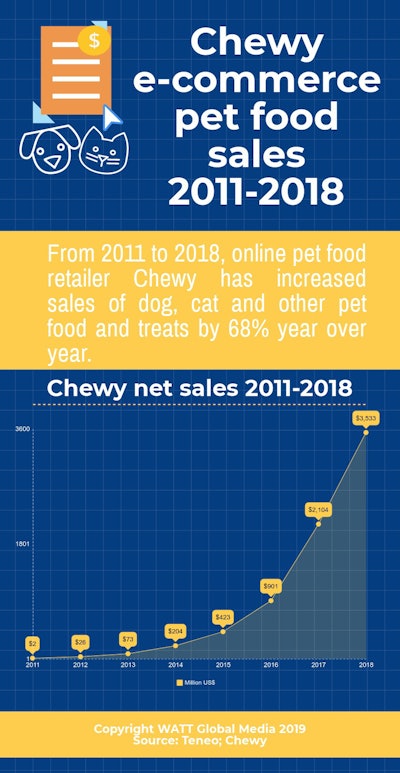

From 2011 to 2018, online pet food retailer Chewy has increased sales of dog, cat and other pet food and treats by 68% year over year (see infographic below). That success led to Chewy’s purchase by PetSmart in 2018 for nearly US$3.4 billion. That in turn led to the initial public offering of Chewy stock (CHWY) on the New York Stock Exchange on June 14.

Chewy net online sales of pet food, treats and other products

2011 US$2 million

2012 US$26 million

2013 US$73 million

2014 US$204 million

2015 US$423 million

2016 US$901 million

2017 US$2,104 million

2018 US$3,533 million

History and sales data for Chewy online pet food retailer

Prior to the purchase Chewy shared sales and other information about the company.

Chewy’s net sales increased from US$26 million to US$3.5 billion between 2012 and 2018. In 2018, approximately US$2.3 billion, or 66% of total net sales, came from the internet retailer’s Autoship pet food and treat home delivery replenishment system.

Chewy offers approximately 1,600 brands and more than 45,000 products for dogs, cats, fish, birds, reptiles, horses and small animals.

More than 11 million customers buy products on Chewy, with 100 million orders delivered since 2011. In 2018, 91% of net sales on the e-commerce pet food retail site were from repeat customers. Chewy ships to 80% of US in one day and 100% of the nation in two days.

Chewy has their headquarters in Dania Beach, Florida. The e-commerce pet food and treat retailer has fulfillment centers in Florida, Nevada, Dallas, Pennsylvania, Indiana and Arizona.

4 Chewy strategies for pet food e-commerce growth

Chewy executives have a four-part strategy for continuing the growth of the internet-based pet food retailer, which they shared shortly before the Chewy’s initial public offering.

- Increase customer spending: Chewy noted that their customers who remain active spend an average of three to four times as much in their third year as they did in the first.

- Expanding health care products: Chewy plans to expand further into pet health care by complementing existing over the counter and vet diet offering.

- Growth at scale: Using an advanced technology platform enables Chewy to grow sales volume and increase active customer numbers while reducing marginal transaction and operational costs.

- Smartly managed cost/logistics network: With high sales volume and participation rates in Autoship, coupled with low seasonality, Chewy aims to use its assets efficiently to lower fixed and variable cost per unit and inventory levels.

Chewy share price opens 60% higher than IPO

Following e-commerce pet food retailer Chewy’s initial public offering on the New York Stock Exchange, the stock increased from its original share price of US$22 to a high of US$41.34. Chewy’s stock price retreated a bit and opened on Monday at US$34.72, or nearly 60% higher than the IPO price.

On June 14, Chewy made 46,500,000 shares of its Class A common stock available at a price to the public of US$22.00 per share. The offering consists of 5,600,000 shares of Class A common stock being sold by Chewy and 40,900,000 shares of Class A common stock being sold by a wholly-owned subsidiary of PetSmart.

PetSmart purchased Chewy in 2017 for approximately US$3.4 billion and remains the majority owner with a 70% stake in the company and 77% controlling interest.

made with Piktochart