The Russian petfood market in 2015 may face a significant reduction of sales—20–25% in volume and roughly 50% in monetary terms—on the backdrop of the fall of the exchange rate of the Russian ruble against the US dollar and Euro at the end of 2014, market participants forecast.

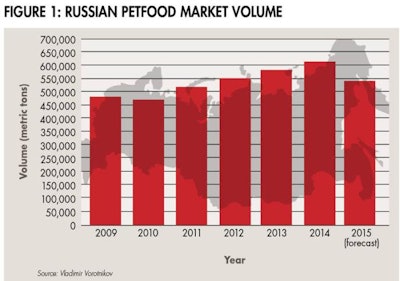

Various experts’ estimations say that the volume of actual sales in 2015 may drop from 610,000 metric tons in 2014 to about 490,000 metric tons—the lowest volume since 2011 (see Figure 1). The size of the market may decrease from 2014’s US$1.2 billion to US$700 million, which may be the lowest drop in a decade (see Figure 2). However, in ruble equivalents the sales will jump from RUB39 billion in 2014 to RUB44 billion in 2015, according to analysts.

Major distributors of petfood have already increased selling prices by 30–40%, both for imported and domestic production. Retail chains are trying to mitigate the rise in prices, but recent forecasts say that a large number of specialized points of retail petfood sales this year may be closed, as the margin of sales has sharply dropped in recent months.

In particular, Irina Zhuravlev, head of marketing and advertising department major of the Ivanko Company (engaged in distribution of petfood production in Russia), said that since November 2014 there have been three or four waves of price increases in the wholesale sector of petfood production, and for different groups of goods prices jumped 15% to 60%. At the same time, she said, in retail the rise in prices has not been as significant. “Someone is selling goods purchased at the old prices, while someone raises prices gradually, limiting the margin in order not to lose a large segment of customers,” she says.

A representative of petfood distributor Triol said they agree that there has been a rise in prices and that a probable drop of sales can be expected in 2015, adding that these trends may result in a large number of small petfood shops closing. "In recent years, we have observed the same pattern: per one closed shop, there were two to three new shops opened,” said the representative. “However, in November 2014, for example, in St. Petersburg 18 non-network retail outlets selling petfood were closed and only two new outlets opened.” Triol’s marketing department has forecast a drop in petfood sales by 20% year-on-year in 2015.

In the meantime, market participants said that the structure of demand is not changing, but the volume of sales is falling. "Even with the dynamic growth of prices, customers so far have refrained from transferring their pets to a cheaper or more natural food," said a representative of KoDmi-meat, a seller of natural petfood.

In the context of the fall of sales in the Russian market, the future of the expansion plans of its leader, Mars Company, is unclear. Currently, the company is investing in an expansion project worth RUB1.5 billion (US$50 million, based on the exchange rate at the beginning of 2014). It was initially announced in 2013 and includes the expansion of production capacities at the Mars plant in Novosibirsk from 45,000 metric tons to 80,000 metric tons.

According to the plant CEO Fedor Lapatkov, the project is expected to be completed by 2015 and the plant will reach full capacity in 2016. Originally it was expected that the project would bring the margin of Mars’ business to 15%, but now this figure seems questionable given the overall drop in petfood sales in Russia.

According to Russian market players, Mars controls about 60% of the domestic market (see Figure 3), and the current reduction of petfood sales in the country might make a production increase meaningless. Representatives of Mars so far have not commented the current situation, but there are rumors that Mars is thinking about establishing export of its products from the Russian production site to neighbors Belarus, Kazakhstan and Baltic States; or abandoning part of its imports to Russia entirely.Â