Although not often discussed in terms of industry-wide patterns, the frequency of pet food purchasing is a key factor to pet food retailing and target marketing. Frequency of purchasing affects everything from the strategic role of pet departments within multi-category retailers, to customer receptiveness to reward programs, to the appeal of subscription ordering and home delivery of pet food or treats.

Purchasing patterns in dry and moist/canned pet food, pet treats

Data from Packaged Facts’ July 2016 survey indicate that, in the case of dry pet food, dog owners are more frequent purchasers than are cat owners (see Table 1). Among dog owners who buy dry pet food, three out of 10 (29%) do so weekly, and another half do so either every two to three weeks or at least monthly. Among dry dog food purchasers, only two out of 10 dog owners stock up less than once a month.

While dog owners are more likely to frequently purchase pet food than cat owners, those who own both dogs and cats are far more likely to buy pet food weekly than either of the other two groups.

Among cat owners who buy dry pet food, three out of 10 do so monthly, as also is the case among dog owners. However, cat owners are relatively less likely to buy dry cat food weekly (16%) and relatively more likely to buy dry cat food less than once a month.

The difference is more dramatic, however, in the case of customers who own dogs as well as cats. Here, nearly half (47%) buy dry dog or cat food weekly and another quarter do so every two to three weeks. Among these multiple pet owners, less than a 10th stock up on dry pet food less than once a month.

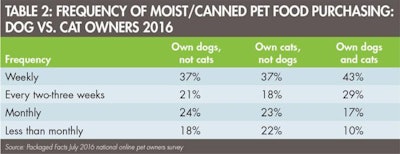

Among buyers of moist/canned pet food, the rate of weekly purchasing increases significantly (to 37%) among owners of either dogs or cats (see Table 2). This pattern reflects in part the especially important role of supermarkets, and weekly shopping, in the market for wet pet food—most markedly in the case of cat owners, among whom the prevalence of weekly purchasing of wet food rises dramatically compared with weekly purchasing of dry food.

Cat owners, dog owners and those who own both are roughly equally likely to purchase moist/canned pet food weekly.

Among buyers of pet treats, frequency of purchase decreases across the board, reflecting the fact that pet treats are supplemental to feeding pets (see Table 3). Even pet parents who own dogs as well as cats, for example, are significantly less likely to buy pet treats than dry pet food weekly. The largest share (38%) of cat owners who buy cat treats, similarly, do so less than once a month.

Pet treat purchasing decreases across the board compared to pet food purchasing, reflecting treats’ status as supplemental to pets’ diets.

Frequent pet food purchasing and the domestic roles of pets

The importance of the frequent pet food purchasing lies not only in associated retailing or marketing strategies, but also, and perhaps more importantly, in the implications for pet food products themselves, because purchasing patterns tie in to the role of pets in the home and in pet owners’ lives.

For example, dog owners who buy dry pet food weekly are significantly more likely to strongly agree (40%) that they are “willing to spend extra to ensure the wellness of my pet,” compared with dog owners overall (33%). Similarly, compared with dog owners overall, a significantly higher percentage of weekly purchasers of dry dog food strongly agree that they seek out pet foods made in the US; that they are concerned about the safety of pet foods; that they would buy natural/organic pet foods more often if they were more affordable; and that concerns about their pet’s allergies or intolerances affect which pet foods they buy. Weekly purchasers of dry dog food are also significantly more likely to strongly agree (32%) or at least somewhat agree (29%) that they “prefer to purchase pet products made by smaller companies I trust,” compared with dog owners overall (19% and 22%, respectively).

The more frequently pet owners buy pet food, the more scope manufacturers have to tie pet food formulation into the larger trends, including freshness and premium “clean” ingredients, that are re-shaping the packaged foods industry overall.

US pet food market information

For more Market Reports by David Sprinkle: www.petfoodindustry.com/authors/145

For information on Packaged Facts’ report on Pet Food in the US (March 2016): https://goo.gl/edHIEH.