Although the largest pet food recall ever has ceased making daily headlines as it did from March through May, consumer concerns over the safety of the US food supply remain at an all-time high and will continue to transform the pet food market. Some of this concern is warranted, and much of it reflects a newfound public awareness of just how closely intertwined the human and animal food supplies are.

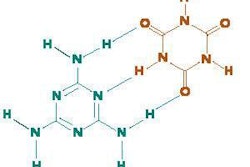

The melamine implicated in the pet deaths was also found in protein ingredients commonly used in human foods, including bread, cereal, pasta and veggie burgers. And it was consumed by more than 150,000 hogs and broilers, which were eventually released for processing and human consumption. This joint decision by five US federal agencies was based on tests confirming that the meat was safe, although the Food and Drug Administration (FDA) and US Department of Agriculture called for additional scientific analysis.

Melamine aside, US consumers have reasons to worry. These include E. coli infection of spinach and Salmonella infection of peanut butter in the past 12 months and limited FDA staff and funding.

A wakeup call

Prior to the pet food recall, most Americans were unaware of the alarming state of affairs with food safety. Apparently, not even frequent contanimation or infection of human food products was enough to warrant major media coverage, making the amount of attention the pet food recall received all the more remarkable.

Even as the media was chowing down on the recall tragedy, the US public tuned in in surprising numbers. During the week ending April 30, 2007, nearly three in 10 Americans (28%) followed the pet food recall "very closely" while another 17% said it was the single news story they followed more closely than any other, according to the Pew Research Center. Only the Iraq war attracted more public interest.

For years, pet industry insiders have been claiming a sea shift in the human-pet relationship. If this doesn't affirm the intensity of emotion, nothing will. Despite the horrific circumstances of the recall, for pet food manufacturers able to rise to the occasion, this high interest level may turn out to be a positive and bellwether of things to come.

For example, Packaged Facts' June 2007 report, Product Safety and Alternative Pet Foods: North American Market Outlook, speculates that billions in pet food retail sales may be in play as consumers consider switching brands. The estimate derives from recent surveys showing the number of pet owners who've said they are open to switching, which ranges from 8% in a GfK Custom Research North America study to 27% in one by the Pet Food Institute. If those percentages are applied evenly to 2006 North American pet food sales of US$16 billion, you get a potential brand shift of US$1.3 billion to US$4.3 billion.

Packaged Facts believes those billions could soon be going toward purchasing alternative products such as natural and organic, raw/frozen, refrigerated and homemade petfoods, as well as other categories explained below. Indeed, such movement may have already started (see Figure 1).

Knee-jerk reaction: no China

Addressing the primary food import concern raised by the recall, one knee-jerk reaction is "China-free." This makes sense in some cases, such as in eliminating suspect China-sourced ingredients. Pet food makers including Menu Foods and Mars division Royal Canin USA are, for example, either cutting back on ingredients from China or phasing them out altogether. Menu says it won't resume using them until the company and the world community are assured they are safe.

In fairness, China isn't alone in turning out below-par foodstuffs, and in most countries, executing food safety officials for putting the public at risk (which recently happened in China) isn't an option. Plus, Chinese-made ingredients are now so ubiquitous in the US food supply that any form of scaling back without causing serious trade disruptions would take years. But, the fact that the China-based addition of melamine and other toxic ingredients to ingestible products has been part of a deliberate and widespread pattern is enough to give any consumer pause.

In the short term, therefore, consumers concerned about the health of their pets and families may respond to label claims like "safe" and "China-free," which, until the new mandatory country-of-origin food labeling regulations kick in (see sidebar), may be the next best thing. Even the often seen "made in the USA" doesn't ensure product safety since, for example, that Sara Lee bread you may have toasted this morning contains ingredients (vitamin supplements) from China.

One company betting on positive consumer response is Food for Health, based in Orem, Utah, USA, which says its products are made from organically grown foods processed and packaged in the US without chemical additives. Its new labeling plans call for "safe" and "China-free" stickers on human and pet supplements, including its Healthy Dog line.

100% US-sourced ingredients

In light of the pet food recall and the pending country-of-origin labeling, the Packaged Facts report predicts that "100% US-sourced" will emerge as a key pet food market positioning in the coming months, especially among alternative products like organic and raw foods. After the recall, Newman's Own Organics spent weeks researching the source of the ingredients used in its petfood line, and the company recently announced that every ingredient in its products comes from US sources.

Ninety percent of the ingredients used in North Hollywood, California, USA, based Artemis Pet Food Company's human-grade products are US-sourced, with the rest coming from Canada (7%) and New Zealand (3%), according to the company. Sales for this $20 million business have soared by 25% to 50% as a result of the recall, even though its dog food costs nearly three times as much as the average bag of supermarket pet food.

Going local

Packaged Facts also predicts much stronger interest in products made from locally grown ingredients. Human-grade organic pet food producer Evanger's, whose business has surged as a result of the recall, buys all its ingredients locally, most of them within 40 miles of its plant in Wheeling, Illinois, USA. In an interview with the Chicago Tribune (May 28, 2007), company vice president Joel Sher said that buying locally has taken on much greater importance since the recall. "You've got to know your suppliers and the kind of people they are. With the local ones, you can know as much as you want to know. You can visit them."

Packaged Facts' expectations for "locally grown" as a potent pet food sales proposition is not based solely on the recall. Trends in the pet food market don't just follow human food trends, they often do so at accelerated rates, and the trend toward locally grown is in full swing on the human side.

In its May 2007 report Fresh and Local Foods in the US, Packaged Facts conservatively estimates that locally grown food could be a $7 billion business by 2011, up from its current level of about $5 billion. This optimistic forecast is based on trends including the rapid growth of farmers' markets, consumer perceptions that locally grown products are tastier and healthier, consumers' growing desire to support their local economy and corporate support for sustainable agriculture.