April 2020’s column argued that pet market gains and losses are increasingly about the internet not simply due the cannibalization/Chewy-ification of pet product sales, but just as sharply because of the indirect effects of the e-commerce boom on cross-channel competition. Notably, for example, despite the long-running pet product premiumization and pet food humanization trends in dog and cat foods, discount mass merchandiser/supercenter revenues grew robustly in 2019 while chain pet store sales fell in the wake of the “mass premiumization” trend, whereby formerly pet-specialty-exclusive pet food brands bridged over into the mass market.

COVID-19 pandemic pushes the digital landscape

Data from an April 28 through May 5, 2020, Packaged Facts survey, however, suggest that the novel coronavirus pandemic has, particularly in the case of superpremium and premium pet food buyers, spun this bridge in the digital direction. Among the nearly 600 dog owners responding to the overall pet owner survey, 10% identified themselves as buying dog foods priced “significantly higher” than average and 30% as buying somewhat higher-priced dog foods. Over half (53%) identified themselves as buying average-priced dog foods and another 4% as buying either somewhat or significantly lowered-priced products.

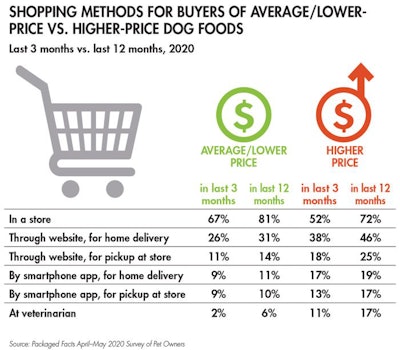

Among the buyers of somewhat or significantly higher-priced dog foods, 52% indicated that they had purchased dog food in a store within the last three months and 72% that they had purchased dog food in stores within the last 12 months (see Table 1). In contrast, among buyers of average or lower-priced dog foods, 67% had purchased dog food in a store within the last three months and 81% within the last 12 months.

TABLE 1: Those pet owners who self-identify as having bought higher-priced pet food in the last three months have been more likely to purchase their products online than those who say they bought average or lower-priced products.

Within the last three months, therefore, roughly coinciding with the first stage of COVID-19 impact, the customer base for higher-priced dog foods has been about one-fourth less likely than buyers of average/lower dog food to buy in-store. In turn, the customer base for higher-priced dog foods has been nearly half again more likely than buyers of average/lower-priced pet food to buy this product online for home delivery, at 38% versus 26%, respectively.

Effects on premium, superpremium pet foods

But how, more specifically, has the COVID-19 pandemic altered the shopping patterns for buyers of premium and superpremium pet foods? These survey data show, not surprisingly, that digital shopping for home delivery retained the most traction among premium dog food buyers, with store-pickup or in-store shopping as a second tier.

Buying dog food through the veterinarian, the most “hands-on” on pet product channels, showed the lowest retention. Only 64% of those who purchased dog food through their vet in the last 12 months did so within the last three months (see Figure 1), even though dog owners typically purchase pet food more often than tri-monthly, and Nielsen data show the novel coronavirus crisis triggering a 50% panic/hoarding buying spike in dog and cat food sales. In contrast, 88% of those who purchased dog food through a smartphone app in the last 12 months did so within the last three months.

FIGURE 1: The COVID-19 pandemic has caused loyalties to shift in purchasing: only 64% of people who said they’ve bought pet food from the vets in the last 12 months have done so in the last three months, while online shoppers have continued to use those methods in higher numbers.

This Packaged Facts survey shows nearly half of pet owners purchasing pet food digitally in the last three months. Overall patterns for dog versus cat owners are very similar, with cat owners slightly edging out dog owners in buying pet food online (at 41% versus 39%, respectively), and dog owners taking a small lead in buying via app (at 18% versus 15%). Interestingly, although adoption of app purchasing for pet foods has been relatively slow, the shopping method ratios for the last three months versus the last 12 months show app shopping — whether for home delivery or store pickup — retaining somewhat more traction than website shopping counterparts, perhaps pointing to a gradual and generationally driven changing of the guard.