[Editor’s note: This is Part 3 of a three-part series on what pet owners think of the pet food industry. Part 1 focused on consumer trust in the pet food industry and Part 2 highlighted consumer perceptions regarding scientific claims about pet food.]

The short answer to what today’s pet owners want from pet food is “everything.” Even setting aside “value consciousness” — the right perspective on “price sensitivity” among today’s pet parents — these consumer expectations translate to a wide, challenging and sometimes discordant set of priorities.

The impact of reputation on pet food consumers

Reputation precedes looking at or reaching for a pet food bag, can or pouch. As shown by a pet owner survey conducted for Packaged Facts’ Petfood Forum 2018 conference presentation, over a third (36 percent) of dog or cat owners strongly agree, and half at least somewhat agree, that brand reputation plays a role in which pet foods they buy.

But even in itself reputation is hardly an uncomplicated factor. Two-thirds of dog or cat owners strongly or somewhat agree that veterinarian recommendation is important to which pet foods they buy, as one facet of brand reputation. At the same time, a fourth of these pet owners strongly agree, and another third somewhat agree, that they research pet foods using the internet and social media, and similarly high percentages factor in word-of-mouth. Corporate responsibility, not necessarily top-of-mind from the medical perspective of veterinarians, is another important component of brand reputation to many pet food shoppers.

The role of product formulation on purchasing decisions

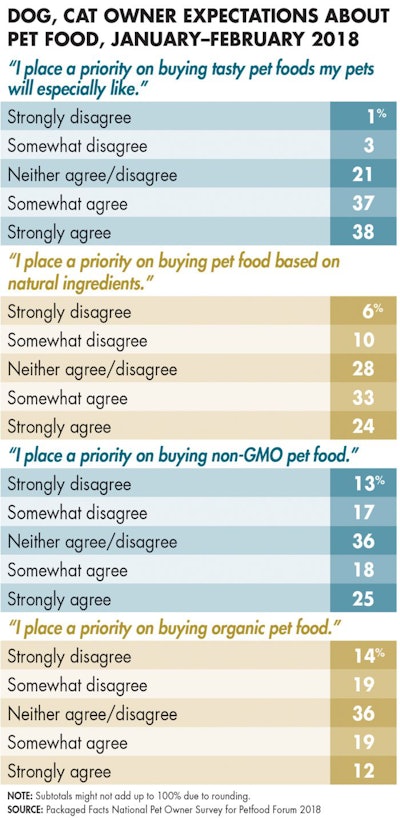

Digging deeper into product formulation itself — thinking inside the bag, can or pouch — taste, ingredient quality and functional attributes all play their parts in how consumers choose pet foods (see Table 1). As is the case in the human food industry, good taste is nearly obligatory, with 38 percent of dog or cat owners strongly agreeing, and another 37 percent somewhat agreeing, that finding products that their own pets like the taste of is a priority. The good news, and a testament to the robust competition and extensive product variety in the current pet food market: 60 percent of dog owners strongly agree, and 37 percent at least somewhat agree, that their pets love the taste of their pet food, along with 64 percent and 33 percent of cat owners, respectively.

TABLE 1: The majority of pet owners, unsurprisingly, place taste as a priority when purchasing pet food. If their pets won’t eat it, they won’t buy it.

In addition, natural formulation is a quality cue for most pet food shoppers, with a fourth strongly agreeing, and a third at least somewhat agreeing, that finding pet foods based on natural ingredients is a priority. Non-GMO or organic formulations, although more clearly defined, rank somewhat lower on this agree/disagree measure.

The influence of specific pet food claims

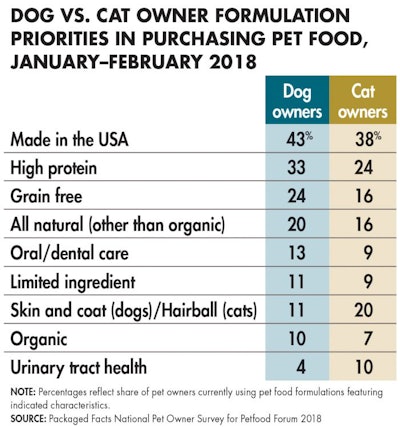

Looking at specific characteristics featured by the products dog or cat owners are buying helps round out the picture. Most notably, given ongoing consumers' concerns triggered by the recent history of recalls (and distrust of ingredient sourcing from China, in particular), 43 percent of dog owners and 38 percent of cat owners report buying petfoods with “Made in the USA” claims (see Table 2).

TABLE 2: Given recalls and fears of China ingredients, it makes sense that both dog and cat owners place “Made in the USA” as a priority when checking pet food ingredients.

High-protein formulations, spilling over (as a marketing and product positioning) from human nutritional and weight management trends, are used by a third of dog owners and a fourth of cat owners. Grain-free positions, similarly transferring over from human market trends, are used by a fourth (24 percent) of dog owners but only 16 percent of cat owners, though it’s felines that are more purely carnivores.

Targeted products with special formulations for health concerns — including for older and overweight pets, here again as in tandem with human food industry — also exert a significant draw. Top product positionings along these functional lines include oral/dental care, skin/coat or hairball, and urinary tract care, as well as limited ingredient formulations that can address digestibility and allergy/sensitivity concerns.

The power of consumer expectation

As reported in Packaged Facts’ US Pet Market Outlook 2018–2019, mass channels appear poised to surpass pet specialty in pet food sales growth for the first time in years due to the “mass premiumization” and superpremium brand crossovers in response to these heightened product expectations among pet food shoppers across the board.

More information on Packaged Facts’ US Pet Market Outlook 2018–2019

https://goo.gl/P6Jrvh

The latest pet food market insights:

www.PetfoodIndustry.com/authors/145