The American Feed Industry Association and a national coalition of groups representing commodity-dependent businesses and consumers announced opposition to a House bill that AFIA says would delay new trading reforms provided in 2010's Dodd-Frank Wall Street Reform and Consumer Protection Act.

The proposed legislation, H.R.1573, would extend the deadline for implementation and enforcement of most Dodd-Frank Act reforms of trading in the derivatives markets, including commodity futures, options and swaps markets, from July 21, 2011, until January 1, 2013, according to AFIA.

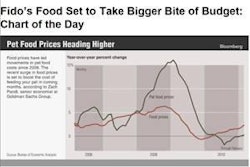

“These reforms, once implemented, will bring greater transparency and stability to the commodity derivatives markets, including energy and agricultural futures, options and swaps markets,” the Commodity Markets Oversight Coalition said in a letter to lawmakers. “Further delay in the implementation and enforcement of these reforms could greatly diminish market competitiveness, stability and confidence, and will preserve today’s artificially high commodity prices caused by excessive speculation in the derivatives markets.”

The coalition letter was sent on behalf of AFIA and CMOC to both Republican and Democratic leaders in the House Financial Services and Agriculture Committees, and is available online.