The acquisition of Vitakraft, a company that ranks seventh in global pet care, by Tiernahrung Deuerer, a private label manufacturer, is expected to imprint a new dynamism and boost competition within the industry, and it clearly is a sign of more challenging times. Overall, the pet care market has proved somewhat recession-proof, resisting the strong winds of economic uncertainty in a positive fashion. Global pet care sales are expected to reach US$96 billion in 2013, the result of 2.5% growth on 2012 numbers. Between 2008 and 2013 sales grew by a 2% CAGR (compound annual growth rate). However, growth might be at risk as private label gains new ground, attracting more cash-strapped consumers.

Despite the good performance, recent times seem to indicate a shift in traditional perceptions. Many consumers are faced with challenging economic circumstances, particularly in Western Europe, where the IMF has been called to intervene in many economies. The stronger budgetary discipline dictated by the institution has resulted in severe cuts for many consumers. For example, annual disposable incomes per capita declined by 26% in Greece and 16% in Ireland between 2007 and 2013. The current climate is thus a boon for private label offerings. Retailers have been savvy in taking advantage of these circumstances, even if traditionally pet owners tend to prefer branded products.

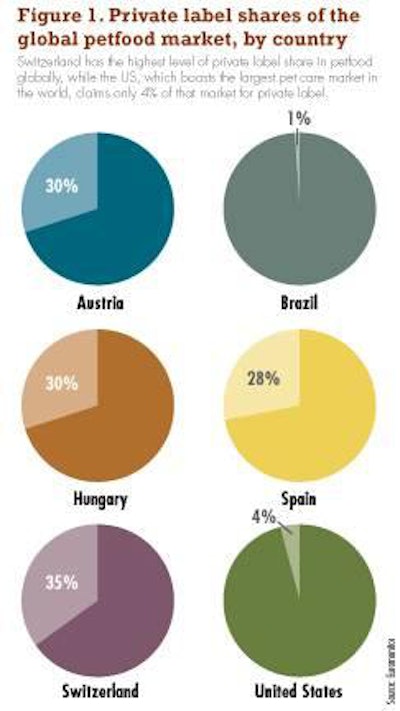

A good example is Spain, where burgeoning private label is related to the wider economic environment. As conditions in Spain are challenging and budget cuts are in effect, pet care is no longer exempt from financial concern. And subsequently, from a 22% share in 2008, private label now stands at 28% in petfood. Different tier offerings are increasingly visible, ranging from basic dry dog food to premium, are also available in different retailers. The national retailer Mercadona ranks third in cat food with a 7% value share and 11% in dog food.

Other factors beyond economic adversity also stand to benefit private label sales. Indicative of this is the fact that Switzerland has highest level of private label share in petfood globally: 35% in dog and cat food. This is a testament to the strength of key retailers in this country, notably Migros and Coop, which offer good-quality products and different tier private label alternatives.

Other markets with a high level of private label include Hungary and Austria, with a share of over 30% in petfood. While in Hungary, much of private label's appeal is related to the economic climate; in Austria it is attributable to a high concentration level in retailing.

Emerging markets, by contrast, show much lower penetration of private label. Once more, the retailing structure is key to this, as modern grocery is less developed and international retailers are just starting to become more prominent. More importantly, the number of economy brands in petfood is much higher in such markets, with many produced by local players. The fact that pet owners tend to shop locally at pet shops or even in more traditional channels is also relevant. For example, in Argentina, forrajerÃas (agricultural shop) provide the chance for consumers to buy smaller portions, mostly loose.

Similarly in Brazil, a mere 1% is taken by private label. Nevertheless, Brazil is the second-largest dog and cat market by economy price platform. Local players are quite strong, as evident with Nutriara, Total Alimentos and Mogiana, which have several economy offerings. While these manufacturers are aiming at premiumizing and increasing the share of premium offering, entry price points, economy platform, are key to attract first-time consumers. Private label in Russia has a similarly limited presence. However, the competitive landscape is quite different: Mars leads with a 63% presence in the economy segment with the brands Kitekat and Chappi. Overall, Russian consumers trust well-known international brands rather than private label.

In Asia, private label levels are also very low, with Thailand being one of the few markets with more offers. Despite this, the presence of various private label products has had little impact on mainstream mid-priced cat food brands, as Thai consumers lack confidence in the quality of private label. However, private label brands such as Tops are positioned at a similar price level to other mid-priced cat food brands.

Finally, the largest pet care market: the US. In mid-2012, Wal-Mart Stores added a premium brand, Pure Balance, to its portfolio of dog food. The company's previous private label brand-Old Roy-was positioned at the economy end of the pricing spectrum. The entry of Wal-Mart into the premium dog food segment indicates the growing importance of price segmentation within the industry-a trend which is now being realized by America's foremost economy mass retailer. Nevertheless, the percentage taken by private label is relatively small, at just 4%.

All in all, a new paradigm seems to be looming in the horizon and manufacturers will need to be savvy in their strategies. Added premium and functional ingredients could be one of the strategies but differentiation will remain key.