Hot keeps getting hotter. With the global treat market worth an estimated US$4 billion, Petfood Industry chose treats as the subject of its most recent Petfood Focus event, held April 18-19, 2007, following Petfood Forum 2007 in Chicago, Illinois, USA. Over 275 attendees were present. Three of the topics from this event are summarized here.

Treat market overview

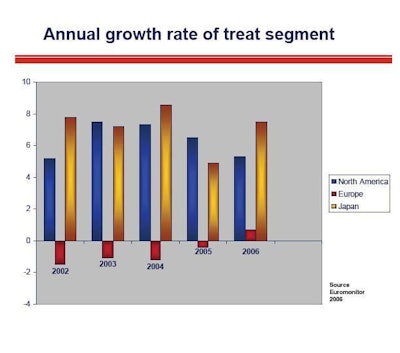

Bruce McKay, a petfood industry consultant, presented an overview of global treat trends using data from Euromonitor International. On a volume basis, the petfood market has averaged modest growth of 2.5% annually over the past five years, while the treat segment has shown slightly higher growth.

He noted that two areas of the world dominate: North America represents 52% of the global treat market, while Western Europe accounts for 30%. In value terms, all major regions of the world are showing solid growth, particularly Eastern Europe and Latin America.

McKay stated that as you look at global opportunity you need to look at the market differently. He believes there should not be a one-size-fits-all strategy for this marketplace and that there are very different opportunities regionally.

"I think there are new volume opportunities in some of the emerging markets of Latin America, Asia and Eastern Europe in particular. I think that they will exist for some time to come," stated McKay.

Germany, England and Japan have all had a lead on North America in terms of sophistication of the packaging and of some of the products, according to McKay. The consumer is showing a strong willingness to pay. McKay thinks this is something American companies should consider. "I think they can increase the sophistication of their products, increase the price points and capture a lot more value," he said.

McKay took a six-year look at the treat business, and he found that the dominating markets of North America and Japan were showing the best growth (see Figure 1). He also found that treats range in price from US$1.00/lb. to US$30/lb. "The truth is that some consumers are buying those products at US$30/lb. This is a very exciting opportunity. And it's only going to get more dramatic as functional ingredients are promoted more aggressively. The beauty of treats is that you should have a singular focus in the functional benefit, so there's an opportunity to have a much more complete line and to capture this idea of added value," said McKay.

Next, McKay compared the human market to the pet treats market. "The important thing here is the consumer has to understand the function of the product for themselves before they would contemplate giving it to their pets. As you evaluate your opportunities, make sure you've looked at it from both sides with a human mind-set before jumping into the pet side of things. We can't get too far ahead of ourselves," he said.

McKay demonstrated that two-thirds of people answering a survey weren't quite sure what particular functional products did. There was uncertainty about probiotics, glucosamine and omega-3s. "If a consumer sees four or five different messages on a petfood package, frankly they get confused. At times we do ourselves a disservice trying to give away too much, or assuming the consumer understands more than we think they do. There is an opportunity to get more of a singular focus on treats. This will capture more of the value that I think is out there," said McKay.

Functional ingredients

Dr. Robert Taylor, chief of staff for Alameda East Animal Hospital and one of the stars of Discovery Channel's E-Vets Interns TV show, gave his veterinary perspective on how functional ingredients in treats could be best used for companion animal health. He began by emphasizing that his over-riding principle is to be overly cautious about the types of treats he recommends because, ultimately, the veterinarian bears the burden of responsibility for everything he/she recommends.

From there, Taylor went on to describe his "ideal treat." He said that he would like to have numerous sizes of a particular product available, because dogs come in variations from two pounds to 250 pounds. Secondly, he requested proven digestibility. "We are seeing great strides in digestibility studies. I commend you [the industry] for doing that. But, as it stands now, many of the treats out there now possess or pose some risk, so we have more work to do in furthering those digestibility studies," Taylor said. His ideal treat would have very little risk for obstruction, and obviously no risk of toxicity/poisoning.

He noted that veterinarians in general have major issues with pilling animals (administering oral medications). He often sees very poor compliance on the part of the owner to give a particular product. Thus, he requested a better solution for an oral drug delivery system, whether it's a supplement or a medicated edible chew product. In an ideal situation, he would like to see an oral delivery form for a variety of different things. Medications, vaccines, vitamins, probiotics, etc., would really make his job much easier and would really benefit animals worldwide, according to Taylor.

One of the things that intrigued Taylor about the petfood industry is that manufacturers can change the taste and the smell of various products. He said it would be very useful to have a functional product with a new taste/smell profile for every day (up to 30 days of treatment), so the animal wouldn't tire of the flavor.

So, what does the future hold? As Taylor sees it, edible vaccines could be used to eradicate animal diseases around the world. Another trend that he has found very intriguing is the emergence of obesity in our animals. He thinks the petfood industry could utilize some of the information that is currently developing with new novel nutritional treats/products involving enzymes, probiotics and some form of oil product, like palm oil, in an effort to create early satiety.

Treats for dental health

Dr. Jennifer Larsen, consultant for Davis Veterinary Medical Consulting PC and assistant clinical professor at the University of California at Davis, shared her perspective on dental treats. She told the audience that a survey of veterinary practitioners from 52 private clinics found that dental disease was the most commonly reported disorder in that population. Of over 31,000 dogs in that population, over 20% of dogs of all ages had calculus and 20% gingivitis. Of 15,000 cats of all ages, 24% had calculus while 13% had gingivitis.

According to Larsen, using foods that are formulated for dental disease as treats in small amounts in addition to the animal's regular diet is commonly seen in practice. The interest in functional foods is likely to drive dental treat growth, according to Larsen.

Larsen said there are two different strategies used in dental foods and treat products, mechanical and chemical. The mechanical effects are scrubbing and structural. The size and shape of the kibble or the treat influences chewing time, which in turn influences tooth contact time and gingival stimulation. Another aspect of the mechanical strategy is the abrasive effect.

On the chemical side, there are a couple different ways to deal with dental disease. Some chemicals are aimed at the bacterial population (antimicrobials) and are designed to inhibit calculus formulation. Some of the common antimicrobials in both foods and treats include enzymes. Enzymes include lactoperoxidases and such things naturally occurring in saliva, and they have been added in even higher amounts in treats and some foods. Chlorhexidine is an antiseptic that is incorporated in some treats and added to some rawhide type dental treats.

Zinc salts are also showing some promise in this area, according to Larsen. Currently, they are used mainly in toothpastes and gel products that are applied to the tooth surface. They have antimicrobial affects and some inhibitory affects on calculus formation as well.

Another newer antimicrobial strategy is the use of grape and green tea polyphenols. They have been used mainly in the food area, and Larsen has not seen them incorporated into treat products yet. She believes that this is an area that will become more common.

Calcium chelators are another chemical means of inhibiting calculus formation. They work via taking away the calcium present in saliva and binding it up so it's not available to mineralize into a calculus on the teeth. Chemical chelators include sodium tripolyphosphate and sodium hexametaphosphate (HMP). They have been proven to be a pretty effective means of dental disease prevention, noted Larsen, especially when used as a coating on kibble. They have not been shown to be effective when combined into the kibble itself, however.

Larsen stressed that it's important to prove efficacy when you have a functional product such as a dental treat. Not only to meet regulatory approval, but because a lot of recommendations will be coming from the professional (veterinary) sector. Veterinarians want to see proof of efficacy because their reputation depends on that. The consumer is also becoming more discerning as far as demanding proof of efficacy.

"There's an expanding market for dental treats, I think, that's really exciting, there's a lot of opportunity for growth and some really great innovative products. I really encourage you to establish efficacy with your clinical trials and apply for Veterinary Oral Health Council approval," she concluded.