Top 10 global petfood leaders

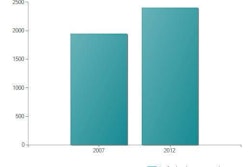

Worldwide retail sales of dog and cat food topped US$45 billion in 2007, according to data from Euormonitor International. That's a total growth of almost 43% from the 2002 amount of US$31.57 billion, and according to Euromonitor, global retail sales of petfood will only continue to grow. Market researcher David Lummis of Packaged Facts contends that there are three primary trends driving growth in the international petfood and pet treats market: humanization, convenience and health. Even with the world going through an economic crisis, indicators continue to bode well for the ongoing expansion of the global petfood market, which just may be recession proof.

Running with the big dogs

The global petfood market is currently riding a strong wave of growth, especially in emerging markets. Take Brazil, for example, whose companies Total Alimentos SA and Nutriara Alimentos Ltda. have already begun climbing from last year's positions in the top 10 to more secure spots in the ranking. Dropping off the list this year is Nutro Products Inc., who was bought up by Mars Inc. in May 2007. Replacing them is Japanese company Nisshin Seifun Group and their subsidiary Nisshan Petfood Inc.

1. Mars Petcare

World headquarters:

McLean, Virginia, USA (Mars Petcare: Franklin, Tennessee, USA)

Approximate 2007 global retail sales:

US$11.8 billion

Officers:

Luc Mongeau, president, Mars Petcare US

Top brands:

Pedigree, Cesar, Sheba, Nutro, The Goodlife Recipe, Whiskas,

Greenies, Royal Canin

New products:

Sheba Premium Cuts, Cesar Single Pouches, Whiskas Oh So…

pouches, cans and Senior (UK), Whiskas Steam Cooked Pouches,

Whiskas Purrfectly Chicken, Whiskas Purrfectly Fish, Pedigree

Joint Care Dog Treats (UK), Royal Canin Mini Dachshund, Royal

Canin Medium Bulldog, Royal Canin Active Mature for Cats

Websites:

www.mars.com

;

www.marspetcare.com

There are more varieties of Pedigree dog food than any other petfood brand in the US and Whiskas cat food is available in more than 40 markets worldwide, according to Mars Petcare. The pet division of Mars Inc. can continue to make impressive boasts such as those as the petfood giant remains on top of the heap, while always innovating and growing. Sales across its core brands, such as Cesar, Whiskas and Sheba, have remained strong, despite a voluntary US recall in late 2008 because of possible Salmonella contamination.

Ol' Roy dog food and Special Kitty cat food were removed from grocery shelves and consequently the Everson, Pennsylvania, USA plant where the contamination was first detected was shut down. As of press time, no pet deaths have been reported. Mars Petcare asserts all of its products, branded and private label, undergo industry-leading testing and quality control, and its stringent quality program extends to its supply chain.

Regardless of such setbacks, newer brands such as The Goodlife Recipe, WholeMeals and Nutro (which Mars acquired in May of 2007) are adding great depth to this petfood monolith's ever-growing portfolio of products. Not only topping the chart in total sales of dog and cat food (see Table 1), Mars Petcare also finds itself leading the pack when it comes to new product launches, with 254 SKUs in cat food products and 248 SKUs in dog food products (see Table 3 and 4). With the 2006 acquisition of Doane Pet Care, pet products are now one percentage point bigger in Mars North America sales than their snack foods division.

2. Nestlé Purina PetCare

World headquarters:

Vevey, Switzerland (Nestlé Purina PetCare: St. Louis, Missouri,

USA)

Approximate 2007 global retail sales:

US$10.9 billion

Officers:

W. Patrick McGinnis, CEO, Nestlé Purina PetCare; Terrance

Block, president, PetCare NA; Rock Foster, CFO

Top brands:

Purina, Purina One, Alpo, Beggin'

Strips, Beneful, Busy Bone,

Chew-eez, Chew-rific, Deli-Cat, Dog Chow, Fancy

Feast, Friskies, Gourmet Gold, Mon Petit,

HiPro, Kibbles and Chunks, Kit 'N

Kaboodle, Mighty Dog, Moist & Meaty, Pro

Plan, TBonz, Purina Veterinary Diets (Canine and

Feline), Whisker Lickin's

New products:

Pro Plan Shredded Blends, Alpo Chophouse Originals, Beneful

Playful Life, Beneful Snackin' Slices, Pro Plan Selects Dry Dog

Food

Websites:

www.nestle.com

;

www.purina.com

According to Euromonitor, Nestlé had a 5% year-to-year sales growth from 2006 to 2007 (see Table 2). Last year (2007-2008), Purina PetCare generated sales growth of about 6% to 7%, depending on foreign exchange rate variables considered, according to St. Louis Business Journal . Secure once more in the second spot, Purina So far in 2008, the division achieved 9.5% organic growth during the first three months of this year, including double-digit growth in markets outside the United States and Europe, according to its first-quarter report. "(Purina PetCare) organic growth continued to be driven by strategic brands, new product launches and product mix improvements," Nestlé stated in the report.

Superpremium brands appear to be a growing strength for the division, which Nestlé acquired for US$10.3 billion in 2001. Purina PetCare consumer research found there was an unmet demand for "a dog food that went beyond keeping dogs healthy and active," according to its annual report. Purina PetCare conducted a limited launch of Beneful in the US beginning in 2006 and has captured 6% market share in its targeted markets, according to the St. Louis Business Journal 2008 article. In the hope of expanding on that success, the company rolled out the Beneful product line-including the new Playful Life blend and the Snackin' Slices dog treats-nationally during the first quarter this year. In addition to Beneful, Purina PetCare's superpremium cat foods under the Fancy Feast, Gourmet Gold and Mon Petit brands also are performing well, according to the company.

Long known for its petfood and snack products, Nestlé Purina is recently branching out into a different-but according to company officials, related-category: pet health insurance. "One of our primary focuses as a brand is delivering a lifetime of health and happiness," says Bill Broun, director of business development for Purina PetCare. "This is a move for us that has financial benefits, but it builds on our core franchise of the brand." To market the insurance, the company will lean on its well-known brand portfolio and iconography.

World headquarters:

New York, New York, USA (Hill's Pet Nutrition: Topeka, Kansas,

USA)

Approximate 2007 global retail sales:

US$3.0 billion

Officers:

Robert Wheeler, Hill's Pet Nutrition CEO; Neil Thompson, Hill's

Pet Nutrition president of Americas; Janet Donlin, Chief

Veterinary Business Channel

Top brands:

Hill's Science Diet, Hill's Prescription Diet

New products:

Healthy Development Original Puppy and Kitten, Nature's Best

Dog and Cat, Tender Chunks in Gravy Cat

Websites:

www.colgate.com

;

www.hillspet.com

;

www.hillsvet.com

Hill's Pet Nutrition just squeaked by P&G Pet Care in total global retail sales, according to Euromonitor, with US$3 billion (see Table 1). With a strong 8.3% year-to-year growth rate (Table 2), Hill's continues to measure its success by building and strengthening relationships in the veterinary profession, while focusing on continuous innovations in health, wellness and therapeutic petfood nutrition.

Holding the third and fourth position in new product launches for cats and dogs, respectively, Hill's continues to expand its core brands with Science Diet Healthy Development Original Puppy and Kitten formulas, Science Diet Nature's Best dry food for Cats and Science Diet Tender Chunks in Gravy Cat - a new wet food. Hill's also relied on it's veterinary alliances to help spotlight a variety of pet health concerns and spread consumer awareness this year, including: dental health, canine cancer, pet obesity and proper pet diet.

Hill's is in the process of developing a new dog treat line and is seeking the knowledge and advice of animal experts who can assist in its creation, recruiting industry experts with various backgrounds, such as animal behaviorists. The advice will be provided in the form of "Expert Blinks" - quick responses to questions provided by Hill's so the company can learn more about current trends from working experts on the front lines of companion animal care.

4. P&G Pet Care

World headquarters:

Cincinnati, Ohio, USA (P&G Pet Care: Dayton, Ohio, USA)

Approximate 2007 global retail sales:

US$2.99 billion

Officers:

A.G. Lafley, CEO and chairman

Top brands:

Eukanuba, Iams

New products:

Iams Veterinary Formulas Feline and Canine (in wet and dry),

Eukanuba Naturally Wild Dry Dog Food

Websites:

www.pg.com

;

www.eukanuba.com

,

www.iams.com

Despite much speculation whether Procter & Gamble would

sell their petfood brand after the 2007 recalls and dropping

sales and shares, P&G Pet Care remains a fixture on this

year's top 10 list, although faltering a spot. P&G Petcare

managed a healthy US$2.99 billion in retail sales in 2007, with

a strong showing in new product launches in both dog and cat

food (Tables 3 and 4).

The company has followed trends this year such as health and wellness, humanization and natural with its US product launches. P&G's Iams brand released Veterinary Formulas for cats, dogs and puppies, in both wet and dry varieties including formulas targeting skin & coat, intestinal problems, urinary problems, multi-stage renal, weight loss, weight control and joint health. Eukanuba also introduced a new line of dry dog food named Naturally Wild in formulas such as New Zealand Venison & Potato, North Atlantic Salmon & Rice, and Country-Grown Turkey & Multigrain. The natural formulas tout natural fish oil, antioxidants and a "100% Nutrition, 0% Filler" claim-no meat by-products or corn, according to the company.

5. Del Monte Pet Products

World headquarters:

San Francisco, California, USA

Approximate 2007 global retail sales:

US$1.7 billion

Officers:

Richard G. Wolford, chairman of the board, president and CEO;

Jeff Watters, Del Monte Pet Products senior vice president

Top brands:

Meow Mix, Kibbles n' Bits, 9Lives, Milk-Bone, Pup-Peroni,

Pounce, Gravy Train, Jerky Treats, Canine Carry Outs,

Snausages, Nature's Recipe (Cat and Dog), Alley Cat, Meaty Bone

New products:

Nature's Recipe Farm Stand Selects Sliced Treats, Nature's

Recipe Healthy Skin & Coat Treats, Nature's Recipe Joint

& Hip Treats, Nature's Recipe Teeth & Breath Treats,

Snausages Breakfast Bites, Snausages Paw Prints, Pup-Peroni 50

Calorie Snack Pouch, Kibbles 'n Bits Wholesome Medley

Website:

www.delmonte.com

Del Monte Pet Products grabbed the number five position for the second year in a row, earning US$1.7 billion in 2007 and 1.5% year-to-year growth rate (Table 1). "I am pleased with the company's (sales) performance driven by strong volume, primarily in consumer products, as well as effective pricing actions and successful new product sales," said CEO Richard G. Wolford in a 2008 statement. "However, our businesses continue to be negatively impacted by inflationary cost pressures ... and cost increases." One of the contributors to reduced profits and higher expenses was an undisclosed amount of general and administrative expenses related to Del Monte centralizing the marketing and certain related functions of its petfood operations in San Francisco, California, USA relocating the operations from Pittsburgh, Pennsylvania, USA the company said.

Del Monte snagged 35 SKUs in new dog product launches this year (Table 4), with the help of such products as the 50 Calorie Snack Pouch treats for dogs, which relied heavily on the humanization and pet wellness trend. Marketers for Del Monte in 2008 followed another trend by developing television programs that are centered on their products. The Meow Mix line of cat food from Del Monte Foods underwrote a game show for the Game Show Network cable channel (GSN) in the US that tested how well cat owners understood their pets-and vice versa. This venture was an example of the trend called branded entertainment, or branded content, and it was intended to embed a product in the plot of a show, making it more memorable than it would be if it had merely made a brief appearance. Unlike a product pitched in a commercial, a product marketed through branded entertainment is almost always noticed because it is an intrinsic part of the show, and that's what Del Monte was betting on. So prick up your ears and pay attention: Del Monte shows no sign of slowing down despite rising ingredient costs and a competitive industry client.

6. Affinity Petcare SA

World headquarters:

Sant Cugat del Vallés, Spain (Main plants/facilities: El

Monjos, Spain; La Chapelle Vendomôise and Moulins, France)

Approximate 2007 global retail sales:

US$0.61 billion

Officers:

Mario Franques, markets managing director; Joan Sanahujes, VP

marketing; Franc Andreu, operations managing director; Frances

Blanch, VP R&D

Top brands:

Affinity, Ultima, Brekkies, Brekkies Excel, Advance, Advance

Veterinary Diets, Premium Dog, Rubadub (treats)

New products:

Brekkies Excel Tender & Delicious, Ultima Cat Sterilized

& Ultima Dog Sterilized, Ultima Cat Shine & Beauty,

Ultima Cat Senior, Ultima les Repas Equilibre, Brekkies Excel

Cat Original

Websites:

www.affinity-petcare.com

Affinity Petcare-part of the Agrolimen Group of companies, leading manufacturers of consumer goods in Europe-has been striving to produce novel, healthy products for pets for more than 40 years. Ranked number six in our annual list, the company offers a wide range of products, from special veterinary diets to superpremium foods to value-priced products for cats and dogs. Affinity says it is committed to the following values: imagination, innovation, flexibility and a scientific, systematic approach. Affinity attests that it is the next real challenger in the petfood category. With plenty of years of experience in the industry and the kind of success to make even larger manufacturers take notice, Affinity Petcare seems poised to keep running with the big dogs in the future.

Affinity products are distributed mainly in the European Union, but the company is building a distributor network within the fast-growing Eastern European petfood market, too. Russia, Turkey and Ukraine now carry Affinity products, and petfoods are even available in specialty stores in countries such as Israel and Kenya. The company has many growth opportunities in terms of geographic expansion and hopes to extend its presence in other markets having high pet ownership concentrations.

Besides expanding distribution, Affinity's growth strategy is based on new product development and strong promotion efforts, according to markets managing director, Mario Franques. "We have introduced nine new varieties for cats and four for dogs in different European countries in the last 12 months," he says. "Our keys to growth are that we have new and innovative products, and that we are focusing our efforts in geographical areas in Europe where dry products are growing the most." The company is already the leader in Spain in total market and dry petfood with shares above 40% and is making considerable gains in countries like France, Germany and Italy.

7. Uni-Charm Petcare Corp.

World headquarters:

Tokyo, Japan

Approximate 2007 global retail sales:

US$0.31 billion

Officers:

Toshio Takahara, chairman; Gumpei Futagami, president/CEO

Top brands:

Aiken Genki, Neko Genki, Gaines

New products:

Ginno Sara Kyono Gohobi (treats)

Website:

www.unicharm.co.jp

;

www.uc-petcare.co.jp

Unicharm PetCare Corp. is a division of Tokyo-based

conglomerate Uni-Charm Corp. and is continuing to take

advantage of Japan's steadily growing pet population. Unicharm

PetCare offers the Aiken Genki, Neko Genki, and Gaines brands.

These products aim to achieve an ideal nutritional balance for

each pet in light of its age, physical attributes, physical

condition and preferences, according to the company. Unicharm

believes the key to its continuing rise is a strong emphasis on

four trends: indoor companion animals, toy dog breeds, pet

obesity and Senior pets. To differentiate itself from other

fast-growing Japanese petfood manufacturers, like Nisshin

Petfood Inc., Unicharm emphasizes the speed of converting

consumer needs into products and applying technology to premium

foods.

Unicharm bet on pet humanization to drive consumers to more premium and superpremium products like its semi-moist dog food Gaines Pakken White Meat Chicken and Ginno Spoon Retort Pouch, a wet cat food. The company must be doing something right, with US$0.31 billion in sales in 2007 (Table 1), despite not raking in a high number of SKUs in new petfood products. In October 2004, Unicharm PetCare was the first specialized pet care product manufacturer in Japan to have its stock listed on the exchange, according to the company website. The subsidiary moved to the First Section of the Tokyo Stock Exchange in September 2005 and is endeavoring to increase its corporate value. To continue a healthy growth, Unicharm faces challenges in improving product quality, safety consciousness and gaining profits in an environment where raw materials are increasingly expensive for everyone.

8. Nutriara Alimentos Ltda.

World headquarters:

Arapongas, Paraná State, Brazil

Approximate 2007 global retail sales:

US$0.27 billion

Top brands:

Foster, Freddy's, Bybos, Dog Show, Blog Dog, Dog Friends,

Tommy, Fulldog, Floop, Farejador, Dunga, Ringo, Pitoko Mix,

Pitty, Bidu, Street Dog, Pitukão Pitukinha, Foster Cat, Gatto,

Street Cat, Blog Cat, Clean Cat, Pitukats, Disney Pets, Mingau,

Bancook, Show Dog

New products:

Bancook Big, Bancook Niño, Show Dog Ossito, Show Dog Soft Bone,

Show Dog Kid Bone, Show Dog Palititos

Website:

www.nutriara.com.br

In 2007 the Brazilian petfood industry produced 1.8 million tons of petfood. Associação Nacional dos Fabricantes de Alimentos para Animais de Estimação (ANFAL, or Brazilian Petfood Manufacturers Association ) believes the potential of the market is much greater; its 31 million dogs and 15 million cats represent a potential petfood consumption of 3.96 million tons per year. But prepared foods are offered to only 45% of pets, while the remaining 55% are fed leftovers. "Approximately 2 million tons of rice, meat, milk and other foods are used to feed our pets; as a result, these are diverted from human nutrition," says José Maria Parra, president of ANFAL.

The first of our two returning petfood companies from Brazil to appear on our list, Nutriara Alimentos Ltda. was founded in 1991. Initially production was directed at birds, pigs, bovine and equine breeders-it wasn't until 1996 that the company opened the pet segment of its business. Nutriara expanded its activities and facilities, changed over its production lines and began focusing its investments solely on petfood. The company experienced radical growth this year, with a staggering 39.1% growth rate from 2006 to 2007 (Table 2).

This year, Nutriara introduced two new dog treat brands: Bancook and Show Dog. With an almost overwhelming range of products for both cats and dogs-many of which are top sellers not only in Brazil but in other South American markets including Argentina, Uruguay, Paraguay and Chile-Nutriara continues to strive to offer pet products for animals of all ages, sizes and special health needs, according to the company. According to company literature: "From the product's formulation to its arrival in the Brazilian consumer's homes, the Nutriara business structure creates jobs and brings quality of life to those who participate in the every day of the company - either directly or indirectly."

9. Total Alimentos SA

World headquarters:

Três Corações, Brazil

Approximate 2007 global retail sales:

US$0.23 billion

Officers:

Antônio Teixeira Miranda Neto, president; Paulo Tavares,

financial director; Anderson

Top

brands:

FamÃlia Max, Big Boss, Lider, K&S, EquilÃbrio, Naturalis,

Natural treats

New products:

Naturalis Dry Dog Food, Natural Chicken Breast Jerky Treats

Distribution:

33 countries besides Brazil

Website:

www.totalalimentos.com.br

Though its petfoods have been available only since 1995, Total ranked as the ninth largest petfood company in the world the past two years, having experienced year-to-year growth of 19% (Table 2) in 2007. That growth has leveled off recently, but the company is still launching dozens of new products, expanding its global distribution and reaching new heights of quality and safety. To keep quality and service high, Total maintains a large sales force selling directly to 12,500 pet store and other retail accounts. As the company has expanded globally, it has opened sales branches in China, US and Europe.

Today, petfood comprises 70% of the company's sales. Besides being one of the largest petfood producers selling to the Brazil market, Total exports its cat and dog foods to 33 countries. To keep up with the growth since 2002, Total has added two new petfood factories to two existing extrusion buildings. Company president Miranda estimates the Total portfolio encompasses 125 product lines or about 850 stock keeping units (SKUs). These include several new brands and line extensions launched just this year:

10. Nisshin Petfood Inc .

World headquarters:

Tokyo, Japan

Approximate 2007 global retail sales:

US$0.20 billion

Officers:

Osamu Shoda, chairman; Hiroshi Hasegawa, president

Top brands:

Run, Carat, Lovely

Websites:

www.nisshin.com

Nisshin Flour Milling Co. Ltd., which reorganized into the Japanese holding company Nisshin Seifun Group in 2001, owns subsidiary Nisshin Petfood Inc., who rounds out the top ten companies for last year. Under its motto, "For a long and healthy life for your pet," Nisshin Petfood Inc. provides a product lineup that meets a wide variety of needs. The company has an integrated manufacturing, sales and research system that enables it to provide products that promise a new era in pet care, the Nisshin website attests.

As the Japanese population ages and single-person households are increasing, pets are no longer simply animals. For many, their pet is now an important member of the family and a life partner with which they have an emotional bond. With this new level of emotional attachment in mind, Nisshin Petfood Inc.'s product lineup offers a wide variety of pet-pleasing tastes. Just this year Nisshin has already introduced 35 new cat food product SKUs (Table 3). The lineup, which includes the dog food brand Run and cat food brand Carat, has found high acceptance among Japanese dog and cat owners. The Lovely brand has also been developed for small pets. All products have been made giving attention to optimal nutritional balance and always with the good health of pets in mind, states Nisshin.

The company provides a pet advice and consultation service, internet website and various other forms of communication to continuously gather up-to-the-minute feedback from pet owners concerning their problems and needs. This feedback is immediately forwarded to product development and product quality personnel. Nisshin Petfood Inc.'s Nasu Research Center is equipped with state-of-the-art technology and facilities for use in developing ideal petfood products, according to the company. The combined know-how of these two facilities allows Nisshin Petfood Inc. to stay ahead of the competition in the market and provide pet owners with new products that are both attractive and safe.