Information Resources, Inc. (IRI) tracks the sales of pet products in supermarkets, drug stores and mass merchandisers (excluding Wal-Mart) across the United States. For the 52 weeks ending October 2, 2005, dollar sales of pet products were up by a slight 0.7% versus the prior year. Among the pet products categories, dog food performed the best, increasing 1.9%. Pet supplies and cat food each declined slightly, by 0.5% and 0.4%, respectively.

IRI tracks 12 subcategories across the dog food, cat food and pet supplies categories, where greater sales swings were found. The biggest growth was experienced by rawhide dog chews, which increased by 6.2%, and dog snacks (biscuits/treats/beverages) which increased by 5.7%. The rawhide dog chews growth was fueled by private label products, which grew by 11.4% and accounted for more than 17% of subcategory sales.

Two subcategories had double-digit sales declines: semi-moist cat food decreased 23% and non-cat/dog pet needs dropped by 11.8%. Semi-moist dog food sales also declined by 5.0%.

Drug channel growth strong

For the second consecutive year, the drug channel experienced strong sales growth. While drug accounted for only 2.7% of total supermarket, drug and mass (excluding Wal-Mart) sales, it grew by 10.2%generating US$16.6 million growth dollars. A large percentage of that growth was generated by Walgreens, which grew its pet business by a staggering 24%.

Price per unit increases

The average price per unit of the two petfood categories increased slightly more than 10% during the past year. Two factors drive average price per unit increases. The first is changes in the mix of products purchased. As consumers trade up to higher-value, higher-priced products (usually new or larger sizes), the average price per unit of the category will rise.

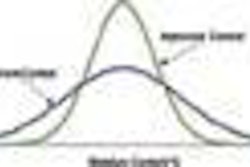

The other factor contributing to average price per unit increases is common inflationary price increases that occur over time to existing products. To gauge the impact, the price increases of existing products non-promoted pricing was examined for the top 75 petfood products. The two-year price increases of these products formed a nearly perfect bell curve. Six products experienced price declines. Six other products had two-year price increases of 9% or more. Eighteen products had relatively small price increases of 0-2.9%. Another 17 products had relatively high price increases of 6.0-8.9% and the other 28 products had relatively normal price increases that ranged from 3.0-5.9%.

Top 100 selling items

The sales of the pet categories are highly concentrated within the top 100 selling items. These products accounted for more than 23% of the sales of the four categories. The two-year dollar sales growth of these top 100 items was a strong 13.6%. Fifty-one of the top 100 items were from the dog food category, 33 were cat food items and the other 16 were litter items. Among suppliers, 51 of the top 100 items were from the Nestlé Purina PetCare Company, 15 were from P&G/Iams and 10 from Masterfoods/Mars.

Top new brands

Each year, IRI does an analysis of the top new products introduced during the prior year. In petfood, many new products offered new high-value features, commanding a higher price point. The top three new petfood brands, as reported in IRI's 2004 New Product Pacesetters published in March 2005, were Purina Cat Chow Indoor Formula, Whiskas Savory Paté and Pedigree Healthy Maturity. Each of these new brands offered a premium or improved feature.

Locality

IRI tracks sales across eight US regions and 64 markets. At the region level, the strongest growth of 2.3% occurred in the Western states of Montana, Wyoming, Colorado, New Mexico, Idaho, Utah, Arizona, Washington, Oregon and California. Hurricane Katrina drove the South Central region of Texas, Oklahoma, Louisiana and Arkansas sales down by 1.7%. The hurricane caused a severe drop in sales in IRI's New Orleans, Louisiana/Mobile, Alabama market.

Supermarket pet category sales declined 30-40% in the two weeks following the hurricane. Of the four categories, through the week of October 2, only the pet supplies category had re-established its average weekly sales rate. At that time, the dog and cat food categories remained 10-20% below average in the New Orleans/Mobile market.

Hurricane reports

IRI has tracked the impact of Katrina and the other 2005 hurricanes. Following are excerpts from an IRI publication, Times & Trends Special Report: Impact of Hurricane Katrina-Report Four: One Month After. This report can be found on the IRI website at www.infores.com. The report begins by identifying the three major phases of consumer packaged goods (CPG) purchasing that were observed. An analysis of purchase behavior before and immediately after the hurricane reveals three phases in consumer demand for CPG products:

Phase 1: Preparation the week before;

Phase 2: Replenishment 1-2 weeks after; and

Phase 3: Adjustment 3-4 weeks after.

This study continues, reporting that CPG sales in directly-affected markets declined in weeks three and four after the hurricane. Major CPG sales increases in directly-affected markets during the first two weeks after Hurricane Katrina (with the exception of New Orleans/Mobile) were followed by declines in weeks three and four. Mass quantities of basic food, beverage and personal care necessities destroyed or left behind had to be replenished immediately following the hurricane. After consumers fulfilled these requirements in a condensed timeframe, there was a gap in "normal" demand in the following weeks.

Markets with a high concentration of Gulf Coast refugees saw a second sales boost as consumers prepared for Hurricane Rita. The threat of Hurricane Rita drove sales up once again as consumers made hurricane-related purchases. These purchases essentially mirrored those made by Gulf Coast residents prior to Katrina with one important exceptionhealthcare, baby care and pet care increased in areas affected by Rita, while these categories decreased in areas affected prior to Katrina. The sheer devastation and length of displacement following Katrina may have prompted consumers to take a broader view of their hurricane-related needs with Rita.

Data sources: Information Resources, Inc. InfoScan® Reviews and IRI Consumer Network household panel.