In spite of the tumultuous year 2020 turned out to be, pet food did extraordinarily well on the global stage. And while the script flipped in terms of pet ownership (the last several years have seen more growth in developing markets, but 2020 saw that growth re-emerge in developed markets and more specifically in the areas of those markets where the money remained more stable during the COVID-19 pandemic), there’s no doubt that various growth markets are still worth keeping an eye on as patterns return to more predictable patterns in the future.

South Korea’s pet ownership: cats playing a strong role

At the end of 2019 there were 6 million dogs and 2.6 million cats as official pets in South Korea, according to the country’s Ministry of Agriculture, Food and Rural Affairs (MAFRA) data.

“Korea is seeing the pet humanization trend proliferate,” said a report prepared by ATO Seoul, OAA Seoul and Hye Rim Chun for the U.S. Department of Agriculture (USDA) Foreign Agricultural Service (FAS) in October 2020. “More people are considering pets as family members and providing pets with human-like experiences and products. As a result of this trend, consumers are willing to spend more for high-quality pet food and pet products.”

The current pet ownership rate, according to Statista data, is at 26.4%, with dogs being the most-owned type of pet. However, the more interesting growth area is in cats, which are becoming more popular as single-person households increase and the appeal of independent felines grows — and the welfare of South Korea’s significant street cat population becomes a more prominent issue.

Asia-Pacific in general and South Korea in particular have seen a strong performance in the cat food segment due to an increase in the cat population, according to a May 2021 Euromonitor International report, “Pet Care in South Korea: A Leading Frontier in the Asia-Pacific Market.” A portion of that strength can be attributed to the phenomenon of the “cat mum” culture, which are volunteers who look after stray cats in South Korea. They typically purchase economy food to feed the cats, and their purchases have significantly affected the cat food market in the country.

Unfortunately, stray animals don’t count in reported pet population numbers, making it difficult to match up pet ownership numbers to pet food growth in areas where this phenomenon exists. In fact, while in early 2010 only 1% of households owned cats in South Korea, according to the Euromonitor report, the prepared food percentage for cats was over 100%. Over the last decade, however, the cat population has significantly increased at a compound annual growth rate (CAGR) of 59%. This, as well as a boom in cat treats, resulted in the prepared food percentage falling to 60% in 2021, according to Euromonitor data.

Potential for pet food brands in South Korea

Unsurprisingly, economy brands hold the majority of pet food market share in South Korea, at roughly 51% by volume in 2019 according to Euromonitor data in the USDA FAS report. However, premium pet food, which holds the second-largest segment of the market, is also the fastest-growing (9% CAGR over five years between 2015 and 2019, according to Euromonitor) other than treats, which saw a staggering 20% CAGR in the five-year span between 2015 and 2019.

“Asia Pacific and South Korea have shown a strong performance in cat food due to the increase in the pet cat population,” according to the Euromonitor report, and “in South Korea, dog food and pet products seem to be slowly approaching mature markets, such as in Western European countries.” But there is still a lot of room for opportunity, as unlike more developed pet food markets a portion of pet owners (though certainly a decreasing number all the time) in South Korea still feed their pets, particularly dogs, table scraps rather than commercial pet food.

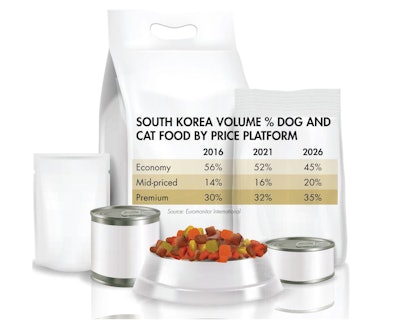

Economy pet food producers since 2010 have launched a campaign to convince pet owners to switch to commercial pet food, resulting in a hike in economy pet food sales at 57% in volume terms in 2017, according to the Euromonitor report, and in 2021 the pet food price platforms are expected to become more balanced in the country thanks to the rapid increase in private label products (see Figure 1).

FIGURE 1: Economy pet food has dominated South Korea’s commercial pet food market, but the segments are expected to become more balanced in the next several years. | Siberian Art I Shutterstock.com

Global pet food brands have long held sway in South Korea, largely due to their credibility and name recognition to those interested in commercial pet food for their animals. However, in 2020 local brands, particularly in dog food, made significant headway by promoting both quality and value for money. The increased competition to international brands means even those who are well established in South Korea must pay attention to trends if they want to remain players in the space.

Humanization is the key to being competitive; those willing to spend money on their pets in South Korea have come to believe, like those in more mature markets, that pets are beloved members of the family, and are looking for many of the same things we’ve come to expect from pet owners in the North American and European markets: healthy ingredients and more formulations that resemble what pet owners might find on their own dinner plates.

South Korea’s fairly recent considerations of increased pro-animal welfare regulations suggest that the country overall is aware of the growth of pet ownership and that there will be continued opportunities for companies looking to expand in this Asian market.