While the largest pet food markets in Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) nations remained in established markets, some of the fastest growth came in developing markets. The CPTPP is trade agreement among Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam, which entered into force on Dec. 30, 2018. The Canadian government’s Feb. 2022 Agriculture and Agri-Food Canada report “Pet Food Trends in Select CPTPP Markets: Vietnam, Singapore, Malaysia, Chile and Peru,” analyzed the economics of pet food in those Pacific Rim nations.

Pet food retail sales market CAGR in Pacific Rim nations

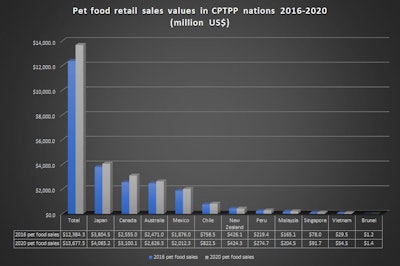

Japan, Canada, Australia and Mexico had the four largest pet food retail sales numbers from 2016 to 2020. However, only one of those four also ranked among the highest compound annual growth rates. Canada accompanied Vietnam, Peru and Malaysia as the four nations with the highest CAGR from 2016 to 2020.

Pet food retail CAGR% from 2016 to 2020

- Total: 2.5

- Vietnam: 16.6

- Peru: 5.8

- Malaysia: 5.5

- Canada: 5

- Singapore: 4.1

- Brunei: 3.9

- Chile: 2

- Mexico: 1.8

- Japan: 1.7

- Australia: 1.5

- New Zealand: −0.1

- Brunei: 3.9%

Infographic: Pet food retail market sales in CPTPP nations

Pacific Rim trade group overall pet food markets

Nations in CPTPP had a combined pet food industry value in 2020 of US$17.5 billion. Pet owners in CPTPP countries spent most of the 2020 total on pet food, making up US$13.7 billion. Within the pet food category, dog and cat food dominated 96.4% of the industry. The cat and dog food markets may grow at compound annual growth rates (CAGRs) of 5.3% and 4.6% respectively from 2021 to 2025. That follows steady growth from 2016, when the market stood at US$12.3 billion. After a CAGR of 2.5% from 2016 to 2020, Wang forecast the dog and cat food sector to hit US$17.2 billion in 2025 at a CAGR of 4.9%.

Vietnam, Singapore, Malaysia, Chile and Peru make up 10.6% of the pet food industry in the CPTPP region in 2020. Those nations also had higher CAGRs from 2016 to 2020 than Japan, Australia, Mexico and New Zealand. These five emerging markets, Vietnam, Singapore, Malaysia, Chile and Peru, were forecast to keep that momentum from 2021 to 2025.