The dust continues to settle on the question of pet population in the wake of COVID-19. Many manufacturing and retail-based sources take for granted that a pet population increase occurred, and understandably so given the spike in pet care spending (including for durables generally associated with pet adoption), while veterinary sector sources have been skeptical (based partly on distribution of veterinary supplies associated with annual pet check-ups).

Shifting reports and anecdotal accounts about pet adoption, intake and population levels in pet shelters have tended to complicate the picture, though Packaged Facts survey data show that only 26% of dog adoptions in 2021 and 25% in 2021 were through pet shelters.

Who adopted pets during the pandemic?

There is no debate over a spike in pet care spending and very positive prospects for pet industry revenues going forward. And a pet adoption spike did occur. But MRI-Simmons data by key demographics show this pet acquisition was counterbalanced by pet ownership attrition in the wake of COVID-19. More specifically: Measured by bedrock pet owner population rather than pet care spending, a spike in pet ownership among upmarket consumers was offset by pet ownership attrition among less prosperous or more budget-conscious demographics.

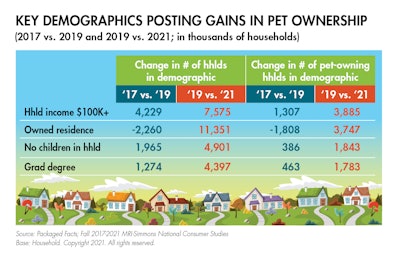

In this pandemic era, the number of pet-owning households jumped unusually among upper-income households, and among those with typically upmarket demographic characteristics such as home ownership or having a graduate degree. Per data Packaged Facts presents in its new “Pet Market Outlook (March 2022)” report (see Table 1), these gains in pet-owner households include:

- In terms of households earning US$100,000 or more, a national increase of 1.3 million pet owners between 2017 and 2019 being tripled by a gain of 3.9 million pet owners in the COVID years of 2019 to 2021.

- In terms of homeowners, a national loss of 1.8 million pet owners between 2017 and 2019 being followed by gain of 3.7 million pet owners between 2019 and 2021.

- In terms of households without children present, which can free up discretionary spending, a national gain of 386,000 pet owners between 2017 and 2019 being multiplied to a gain of 1.8 million pet owners between 2019 and 2021.

- In terms of graduate degree holders, generally associated with higher incomes, a national increase of 463,000 pet owners between 2017 and 2019 being multiplied to a gain of 1.8 million pet owners between 2019 and 2021.

TABLE 1: More affluent homes gained pets during the pandemic years, accounting for a surge in pet care spending as well as an increase in pet ownership numbers.

Pet owner increases account for spending boom

These anomalous increases in the number of pet owners among financially comfortable-to-prosperous households account for the pet adoption spike and triggered the pet care spending boom virtually industry-wide in the wake of COVID-19.

Notably, in this vein, a national gain between 2017 and 2019 of 688 million dog owners with household incomes of US$100,000 or more was followed by a far more dramatic gain of 3.2 million dog owners at this highest income bracket between 2019 and 2021, translating to a surge in ownership of the most expensive pets to keep among the most affluent households.

Corresponding, according to data Packaged Facts will present at the Petfood Forum 2022, the number of dog-owning households spending US$500 or more on pet food annually jumped by 2 million.

These gains were countered by losses among lower-income counterparts, along with full-time workers and those with children in the home. This socio-economic pattern represents a significant disconnect between pet population and pet industry revenue levels — and points to the ongoing need to keep affordable pet ownership options accessible in the market.

Boomer, millennial owners lost pets for different reasons