2015 has been a big year so far for the global pet food business landscape (see Table 1). In January, Spectrum Brands Holdings Inc. acquired Salix Animal Health LLC, looking to diversify in the Americas. In April, global private equity investment firm Pamplona Capital Management acquired Europe’s Partner in Pet Food for EUR 315 million (US$342.7 million), planning for further expansion in Western and Central Europe. Also in April, Germany-based Rondo Food announced that it would take over the extruded semi-moist product business of French producer BHJ Adax Pet Snacks. In June, Australia’s Quadrant Private Equity entered into an agreement to acquire V.I.P Petfoods for AUD410 million (US$317.8 million), with the goal of expanding V.I.P. both domestically and internationally.

Then there are the North American shifts: In February, the J.M. Smucker Company announced that it would acquire Big Heart Pet Brands for US$5.8 billion, heralding the entrance of Smucker’s into the pet food business. In March, Natural American Pet Products and Natural Life Pet Products were acquired by Dogswell LLC. In July, Bosch Tiernahrung announced that it would acquire Harrison Pet Products Inc. of Canada. July also brought the news that Nestlé Purina PetCare Co. would purchase Merrick Pet Care from its private equity owner, Swander Pace Capital.

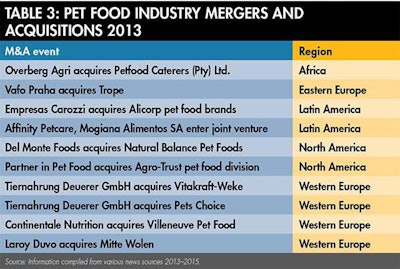

These are significant changes in the industry, and they’re not happening in a vacuum—in 2013 (see Table 3) and 2014 (see Table 2), there were at least 20 mergers and acquisitions among various pet food companies, some earlier moves leading to additional shifts later as companies continue to aim for prime positioning in an expanding, ever-changing market.

Certainly mergers and acquisitions are a common part of business, but what does this influx of pet food deals in the last few years say about the current industry climate?

“If you take a high-level perspective to the pet industry prior to, and even through, the recession, it was growing at a very attractive clip relative to both the broader economy and other consumer industries,” says Bryan Jaffe, managing director of Cascadia Capital LLC. “The primary driver of that growth was consumers trading up to ‘better-for-you’ pet foods, and paying a higher price, oftentimes for a lower volume.”

Historically, according to Jaffe, the rationale for one pet food company buying another, or a company entering the industry through the purchase of a pet food company, was to take a brand that already resonated with a small consumer segment and leverage the distribution framework available to a larger company—in other words, buying brands that resonated in one channel and taking them to mass.

Subsequent to the recession, however, the focus has narrowed as companies take a closer look at which segments of the industry have the most potential. The overall growth rate of the industry has moderated, and within that growth there is a disproportionate focus on superpremium customers and pet food sales through independent channels. “What you’re seeing through Purina’s acquisition of Merrick (in 2015) and Zuke’s Performance Pets (in 2014), through Big Heart Pet Brands’ (formerly Del Monte Foods Pet Products) acquisition of Natural Balance (in 2013), and a myriad of other transactions, is that the primary logic has been to buy into a product set that resonates with that consumer who is orienting their purchasing behavior around natural products and around brands with authenticity that are sold primarily in the independent channel,” says Jaffe.

The tacit admission, then, says Jaffe, is that the companies being acquired have been able to create a pedigree that the larger companies have not been able to replicate. “As independent brands they’ve created marketing messages and product attributes that resonate with the most attractive customer base,” he says. “So rather than try to continue to build solutions that are marketing towards that audience, the large consolidators have chosen to buy those assets. That is, in my opinion, what is essentially driving the most recent set of deals in the pet food industry, and it’s my expectation that going forward deal rationales will be underwritten on the same basis.”

As for what these changes mean for the pet food industry—in terms of challenges, opportunities, future prospects—Jaffe says there’s still plenty of opportunity available for innovators. “There’s opportunity created any time one of these brands is bought by a bigger company, because it opens up shelf space and it opens up a segment of customers who are open to switching,” he says.

Invariably, according to Jaffe, there will be retailers who don’t do business with large companies, and once a smaller company is acquired by a larger company, their products might shift outlets. In addition, there will always be consumers who take one look at acquisition news and become convinced that formulations or quality will change, no matter what the companies say. “That consumer shifting, as well as that available shelf space, will provide other companies the opportunity to grow up quickly,” says Jaffe. “You need that evolutionary cycle to fuel the growth of these brands.”

There continue to be opportunities for larger companies looking to follow the current merger/acquisition strategy, though the field will inevitably get smaller. “If you look more broadly at the consumer landscape, these large multinational [consumer package goods] companies have largely turned to mergers and acquisitions as a form of R&D,” says Jaffe. “Instead of spending on creating their own formulations, they’re buying other companies’ in an effort to more quickly position themselves to where the customers’ dollars are flowing. And I don’t see these large companies amassing the capabilities necessary to disaggregate that strategy.

“At the same time, my view is that there’s a very limited set of highly attractive assets that are going to be available,” he says. “The other brands that are ultimately going to be interesting—brands like Stella & Chewy’s or Honest Kitchen—they’re smaller businesses and less likely merger/acquisition candidates, or they’re family-owned businesses like Canidae or Fromm’s; certainly people would love to buy them, but they historically haven’t expressed a need or desire to do anything. So unless some of those family businesses come off the fence and pursue a sale, my expectation is that appetite will remain constant, supply will go down and a limited set of premium assets are going to garner historic prices given that scarcity.”

Public trading and the pet food industry

“Now that you have a publicly traded Blue Buffalo and FreshPet, it provides other potential transaction alternatives to growing companies,” says Bryan Jaffe, managing director of Cascadia Capital LLC. “One of the key bidders for Merrick (which announced that it was going to be acquired by Purina in 2015) was a food company that wasn’t currently in the pet food space, and so as potential acquirers increase, that augers for favorable outcomes.

“I think if you look at history, the big three—Mars, what was then Del Monte (now Big Heart Pet Brands) and Purina—had the run of the lot,” he says. “If only one of them was a bidder, their ability to get something attractive went up exponentially. Now those folks are going to have to worry about what is Blue Buffalo doing, what is FreshPet doing, would they be interested, as well as is this a business somebody from outside is going to buy into. Therefore, it spawns more competitors.”