When top economic experts agree the economy is in its worst state since the Great Depression, it's hard to be bullish on just about any industry. With each passing day, the litany of negative financial indicators seems to get longer, adding to a sense of unease.

According to the US Conference Board's monthly Consumer Confidence Survey , the consumer confidence index stood at 59.8 in September 2008, compared with 99.5 in September 2007 and 105.9 in September 2006. The forward-looking "expectations index" was at 60.5, a low not seen the past decade.

But it's not just that US consumers lack confidence in the economy: They are afraid. The US has seen not just one but a series of generation-defining events, from the 2001 terrorist attacks on US soil to Hurricane Katrina's devastation of much of the Mississippi Gulf Coast to the current economic crisis.

Rising pet ownership

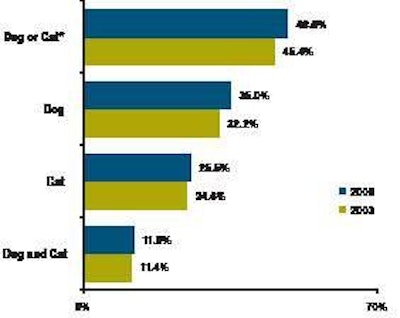

This combination of factors makes any predictions about the 2009 fortunes of US pet food sales speculative at best. But the sum total does, Packaged Facts believes, represent an opportunity for the US$50 billion pet products market to strengthen its foundation of the 54.4 million US households who own dogs or cats. As discussed in a new report on the US pet food market (see box at bottom), ownership rates for both dogs and cats have been edging up, from 45.4% in 2003 to 48.6% in 2008, with the number of dog- or cat-owning households increasing by nearly 5 million (Figure 1).

For a non-discretionary category like pet food, this is good news, especially if some pet owners do temporarily scale back to less expensive brands and shopping venues.

Bond breeds security

At least part of this upward trend in December derives from the human need for companionship and security inherent in pet ownership; this need increases during times of external turmoil. Indeed, the advent of the rise of humanization as the primary (and extremely effective) marketing theme in pet product advertising seems to correlate with the turn of this century and the events of 9/11.

For many people in the US, the response to these events has been turning to home and family. Now more than ever, pets are part of the family and a unifying bridge to a larger community. At this time in history, it's up to each pet food industry participant to understand the wants and needs of the US pet owner. Carpe diem (seize the day) in a way that brings out the best in all of us.

.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)

.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)