2020 saw a significant uptick in pet acquisition, and the trend wasn’t limited to dogs and cats (see Figure 1). According to Packaged Facts’ “Fish, small mammal, herptile and bird products: U.S. pet market trends and opportunities, 3rd edition,” released in August 2021, sales of herptile (reptile and amphibian), small mammal and bird products spiked as pet owners purchased supplies for their new pets. In fact, new pet acquisitions of these types raised ownership levels of animals other than dogs and cats to the highest in 10 years for three of the four main “other pet” types (pet birds were the exception). Now, 12.2% of U.S. households own one or more type of pet other than dogs or cats, according to Packaged Facts, up from 10.8% five years ago.

.png?auto=format%2Ccompress&fit=max&q=70&w=400)

Small pet ownership feelings merge with dog and cat trends

For quite some time now the standard for dog and cat ownership, at least in the more mature pet food markets, has been humanization. Now, companies in the “other” pet space say more and more of their customers are coming around to that way of thinking, as well.

“We believe that the days of customers coming into a store and asking for the biggest bag possible at the cheapest price are behind us,” said David Brainard, COO of Central Farm and Garden, which owns the Bird Pro brand of bird food. “Instead, customers are gravitating to more experiential products and engaging brand stories. As we interact with and listen to customers in the wild bird and companion bird food markets, we are seeing the same trends that we saw 10– 15 years ago in the dog /cat food industry.”

According to Brainard, today’s customers in the pet bird segment are:

- craving a more satisfying experience when it comes to their wild bird and companion bird food choices.

- looking to form genuine connections with the brands they choose to interact with.

- looking for honesty and integrity in the representation of the products they’re purchasing.

The same ideas are being seen in the small mammal pet space.

“People care about their pets as much as their family members and treat them as such,” said Erin Lenz, senior brand manager for Kaytee Small Animal at Central Garden & Pet. “They seek the same natural, high-quality food they feed their family. When purchasing small animal food, pet parents are looking for healthy, species-specific food that uses natural ingredients and does not contain added sugar, fillers or artificial preservatives. Natural, healthy, premium products that support ancestral and instinctive behaviors continue to be relevant trends that have influenced small animal food production and marketing. In the wild, small animals forage from a range of different ingredients where they are mentally stimulated from the various tastes and textures. To support the mental and physical health of domesticated small animals, pet parents are looking for healthy, natural and enriching food and hay that offers a variety of unique tastes, textures and experiences.”

Acquisitions and new product lines drive small pet forward

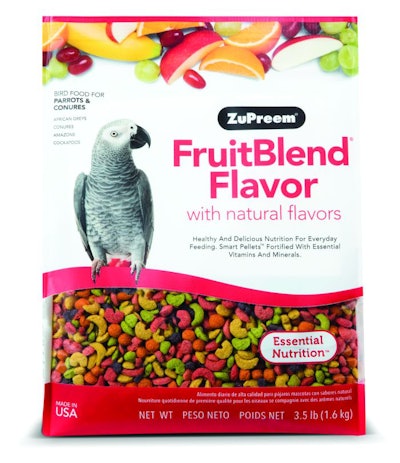

In April 2021, Manna Pro Products, a manufacturer and marketer of pet care and nutrition, acquired ZuPreem, a global brand specializing in premium nutritional diets and treats for companion birds. The acquisition expands Manna Pro’s pet care portfolio into the premium companion bird market.

It’s the next logical expansion for the company, which already provides food and care products for dogs and cats and small animals, as well as cattle, swine, poultry and other farm animals.

“The choice of ZuPreem as our entrant into the premium bird food market was an easy one,” said Howe. “Within measured channels, ZuPreem is the number one selling indoor bird food brand and is a premium, trusted product.”

Bird Pro took a look at the evolving trends and has completely rebranded over the last few years.

“[We] re-invented how we look at bird food packaging and are focusing on bringing fresh ideas to market,” said Brainard. “We are actively working to challenge any preconceived ideas about the market that we might have and are instead focusing all of our attention on connecting with customers in a new and more experiential manner. Brands can no longer get away with treating wild bird and companion bird food as commodity products. Instead, they need to view these items as luxury products and treat them as such, with all of the corresponding improvements to marketing, packaging and experience. There is absolutely no reason why purchasing a bag of parrot or cardinal food for a feathered friend can’t be a unique and fun experience.”

Part of the luxury experience includes trends that fall along the lines of premiumization, well established in the dog and cat space and growing ever-more popular in other segments of pet food. That idea led Kaytee to introduce its Field+Forest line, aiming to provide small mammals with “naturally good nutrition and simply good food to help [them] live their best lives.” The line uses ingredients “curated from nature’s fields and forests,” is natural with added vitamins and minerals, and is made without unwanted sweeteners like molasses, fillers or artificial preservatives.

“Every small animal is different and needs varying levels of protein, fat and fiber to help them live their best life,” said Lenz. “If every small animal is different, shouldn’t they have a food as unique as them?”

The future of the small pet food space

COVID-19 has changed the way consumers across all channels shop, and pet food has been no exception.

“Previously, the opportunity for a bird owner to acquire food and bird products was limited to traditional shopping opportunities,” said Van Velsor, CMO of Manna Pro. “Now, shopping barriers to acquire food and bird products have been removed. There’s a new mindset with retailers and manufacturers to make products available based on the pet owner’s individual need. This is true for the bird category as well. Ecommerce, brick and mortar stores, curbside pickup, home delivery and channel expansion all present opportunities to gain access to the bird owner as well as to meet their needs so they have an increased awareness for better choices and relationships with a brand. This presents opportunities for increased education, sampling and referrals that are significantly growing bird sales.”

And while channel opportunities grow for the industry and premiumization takes hold in every segment of pet food, it’s safe to say that everyone involved in the care and feeding of pets has the potential to thrive in this complex market.

Higher online demand for pet food continuing in 2021