The Indian pet industry has come a long way in the past decade. What was once a motley crew of shop keepers casually selling a sparse and sometimes dubious assortment of shampoos and biscuits has now evolved into an US$800-million-plus industry. At the top of the food chain rests petfood, with 24% annual growth.

Continuing its growth trend, the petfood segment in India is expected to register strong double-digit retail value growth in 2013 and beyond. This growth will be driven by several factors-an increasing number of pet adoptions, rising disposable income, higher awareness of the dietary needs of pets and the benefits of petfood, and the booming population of the Indian middle class.

"Dog food in India has good potential, as out of the roughly 8 million cared for pets in the country today, commercially prepared petfood caters to approximately 6%-7% of the total calorie needs of the pets, the balance being still fed through homemade food," says Nitin Kulkarni, director of corporate affairs, Mars International India Pvt Ltd, a 100% subsidiary of Mars Inc., USA. Headquartered in Hyderabad, Mars International India manufactures and markets dry dog food indigenously and imports and sells cat food under the brands Pedigree and Whiskas, respectively.

"This gives an indication of the potential for prepared petfood in the country," says Kulkarni. "We are witnessing double-digit growth in the petfood category in the past five years. We have also observed a rise in pet adoptions, along with increasing responsible pet ownership amongst pet owners. Pet parents are doing well economically, and are willing to spend more on their pets than ever before. Further, most of the people that can afford pet products are of a certain economic strata, and with the middle class burgeoning year after year-it doesn't take much to see that the petfood industry is growing rapidly, and that better times lie ahead for petfood in the country."

Growth Factors

According to Euromonitor International, an international strategy research firm, the pet population in India (including all species) in 2011 was approximately 10 million. Approximately 600,000 pets are adopted every year on average.

In most Indian homes, roti (Indian bread) and milk initially comprised the staple diet of pets. However, dog and cat food is now increasingly been perceived as a staple diet for pets. Again, many factors contribute to this change in perception-dual-income couples do not have the time to prepare home-cooked meals and much prefer the convenience of commercial food. Further, people are becoming aware of the positive qualities of petfood and the fact that roti and milk do not meet the dietary requirements of pets.

All pet products, including petfood, were sold at pet shops or veterinary clinics. That has changed, however, as supermarkets, mom-and-pop grocery stores and e-commerce websites have jumped into the fray by stocking petfoods and treats, allowing for wider availability and increased sales.

India is a country with a gargantuan human population (1.2 billion), of which 160 million individuals fall under the category of the middle class, a number that according to the National Council for Applied Economic Research's (NCAER) Centre for Macro Consumer Research, New Delhi, is expected to swell to 267 million people by 2015. Therefore, the growing interest among Indians in keeping pets and keeping them well, blended with the sheer vastness of the populace, makes for a winning combination where the Indian petfood market is concerned.

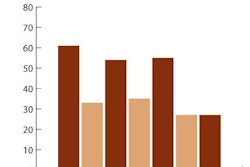

According to official estimates, the Indian economy grew at 7.6% (+/- 0.25%) in the fiscal year 2012-2013. Further, Euromonitor statistics report the annual disposable income of Indians to be US$1,576,087.6 million in 2012, a considerable increment from the US$1,073,243.4 million in 2008. As disposable income increases, consumers are more likely to trade up to premium petfood brands, as they become more willing to increase spending on pets and are equipped with the resources to do so.

Urban, career-minded couples are putting off parenthood for their mid- to late 30s, because they either marry late or want to first secure themselves financially before starting a family. These couples find adopting pets the next best thing to having children in the interim.

Owing to the general atmosphere of sensitization towards pets in the country, more Indians have come to regard them as thinking, feeling, human-like parts of the family. The trend of humanization of pets is expected to spread further, with pet owners becoming more interested in understanding their pets and meeting their needs.