In an era of moderating growth rates in the US market, specialized pet nutrition products of all stripes will keep growing at an above-average clip. An important arena will be “functional” petfoods and treats, products that proffer special nutritional benefits in terms of general wellness and, quite often, that address specific health concerns such as digestion, the immune system, joint/cartilage function or oral/dental health. Fueling this trend is America’s increasing attention to health issues, both human and pet, which ties in to an aging and often overweight population, again both human and pet.

“Functional food” is neither a consumer term nor an appetizing one, but the concept is entrenched in our food industry. Functional foods, in the sense of processed foods and beverages that are wholly or primarily engineered to meet nutritional goals, are with us from birth with infant formula to old age with meal replacement drinks, with stops along the way for athletes and body builders, the infirm, those too busy for breakfast, and those trying to lose weight, among diverse other target audiences. All petfood is functional in this sense, and specialized petfood formulations by life stage, breed size and activity level, weight control/diet, specific ingredient avoidance and other angles echo the target marketing in processed foods for humans.

Even so, the fact that “functional food” is a standard industry term that has not exactly caught fire among the general public reflects some consumer ambivalence about the concept, because Mother Nature in the form of whole foods remains the popular ideal. (The power of “superfoods,” the country cousins of functional foods, stems from reconciling the appeal of the natural with the lure of the extraordinary benefit or boost.) Thus, a Packaged Facts January 2015 survey of US adults shows that food ingredients with functional benefits have a notable contingent of consumer fans, without ranking as a top concern among grocery shoppers overall.

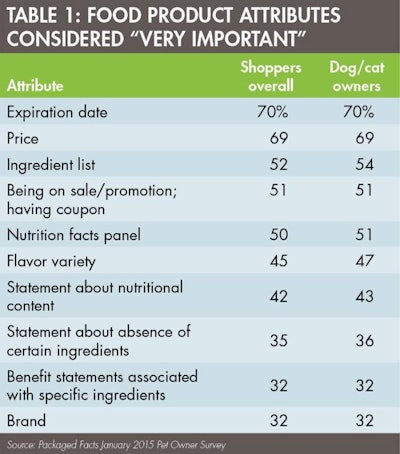

That is, 32% of grocery shoppers overall (and the same percentage of dog/cat owners) consider “benefit statements associated with specific ingredients” to be “very important” when choosing which processed food products to buy (see Table 1). To put that 32% in context, that’s only slightly lower than the percentage who consider the absence of certain ingredients to be very important and equal to the percentage who consider the brand to be very important. Among consumers overall, the more straightforward information in the Nutritional Facts panel (50%) and ingredient list (52%) ranks higher in priority, and the prosaic attributes of price (69%) and expiration date (70%) top the scale.

Those consumers who in their overall food shopping do prioritize the functional benefits of specific ingredients bring this mindset to their pet product purchasing behavior. At the most general level, compared with dog or cat owners overall, dog or cat owners who consider benefit statements associated with specific food product ingredients to be “very important” are significantly more likely to be spending more on pet products than they used to (at 17% vs. 24%, respectively) and to be buying more pet products online than they used to: at 15% vs. 22%, respectively (see Table 2).

More specifically, compared with dog and cat owners overall, dog and cat owners who consider benefit statements associated with specific ingredients to be “very important” to food shopping overall are significantly more likely to consider targeted petfoods and treats beneficial, more likely to be concerned about the affordability of pet health care, more convinced that high-quality petfoods are effective for preventive health care, more likely to buy products addressing pet aging and weight issues and more likely to consider that their pets have special nutritional or health needs.

Moreover, while dog owners on average are slightly more concerned about such issues than cat owners, that pattern does not hold when comparing dog and cat owners who are fans of functional benefits.

This functional mindset has had and will continue to have a significant effect on the competitive landscape for pet nutrition products. For example, treats have grown their share of the market (and challenged nutritional supplements, which are the ultimate distillation of the functional concept) due to robust interest among dog and cat owners in treats as a way to promote overall pet wellness and to address specific pet health concerns. Sales of functional petfoods and treats are also fueled by another characteristic of fans of functional benefits: a higher propensity to pamper their pets. Compared with dog and cat owners overall, dog and cat owners who prioritize food product benefit statements are significantly more likely to strongly enjoy purchasing products that pamper their pets, at 29% vs. 41% in the case of dog owners and at 27% vs. 44% among cat owners.