Shanghai, China-based Navarch Pet Products Co. Ltd. is young but motivated. Only 10 years old, Navarch says it has accumulated 2 million customers and served hundreds and thousands of dogs and cats within its mission, “Respect All Life, Embrace Them with Love.” With a keen focus on the consumer experience, particularly in China, Navarch has made great strides in the Chinese pet food market.

“What sets us apart is our focus on the consumer experience, consumer insight and consumer interactions, in addition to our fun, engaging and entertaining marketing strategies based on consumer insights,” says Jin Huang, international business director for Navarch. “We pay great attention to thinking the way [our customers] are really thinking and getting to know what they really need.”

Intertwined: e-commerce success and company culture

Navarch moved into the e-commerce space in 2011, when it became clear that Chinese consumers were becoming increasingly drawn to online purchasing. It’s a move that has paid off significantly for the company. Today, 70 percent of Navarch’s business is e-commerce, all coming from mainland China, and 80 percent of business is mobile.

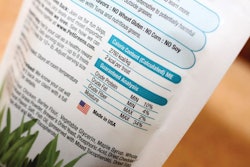

According to Huang, the majority of Navarch’s growth continues to come from its e-commerce business — the company even has a special e-Navarch pet food brand available exclusively through online ordering. The products come in 2.5-kilogram bags for RMB60 (roughly US$9.48) each, with both dry cat food and dry dog food formulas available. The packaging is custom-made to stand out in an online space: plain branding and colors that paradoxically pop out among the complex noise of the internet.

Navarch has taken great pains to build its company culture around the success of e-commerce and its inherent closeness to pet owners through easy digital access and social media. The company has an entire customer service center, about 20 people, each person specializing in a given platform and/or food product — and in the consumers buying or seeking to buy those products. Beyond simply recommending a product, the employees at the customer service center answer questions about food, pet care and nutrition, and are able to recommend additional orders. They are trained by both in-house and third-party trainers on things like nutrition, pet care and customer service.

“Our company’s keys to growth are strict control on product quality; attention to consumer experience, consumer insights and interaction; and our marketing strategies,” says Huang. “Pet culture is our company culture. Navarch employees bring their pets to work, and some of the pets live in the office. Neighbors in our community bring new-born puppies to our front lobby for adoption; stray cats and dogs in the community come to our garden for food and water.”

A future for Navarch online and offline

In the second half of 2018, Navarch will begin construction on a new manufacturing and pet culture base in Shanghai. It will include a state-of-the art manufacturing center, a modern logistics center, and a pet supplement and human-grade food analytical laboratory. But perhaps the most interesting structure in the new base pays homage to part of China’s history. “Most uniquely, [the base] contains a well-preserved antique building from the Qing dynasty 400 years ago,” says Huang. “The antique building will be kept in its original splendor with slight decorations to function as our pet culture museum.”

Navarch’s biggest opportunity, according to Huang, is upgraded consumption in China and the booming Chinese pet care market. “We will continue to focus on e-Commerce/m-Commerce while continuing to monitor and develop offline businesses,” she says. “We’d like to create a pet industry ecosystem including pet care products, pet foods, media, entertainment and pet-related IP products.”

Navarch is also exploring expansion into the international pet food market, starting with southeast Asia.

The company’s philosophy, however, is one thing that won’t change. “What we strive to be known for is, first, our mission: ‘Respect all life, embrace them with love’,” says Huang. “And second, our guiding principles of products: Do customers feel our products worth the money or worth more than that? Are they feeling touched or pleasantly surprised?” With their sales rising each year and their fingers firmly on the pulse of e-commerce and its related challenges, the answer would seem to be, “yes.”

Just the Facts

Headquarters: Shanghai, China

Facilities: Manufacturing Center in Feng Xian District, Shanghai; Logistic and Warehousing Center, Kunshan, Jiang Su Province; e-commerce center, Minhang District, Shanghai

Officers: Hualong Huang, CEO; Jin Huang, international business director

Sales: Annual CAGR 36 percent; online sales remain growing; breed-specific food sales see steady growth and accounts for the majority of the sales. Offline sales remain steady with a slight increase. Natural and grain-free products see steady growth.

Brands: Navarch, Yousheng, Sanidiet, CoolPet, Justborn, Ale’s, etc.

Distribution: Online – B2C; Offline–Regional Distributor – B2B

Employees: 200

Website/Social Media: www.navarch.com.cn; @navarchpets on Facebook

The present and future of China’s pet food industry

China's pet industry is currently in a period of rapid development after nearly 20 years of gradual development, maintaining an average annual growth of 32.8 percent in the past decade, says Navarch Pet Products International Business Director Jin Huang.

“According to statistics, the market size of China's pet industry was RMB71.9 billion (roughly US$11.4 billion) in 2014, RMB97.8 billion (US$15.5 billion) in 2015, and in 2016 exceeded RMB100 billion (US$15.8 billion) for the first time,” says Huang. “It is expected to exceed RMB200 billion (US$31.6 billion) in 2020.”

In the pet care market, the pet food category accounts for the largest market share at 38.35 percent, according to Huang, with pet medical coming in at 25.91 percent, pet supplies at 23.69 percent, other services accounting for 8.34 percent of the market, and live pet sales coming in at 3.7 percent market share.

“The pet industry will continue to grow rapidly,” says Huang. “Pet medical and pet care services will have further development.”

Dog food e-commerce up 92 percent in 2017