionally for 5 years, Charlie worked for the Minnesota Vikings and Merrill Lynch before joining KLN Family Brands, becoming the 3rd generation to carry on the family business. Today Charlie leads KLN family brands and is actively involved in philanthropic efforts rooted in his and his family's passions to serve communities in need.

Finley's brand was acquired by Tuffy's Pet Treats, a division of KLN family brands, in May 2022.

Kyle is a former Special Education teacher who found his way into the pet industry when he and his wife Angie founded Finley's in 2016. Finley's mission is to create jobs for people with disabilities, combating the over 80% unemployment rate people with disabilities experience today, and to serve as platform for conversation about inclusive hiring and community advocacy for the one in four Americans with a disability. Today, Kyle leads the marketing efforts for the NutriSource and Finley's brands. He and his family call Henderson, Nevada, home where they are actively involved in the start-up community and mentoring new entrepreneurs on their journey in the CPG space.

Charlie and Kyle's success in pet businesses, their acquisition history together, and their devotion to making the world a better place through their companies, are all why I've brought them on today to answer this question: How can mergers and acquisitions happen without a company losing its brand mission and purpose?

Now, there's a lot of background information that we need to establish before we can appropriately have this conversation, because one of the reasons we're even having this conversation is because of the way KLN does business and its unique philosophy toward mergers and acquisitions. I want to start off our conversation by talking about what the story is behind KLN and its brands. Give me your origin story.

Charlie Nelson, CEO of KLN Family Brands: Lindsay, first, I want to thank you for calling my hometown, Perham. A lot of people say that incorrectly, that's a great start, and I appreciate the kind words there.

As you mentioned, we're a third-generation company. Manufacturing has really been our space for 60 years now. We enjoy what we do, and really our focus, our why, our purpose, if you will, has been, in some regards, quite steady over the years, and in some regards, been tweaked throughout the years. I think my dad and grandpa started the business with the mindset of creating jobs. Back then that was a big focus. Create as many jobs as you can for our nice community and hire good people, which we're always about, and the rest will take care of itself. While that's certainly still a focus of ours, giving back was always a piece of who my dad and grandpa were, and that certainly remains very much of a focus for us.

In fact, one of the things we talk about, quite honestly, is our why. Why do we do what we do? Why are we a proud people-first company? Why do we believe in changing the world by bettering this place that we live on? It comes back to the why, and that's full circle here. That's why the Finley's acquisition really made a ton of sense to us.

It was not as much the product, as much as the mission and the initiative and why they were doing what they were doing. It fit with us. That's what kind of led to even the discussions in the first place, with bringing something together, if you will. Our why is just making a difference, it's caring about our people. Our three focuses right now are really helping military vets with training dogs, working with facility dogs and Children's Hospital, which has been just phenomenal.

We're just tip of the iceberg there, and then focusing on the mission that Finley's brought to the party, that was really working with people with different abilities, and how we can make a difference and create jobs together. We kind of have a three prong approach, if you will, to our why, and it drives us every day. I can tell you that Lindsay.

Beaton: We talk a lot in the pet industry about philanthropy, and I think it has something to do with the industry, especially when it comes to philanthropy with animal shelters and animal-based things, that's something that really is easy and even expected in terms of pet consumers for these companies to get involved in. Kyle, your company, Finley's, goes beyond that and really aims to establish itself in the community.

What I want to know from you, obviously, an acquisition could not possibly lose the mission of Finley's. Otherwise, what is even the point? You're losing the core of the company. What did the conversation between you and KLN look like when you were discussing an acquisition and the obvious importance to you that your mission not be lost in an acquisition?

Gallus: I think what really encouraged us and really taking a step back and understanding where -- Angie, my wife and other co-founder -- when we started Finley's, we were just a small operation. We had six people with disabilities in a commissary kitchen, and as that grew into a much bigger opportunity, we started to really understand and anchor into what inclusive hiring truly means.

As we understood that, and as KLN came to the table later on in the conversations, what made this so different was that question always led the conversations, the questions of, how do we do this, where we still maintain that integrity of what we built, but also can Finley survive without that brand and mission and purpose still the root of everything?

I think the early conversations were really around, well, what do Angie and I think, what are our ambassadors, or people with disabilities? What do they think? What do our board of directors, deeply rooted business people in the disability community, think? The very first question that led this whole conversation was, how do we do this in a way that not only maintains that brand purpose, but accelerates it? That is rare.

Very early in the Finley's journey, we had multiple conversations with different stakeholders in the pet industry and the Nelson family and Charlie and KLN, and they just approached it with that leading question that other companies didn't. There's profit that must drive purpose. Sometimes we think that is rooted in the right thing, but it's a little bit flipped with the Finley story -- that purpose can drive more profit if we scale this correctly. If it's given the platform, the operational components, just that deeper pet industry expertise.

Believe me, as two special ed teachers, we were just guessing, and nobody's going to be shy with that, but we guessed right in some areas. We guessed wrong in some areas. But those initial conversations were rooted in what is the best way to go through this complicated process, to maintain that integrity of the brand mission, but ultimately given a platform to go out and thrive. From May 2022, when the brand was acquired, we had 35 individuals with disabilities around five states. Today, we've served over 160 ambassadors with disabilities across 19 states.

That would not have happened without that initial approach, that initial question, just kicking off the conversation. Kyle and Angie, if we're going to do this, we know the mission must lead the conversations. We know there's going to be some hard conversations and steps along the way, like any acquisition, but we've always kept that mission front and center. I think that was what was so different in the initial conversations, the initial approach that Charlie and his team brought to the table.

Beaton: You mentioned that you talked to other stakeholders, and the conversations just did not feel the same. Charlie, obviously, KLN has a very deliberate, intentional and as far as I can tell, different way of doing business than a lot of other companies who exist and expand via mergers and acquisitions. In your day-to-day business, and then in determining the overall growth, how important is it to you to keep that differentiating factor in how you do business in the pet space, and in your conversations with potential acquisitions like Finley's?

Nelson: That's a great question. Even just to back up, Lindsay, you mentioned this industry. It's the most passionate industry that we've ever been involved in as a family, and that makes this fun. It really does.

An acquisition should have a mindset of 1 + 1 = 3. It should make sense for everybody involved. I think what really kind of happened, in this regard, is I reached out to Kyle and Angie, more than anything, with congratulations. Awesome, what you're doing. Awesome how you're making a difference.

It's important to share that my dad and grandpa were entrepreneurs. They understood the challenges of business. My dad's got many a story 50 years ago of trying to build something and the challenges and the number of people that said, “I think it's time to quit. I think it's time to do something different.”

I thank God and a lot of people that my dad had that drive to keep going. It’s inspirational and motivational, and I took that with me. My job is to grow this, and grow it in a proper manner, and make a difference along the way. But I don't ever forget the challenges that you can have starting out a business, and that's where I felt Kyle and Angie were. Great concept, great people, easy to embrace what they were doing, but also know that they were at a point where having the wherewithal, having a lot of the things that you kind of need to ramp up and scale the business, was probably tough to come by.

Honestly, I got involved at first because that's how I was raised, and just better understanding where people are at with their business, and if we could be of any assistance, really. I would say that it started in a great place. It started with us coming from an angle of, hey, if we can help you, we'd love to do so. Congratulations on taking the risk, taking the chances. We need that in this world. Started from a great place. It was easy to embrace their mission, but yes, there were certainly discussions of, okay, how does this fit what we're doing? Is there a benefit to the brand? Is there a benefit to the mission? Does it benefit us?

We were in the place where we were expanding our business in certain segments, what they were doing made sense for us to get vertically integrated with it. What was so important, Lindsay, and I think this is lost in a lot of transactions, is oftentimes there's that goal to slowly remove from previous ownership and previous focus. Someone buys something, and the goal is just slowly, almost create a separation.

We came at it completely different. We would not have done this if it did not include Kyle and Angie being absolutely the drivers of this going forward. They are the founders. They had the mindset. They had the willingness to kind of lay it out there, and our biggest goal was making sure they get to do what they do best, and that is, tell their story, tell their passion, embrace that community and figure out how we create more and more jobs.

Transactions happen in a lot of different ways. We've been a part of those in the past. This one was not a big transaction, but it had to come from a place where we were going to continue to do what they wanted to do. Let us play our role. Let us bring our expertise, let us bring our stories, both positive and, “hey, be careful from this, watch out for that.” It gave us an opportunity again to expand our total portfolio that we're excited to get really rolling here. Work in progress. But I think it just came from a good place, from both sides, and the timing was right, and it just made a lot of sense to strongly consider at the time.

Beaton: I really want to dive into that more, because you're talking about an integration of business practicality and partnership that is not always on the table when there's an acquisition. Obviously, mergers and acquisitions are two different things, but I think a lot of times there's the idea that, okay, for the first year, we'll let you keep going as an independent business, and then we're going to slowly start to integrate. Then things happen, and next thing you know, that brand has disappeared, or it means something completely different than it used to mean when the acquisition first happened.

What you guys have done is something that seems to work from a business perspective but also honors the partnership that you were able to have. I want to cover it from both angles, but I want to talk to Kyle first, because there are a lot of small pet food and treat companies out there that began as passion projects, who just get sucked up in the industry and are never seen again.

What was it like for you to have the opportunity to integrate and have those kinds of resources and have that kind of partnership without having to sacrifice your brand identity and everything that you'd work for?

Gallus: There's a lot that you covered there that I think fits back to when Charlie walked us through an important timeline where it wasn't rooted in just capital raises and all those other crazy things that come with an emerging brand and board of directors and all those things. It was really rooted in a trust factor.

We were able to build trust very early. We're able to see how everybody was thinking, and because we had that context leading into that bigger conversation about the acquisition for us, we just believed it. We trusted it. We still trust it today. Again, when we looked at what was being offered, we removed the dollars from the equation and had a very, very long conversation -- Angie and I – about how we didn't start this to make a ton of money. We started this to give people that needed a chance to have a platform to do what they love, to give them that chance.

When we looked at each other and we said, “This is our best chance to follow through on that mission,” knowing all of the hurdles in this pet industry, the market trends, just what was going on with other brands, raising capital, whether they're trying to be acquired, but just trying to stay alive, trying to find something that helps them sustain.

We were at a pivot point, and it became obvious with the trust that we built with KLN and through Charlie and Chase and the family, the right move to give this brand the platform it needs to thrive was to fully integrate under KLN, and it was never a question of, will we stay involved? That trust was already pre-built, and we knew for this to work, we were going to be closely involved.

Part of that too is you go from a team of eight at Finley's to a team of 800 at KLN. There is a lot of deep rooted passion, legacy thinking and history and expertise that we get to plug-and-play into and leverage. Honestly, we all learn from each other now at a level that I think maybe wasn't quite as expected, but it's what can we bring over from Finley's, and what have we seen from some of these learnings to integrate into the good that KLN and NutriSource do.

It was never really rooted in something big and scary and dollars driven. It was, “what's the platform and the next evolution? Do we trust that this is the group to do it?” It was 100% emphatically yes, that KLN was the group to do it.

Beaton: Charlie, I want to talk to you about the benefits of doing business this way, because it's easy to go the traditional route, and it's very established. There are a million different examples of how to do a more traditional acquisition or merger. Speaking to other business owners who do acquisitions and mergers or who might be looking at it, what are some of the benefits of doing it this different way and adding this extra component to the decision-making process?

Nelson: You know, Lindsay, I'll answer that first with a little bit of a comment you made earlier. That was the typical transaction. We've been a part of that. When we learned, gosh, it's been 12, 13 years now, but we had a salty snack food division called Barrel O' Fun. We made popcorn, potato chips, what have you. Totally different space, different world, same community. We sold that business. My dad was nearing retirement. It was the right time. It was the right company. That's another set of decisions, right? That comes down to you start looking at who is your competition, what are the opportunities together, and all of that. We talked about being slowly removed from the equation. We experienced that, and we were still in that community. We still knew a lot of people, but we sold that part of our business. Letting go isn't always easy. Being slowly outside the room, if you will, from decision making isn't easy. We've experienced that too, when there's a set of reasons and standards and reasons that happens. But back to this one, I just think that again, I go back to knowing where Kyle and Angie were with the business.

The biggest thing is being open-minded enough and true to yourself to know you don't know it all. I think the biggest demise in business, in any organization, is not knowing what you don't know. To add to that is not being willing to learn what you don't know. Kyle and Angie brought some experience to the party, and it was a reminder of how difficult it can be to get started.

Kyle talked about raising money. Is that the right thing? Is it not the right thing? You start talking about cash flow challenges, wearing so many different hats. Our biggest goal in this was to free up Kyle and Angie. It was to say, “hey, you have strengths here. Maybe some of it isn't production, but it is your story. You know, the community and a lot of it was letting people do what they do best.”

I think we're very good at manufacturing pet food and treats. I'm proud of that. We try to get 1% better every day, but I'm proud of where we're at. But we needed Kyle and Angie to be allowed to do what they did best, and that's what they're doing every day right now. Full circle.

Every transaction is so different. This one was, as Kyle said, it was not based on immediate financial benefit. It was -- how can we give this brand an initiative the best opportunity to be successful? I think it's letting us do what we do best and letting what Kyle and Angie do what they do best.

Kyle and Angie brought more to the party than we maybe ever would have thought. That's not a negative comment. It's amazing how those two have embraced our organization, have been willing to look beyond the Finley's brand at the larger umbrella, if you will, of who we are and how they can be a part of that and make us stronger. Again, we've got some exciting plans with the Finley's brand. Believe me, there's a business decision here that was made and works about where that can go. Like I said, we're just kind of getting that rolling.

Beaton: This is a little bit of a sidebar, but it speaks to business strategy, and something I think you can both speak to as business owners. Letting people do what they do best, getting the right people around you, realizing that you might not be the one to do it, find the people who can, get them around you and how it boosts your business overall.

Can you both talk about how that has affected the way that you run companies and do business? It's such an important thing to do. But I think it could be difficult to let go sometimes and to admit especially higher up in the food chain, it can be a little difficult to acknowledge that I'm not the right person for this. Let me find the people who are and then let them get down to business and make us successful.

Gallus: I want to approach us from Finley's first. I think there's two different perspectives that are really going to be important and fun here.

From a Finley's perspective, I think with Angie and my story, two special ed teachers, we grew up in the classroom, our students were teaching us. We never had a choice to do it all by ourselves. There was always a support system built in. That kind of ethos came into play with Finley's. We knew very little. For us, between Google, searching everything, finding contract manufacturers, making phone calls, asking probably all the wrong questions, but having people on the other line be gracious enough to be patient and say, “I think what you're trying to ask is A, B and C.” Those were some of the early light bulb moments where we didn't have a choice at Finley's where we had to find anyone and everyone that would listen and then help guide us.

From some early learnings, we had different stores. Some of our first stores we were open. There was no offending Kyle and Angie, because we needed this mission to succeed. We went from customers to telling stores, “hey, you got to carry these products.”

Well, those stores have initiatives and goals, and when they sat us down at the table, they were very gracious and saying, “here's what's working well for you. Here's what you need to improve on, and here's why, and then here's maybe who can help.” We never really had an option at Finley's to isolate in any way, shape or form. It was all systems go. Nobody was going to get off easy not getting a question from Angie and I simply because we didn't know.

We had to ask questions, we had to engage people, we had to network like crazy. It was always an iteration and an evolution of who you're talking to and what level of trust you can build. Have they truly been in the trenches versus maybe at the super high level? They might have really good ideas, but then when you talk to somebody else doing it in the trenches, they say, “hey, you know what trends are saying this, or the customer wants this?” That was always something that we had to do, that delicate dance of really good, high-level feedback, but also understanding that feedback that's coming from the trenches of people that are truly at the ground level, at the store level, and your customers, they're going to tell you what you want.

We had to learn quickly at Finley's, you got to listen to everybody in some capacity and really entertain all perspectives and have no bias to what you believe, because what you believe could be the death of your business.

Nelson: I would totally agree, for what it's worth. I would add that business gets harder every day. I truly believe that there's headwinds out there that you're facing, that we're all facing. It's just complicated business right now.

We really focus on being collaborative in our organization, and I think we have more of that today than ever, because I think you need to. I think you need to be communicating from department to department. You talk about not knowing what you don't know. I look at it this way, I'm a proud person, but my goal every day is to bring people in that are smarter than I am. That's not difficult at times, believe me, but it's tapping people that are great at what they do in a particular space.

We have a phenomenal IT department, because we have people that are really good at it, and there's a lot of trust there. That's just one example, but I think it's really hiring people smarter than you, surrounding yourself, people smarter than you. Remembering business is hard. Remember there needs to be more collaboration than ever, and again, Kyle and Angie brought some of that.

My first job at the company was sales, so I hit the street. It's a place that really is near and dear to me. I can immediately feel for that portion of the business of getting out there, shaking hands, executing, providing service, pulling through all the things, and it's a lot. It's an undertaking. Again, our goal was to let Kyle and Angie do what they did best, and that's what they're doing.

Beaton: Something that I'm finding interesting… Just after 15 years of talking to various owners of companies and people in the pet food business, I have a lot of these, making sure I have the right people around me, making sure that the partnerships are trending true and secure and transparent. I have these conversations a lot more with family-owned businesses. Do you think there's something special about a family-owned business that breeds that kind of collaborative culture down the generations? Truly, the things you're saying are things that I've heard from almost every head of a family-owned business, and it makes me wonder if there's something there.

Nelson: Yeah, I would say this. First thing that comes to mind is we aren't attached to anybody else's timeframe. We can do what we want. We can grow in a manner which we're most comfortable with. We're healthy enough to borrow money when we know there's opportunities to expand and grow. I just think we don't have to answer to a group from that formal standpoint, and believe me, we've got to rely on our board. We've got to continue to build a strong board and people that can sound things off.

The biggest thing is, I don't ever go to bed or wake up thinking about a deadline when something needs to exactly happen when it comes to the acquisition world or growth world or what have you. Lindsay, first thing that comes to mind when you bring that up.

The other thing is, I think you get to decide what's most important. Let's be honest. We know in private equity and VC world, it's returns, it's all those things. I get it. That's not a negative comment, but we get to decide what's most important. We get to decide how we give back. We get to decide our profit-sharing programs.

As we continue to grow and target being a more sizable company, you want to play with the big boys, but you don't want to get away from what made you who you are. There's a balance to that, there really is, and that can be challenging, but that's my biggest goal, and it's my biggest focus -- the vision of the company. How can we play with the big boys and never lose what got us here? Why we're here in the first place. Because we can make a difference.

Gallus: You know, Charlie, you made a good point that I want to speak to as well. It's that community feedback loop. Our stores, our sales team, our marketing team, our IT team, just the feedback component, that communication piece, has become so critical. What I've noticed coming from the Finley side into the NutriSource side and KLN, it's really such a secret sauce opportunity where we have such strong relationships that we can act on that feedback.

When we get some communication from a customer on social media or a store manager, a store level worker, we can hear that immediately, get a team together and act on it. If it's something that is good for the business, there is usually months and months of churn in bigger companies. You must go through a hierarchy of communication. What's really cool and what's really different in this family-owned business is just our ability as a small team to hear that feedback, good, bad and different. We get to hear it, and we get to act on it and maintain that really close relationship that I feel like is often lost with some of the bigger brands and bigger companies.

Nelson: It's staying nimble. It's hearing your people. In our case with NutriSource, we know that the relationship between us and the retailers, everything is why we're here. Those things help. I think we've certainly brought Finley's into that mix. Kyle, to your point, we said, “we've got to listen to the very people that support us and encourage us and created some influence for us over the years.” The cool thing is, we all want to do that. We all see the value in that.

Beaton: Before we wrap up, I want to get some insights from both of you on what companies should consider during the acquisition process from both your angles. Kyle, I want to ask you first, if there's a company out there that is either looking to be acquired or their fielding interest in being acquired, what are some of the top things they should be asking themselves before they move on with an acquisition process?

Gallus: I think, again, I'm a small sample size, but from Angie and my perspective, there is a lot of chatter, a lot of noise around the acquisition space, in sales, multiples, the money conversation, I think sometimes gets more noise than it should. What I would suggest for a lot of early founders with emerging brands or otherwise, really rooting in your purpose, and going back to why did you start this business in the first place? Why did you quit your job and not take a salary for three years? Why did you employ people, or try to employ people, or expand on a mission that was near and dear to your heart, whether that be a product that is innovative or a purpose that means something close to you? Remove the money from the equation and really evaluate what do you need to build a platform that you would feel happy with.

Everybody, at least that we've crossed paths with, has kind of a reset, and they're looking at their small brands, they're saying, hey, we're going to either raise money or look at being acquired. The one question that stumps them, or at least causes them to think more, is remove money. What do you need? When you go to bed at night, when you put your head on that pillow, or you're out with your kids, coaching sports, what's really important to you? You'd be surprised at how many of them just say that operational piece, or just that brand building or just more mentorship, and you don't need a lot of capital to solve that. You just need the right people when you're at the table having those conversations about acquisition.

My number one thing has always been, remove dollars from the equation, and what do you truly need? What's going to get you up in the morning excited to go to work after your brand or your baby has been purchased? I think that it always gets people in a totally different mindset, that I think is often overlooked, quite frankly.

Nelson: I can appreciate that coming from Kyle, and this was a smaller deal. I don't make a light of it because, again, the initiative and mission are so huge, but it was a smaller deal. But to answer your question, Lindsay, these deals happen for so many different reasons. To Kyle's point, you have got to decide what's most important.

There are a lot of people that start a brand that try to borrow as little money and bring as little capital into it, hang on to as much equity as possible, with an absolute goal in mind, to sell at a certain date. Listen, that's business too, right? But for us, what we need to look at, is it the right partner? Is it the right time? We must look at price -- is it the right price? We also look at, we believe in building something, oftentimes more than buying something. You can spend a lot for some brands out there, and then you’ve got to incorporate it and integrate it. That's not always easy either. We are more apt to greenfield something ourselves, build something ourselves, than we are to typically make a big acquisition.

I think the other piece of this is when you're on the selling end, you really must understand how involved you think you're going to be and plan to be going forward, and how much do you care about any sort of initiative or mission that you brought to the party? Because if you aren't sure, the purchaser embraces those things, you need to be prepared to be on the outside looking in.

Again, Kyle spoke of it, there was no confusion with the reasoning behind our purchase, and the biggest one was to drive the mission that Kyle and Angie had the vision and willingness to start. This would not have gone past first base if Kyle and Angie weren't going to stay involved with us and that we weren't going to drive this mission. We're big believers. People must buy your company and buy your mission before they buy your product, and that's why I think this was important. This was our way of driving that and creating jobs.

There's just so many reasons why people get into the business in the first place. Kyle and Angie got into it for all the right reasons, in our mind. It was whether we could continue to drive that, and I think we've been able to, and that's been the fun piece. It's fun to see the growth, not of just this brand, but what Kyle shared earlier, the number of people that we're able to work with now, and how that has spread, and how, again, we see this really being the beginning more than anything.

Beaton: Well, I want to thank you both for coming on today and talking about this. There's always a lot of merger and acquisition activity in the pet space, and there are a bunch of different ways to go about it, and we've seen brands come and go. One of the things that I've really enjoyed about this story and just following Finley's.

I've been following Finley's for a while and just the different way you guys have gone about it. I mean, it was an acquisition, but it's a true partnership, and I find that to be a fascinating way to do business, and something that is a completely valid way of doing business that maybe companies could think about a little bit more, and if they go the other route, that's okay. But just to know that there's a different way to do business, I think it's important to get that kind of thing out there and let brands know that they don't necessarily have to cease to exist the second they get acquired.

Thank you very much for telling your stories today and talking about business and talking about partnership and all those things. It's been a really great conversation.

Nelson: We appreciate the stage, Lindsay, we do. Thank you.

Gallus: Yeah, thank you, Lindsay. It's been fun.

Beaton: Now, before we go, I always let my guests do a little plug. Where can people find more information about both you and your companies and brands?

Gallus: If they're looking to find more information about us personally, the best place to go is LinkedIn (Kyle Gallus and Charlie Nelson). You can find us there, communicate with us.

Come say “hi” at all the trade shows. We know how that goes. I think, as you heard throughout the conversation, we love people, so our brands are built on community and built on people and relationships and handshakes. Find us at trade shows. Look us up on LinkedIn. Then you can find our brands, nutrisourcepetfoods.com if you want to see everything about the NutriSource brand and really deep rooted history behind the legacy brand at KLN, and getfinleys.com for all things Finley's. As you go to those pages, one thing you'll note too is just plenty of history, but plenty of purpose behind both brands. From NutriSource supporting over six facility and therapy dog programs at six hospitals throughout the country, to the Finley's mission, creating a ton of jobs for people with disabilities, a lot of fun things you can find on our website, and again, just appreciate the time and attention to our brands and our purpose here. Thank you.

Beaton: Perfect. That's it for this episode of Trending: Pet Food. You can find us on petfoodindustry.com, SoundCloud or your favorite podcast platform. You can also follow us on Instagram @trendingpetfoodpodcast. If you want to chat or have any feedback I'd love to hear from you, feel free to drop me an email [email protected].

Of course, thanks again to our sponsor, AFB International, the premier supplier of palatants to pet food companies worldwide, offering off-the-shelf and custom solutions and services that make pet food, treats and supplements taste great.

Once again, I'm Lindsay Beaton, your host and editor of Petfood Industry magazine, and we'll talk to you next time. Thanks for tuning in!

Learn more ... KLN Family Brands: 60+ years in, still growing with purpose

This multi-brand company aims to meet pet owner needs while staying true to its philanthropic mission.