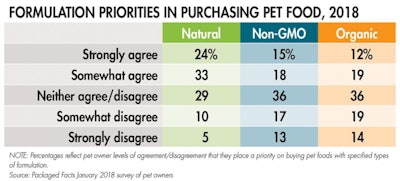

May 2018’s column noted that natural formulation of pet food is an important quality for most pet food shoppers, with a fourth (24 percent) strongly agreeing and a third (33 percent) somewhat agreeing that finding pet foods based on natural ingredients is a priority (see Table 1). Ranking a notch down are non-GMO (either strongly or somewhat of a priority for 33 percent) and organic (strongly or somewhat of a priority for 31 percent).

TABLE 1: The majority of pet owners place a priority on buying pet foods with natural formulations, according to a recent Packaged Facts survey.

Natural positioned pet foods have therefore been posting double-digit annual growth rates in the overall US market, including mass as well as specialty channels. It stands to reason that the broader (albeit more nebulous) positioning as “natural” would have the wider appeal, especially factoring the higher price points associated with organic.

More to the “natural” pet food story

At a Petfood Forum 2018 presentation, Gfk reported that between 2011 and 2017 the average price per pound of pet food and treats in the pet specialty channel jumped by 46 percent, corresponding to similarly supercharged growth rates for freeze dried and dehydrated pet foods, even though these formats are more expensive than organic.

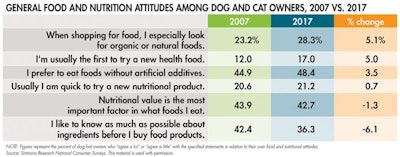

Broader food industry trends shed some light here, as is usually the case in the new normal of humanized pets and pet foods. Looking at general attitudes toward their own food among dog or cat owners over the last decade, the priority placed on organic/natural, “health” foods (another nebulous but potent concept) and artificial-ingredient-free foods has edged upward. In contrast, the value place on “nutritional value,” and especially on specific ingredient information, has slipped a bit, although these remain key priorities.

That is, while the preference among dog and cat owners to eat foods without artificial ingredients increased from 45 percent in 2007 to 48 percent in 2017, eagerness to know as much as possible about food ingredients edged down from 42 percent to 36 percent over this same period (see Table 2). Similarly, though at different numerical levels, the preference among dog and cat owners for organic or natural foods notched up from 23 percent in 2007 to 28 percent in 2017, while the priority on nutritional value actually slipped slightly from 44 percent to 43 percent.

TABLE 2: The percentage of pet owners who say they look for “organic” or “natural” foods for their own plates has increased since 2007, as has the percentage who say they prefer to eat foods without artificial additives.

“Wellness” as a pet food consumer concept

The message is that pet owners have been — for their own foods and for pet foods — honing in on whole, natural and “clean label” foods, as a shorthand for what’s really best to eat for wellness. In the case of pet foods, whole and natural includes freeze-dried or dehydrated, as well as fresh.

Wellness, which like natural is a slippery but (or perhaps therefore) powerful concept, encompasses healthfulness as well as enjoyment of food, whether human, canine or feline. As argued in Packaged Facts’ US Pet Market Outlook 2018–2019, products positioned on health and wellness will remain at the leading edge of the pet humanization and pet product premiumization market trends, rather than pet pampering. Put another way, enjoying holistic health and wellness — centrally including through the whole, natural foods we eat — is the ultimate form of pampering both furry and non-furry members of the family. And this holds especially true for millennials and the rising Generation Z as they drive the trends that will drive market growth.

The latest pet food market insights

www.PetfoodIndustry.com/authors/145