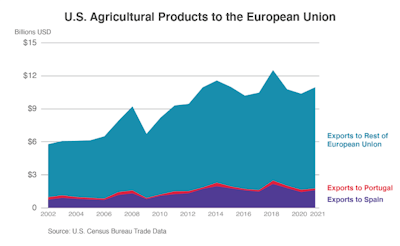

In recent International Agriculture Trade Reports, the U.S. Department of Agriculture’s (USDA) Foreign Agriculture Service made specific mention of pet food as a high-potential agricultural export for three countries: Spain, Portugal and Taiwan. Spain is the third largest European Union (EU) destination for U.S. agricultural exports, with Portugal ranking 11th, while Taiwan is the seventh largest destination for U.S. agricultural exports globally.

More premium pet food products for Spain

In terms of dog and cat food, the USDA report noted that Spain has seen consistent growth in its import demand over the last five years, with imports valued at US$511 million in 2021, up 27% from 2020. The U.S. is among the top exporters of pet food to Spain already, alongside other EU countries and Canada.

The Spanish pet population continues to grow, with 28 million registered pets currently; it is fifth in the EU in terms of pet populations. USDA seeks to target more premium categories of pet food and pet care products, as the Spanish population becomes more aware of their pets’ nutritional needs.

US pet food imports rising in value in Portugal

Portugal is a net importer of pet food (valued at US$243 million in 2021) for its 2.1 million dog and 1.5 million cat populations, receiving the lion’s share (64%) from Spain. The U.S. has a market share of 2% in the Portuguese import market, at a value of US$5.3 million in 2022. This has more than doubled since 2017, when the U.S. dog and cat food share was valued at only US$2 million.

While the U.S. faces stiff competition in the Portuguese import market from EU countries, another point to consider is the growing local pet food industry. In 2020, the top nine Portuguese pet food manufacturers had combined annual sales of US$61.3 million, up 470% from a decade prior. Local manufacturing now represents 20% of the Portuguese pet food market. USDA’s report emphasized the benefit to U.S. exporters of premiumization and innovation from their brands and private labels.

Taiwan pet food importers should focus on premium ingredients

Taiwan remains one of the steadfast trade partners for the U.S. and an important market for consideration by pet food exporters. With a robust and highly diversified economy, Taiwan did not see significant impact from the COVID-19 pandemic in terms of its imports in food and agricultural products categories. USDA noted that overall agricultural imports represent almost 50% of the U.S. market share in Taiwan, indicating that U.S. exporters have an opportunity to continue exploring high-value consumer goods in the Taiwanese economy.

For U.S.-based pet food manufacturers, the report indicated the Taiwanese pet food market is to rise to US$1 billion in 2022, with a focus on commercial pet food and the use of human-grade, premium ingredients. Taiwanese dog and cat food imports stood at US$226.4 million in 2021, more than doubling in a decade, at a consistent growth rate of 8.5% annually.