The first-quarter 2010 installment of this column stated that, true to its recession-resistant claim to fame, the US pet industry added US$2.5 billion in the midst of the biggest economic crisis since the Great Depression, rising 4.8% in 2009 to reach a total of US$53 billion.

But it also noted that economy-wise, 2010 would not be a cake-walk, as the word “restraint†continued to characterize how Americans shop and what they buy, making petfood appeals based on health, safety, convenience, comfort, practicality and professionalism more important than ever.

As of December 2010, these words are ringing true with reverberations certain to carry over into 2011 and perhaps 2012. In Packaged Facts’ February 2010 poll of pet owners, only 29% of respondents agreed that they anticipated spending less on petfood/supplies in the next 12 months; this figure was up to one-third (34%) in Packaged Facts’ May/June 2010 pet owner survey.

Moreover, there are strong signs that this belt-tightening cohort includes its fair share of premium product consumers, since purchasers of natural dog or cat food were more likely than dog or cat owners overall to report that they’ve been cutting back.

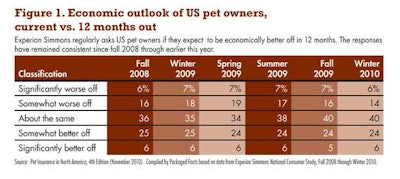

More sobering news: According to Experian Simmons consumer survey data for winter 2010, the percentage of pet owners who expect to be economically better off in 12 months is not rising. In fact, the percentage was slightly lower in that survey than in one Experian Simmons conducted in fall 2008 (Figure 1).

Zeroing in on petfood, the overall news isn’t better. During the 52 weeks ending October 3, 2010, sales of dog food rose 2.3%, while cat food sales were up 0.6% and “other†petfood sales (for species other than dogs and cats) were down 10%, according to SymphonyIRI data for US supermarkets, drugstores and mass merchandisers other than Walmart. This marks a significant slow-down from full-year 2009, when the comparative rates were 8.1%, 4.8% and -1.0%, respectively.

However, considering the various petfood types, there are some bright spots. During the same 52-week period, US sales of dog biscuits/treats rose 6.9% and sales of cat treats rose 10%. In addition, frozen/refrigerated dog food remained a highlight, up 13% to US$39 million, with the fledgling frozen/refrigerated cat food segment up almost 3,000% to US$800,000 (Figure 2).

Looking ahead, the news isn’t all bad. Although 34% of US pet owners admit to reduced pet product spending, the exact same percentage said they were planning to ramp up in the coming year, according to Packaged Facts’ May/June survey (Figure 3). And chances are higher-income consumers will rebound the fastest.

But whereas the petfood market has been driven to a large degree by the high level of receptiveness of consumers to premium products, 2011 will likely see continued strong demand for value-priced products. In other words, while the human/animal bond, pet health and convenience will continue to intersect as factors determining where pet owners shop and what they buy, the additional factor of price will at least as often continue to have the last word as pet owners struggle to adjust to the “new normal†of these still tough economic times.