The “new generation” pet parent is an elusive concept but very real phenomenon. It’s a tricky concept because the underlying trends, based on ever-sharpening and broadening concerns over pet health, have been the primary drivers of pet industry growth for decades. These trends were accelerated (though not generated) by COVID-19: Packaged Facts survey data show 41% of pet owners paying closer attention to their pets’ health and wellness in response to the pandemic.

Health, nutrition concerns grow among younger pet owner demographics

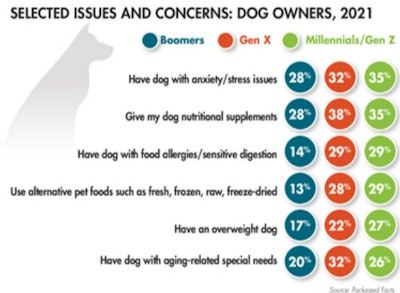

Even so, and with due acknowledgment of customer diversity and complexity, the reality of a new generation pet parent is evident by several consumer attitude and behavior metrics. In the pet food category, for example, only 13% of Baby Boomer dog owners, compared with 29% of their Millennial/Gen Z counterparts, report using alternative pet food formats such as fresh/frozen. This new generation of pet parents make fresh pet food company Freshpet the highest dollar sales gainer in the mass market.

Similarly, only 14% of Boomers, compared with 29% of Millennials/Gen Zers, report having a dog with food allergies/sensitive digestion. And only a delusionally low 17% of Boomer dog owners, compared with a relatively plausible 27% of their Millennial/Gen Z counterparts, report having an overweight dog. To underscore the point that Millennial and Gen Z pet owners are casting a more critical eye on pet health issues, factor in that Boomers are more likely to have senior/overweight pets.

In fact, it would be difficult to find a pet food or nutrition issue in which Millennials and Gen Zers don’t exhibit an at least somewhat higher level of concern than the Boomers and older seniors age 75+ at the other end of the age spectrum. An example here is having pets with anxiety/stress issues, reported by 28% of Boomer, 32% of Gen X and 35% of Millennial/Gen Z dog owners (see Table 1) — with the pandemic in the case of dog owners both elevating the percentages and narrowing the divergence across generations.

TABLE 1: Millennials and Gen Zers are seemingly more likely to be aware of their dogs’ health and wellness.

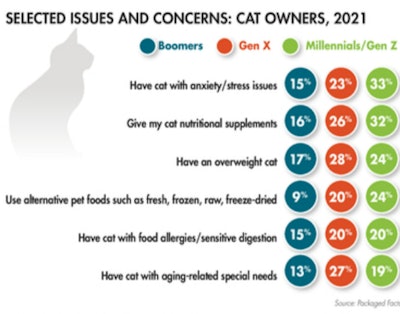

The same general pattern holds among cat owners, albeit with some variation. As among dog owners, for example, a relatively low (9%) of Baby Boomer cat owners, compared with a relatively high (24%) share of Millennial/Gen Z counterparts, report using alternative pet food formats such as fresh (see Table 2). In partial contrast to the dog owner pattern, however, the generational spread for having cats with food allergies/sensitivities is relatively narrow, while the spread for having cats with anxiety/stress issues is relatively wide.

TABLE 2: As with Millennial and Gen Z dog owners, cat owners in the same generation are more likely to use alternative pet foods to feed their animals.

Higher expectations across the board from Millennials, Gen Z

Within the pet food category, greater expectations by Millennial and Gen Z pet parents are evident across various other measures as well. Among dog or cat owners, for example, as Packaged Facts reported at Petfood Forum 2021, only 39% of Millennials/Gen Zers report being “very satisfied” with the pet foods they use, compared with 66% of their Boomer and 69% of their older senior counterparts.

Sales and share growth will come to pet food marketers who meet these greater expectations of new generation pet parents. This is the case not only because Millennials and Gen Zers account for the plurality (44%) of dog or cat owners, and because they are the rising generations, but because their attitudes and priorities trickle up to Boomers and older seniors as well.

Which U.S. pet owners spend the most on pet food?