While recent data and analysis show pet ownership and pet food sales gains happened mainly among higher-income households during the pandemic, all indicators for continued pet food growth point up. For example, during a presentation at Global Pet Expo on March 23, 2022, David Sprinkle, director of pet market research for Packaged Facts, said end-of-year projections for 2021 put U.S. pet food and treat sales at US$15 billion, a healthy 15% increase over 2020. (The 2021 data are not yet finalized.)

As we all know, much of that growth has happened online; indeed, rising pet food e-commerce is probably the most significant driver for overall pet food market growth. This started before the pandemic and has accelerated since. Sprinkle shared additional data showing that 40% of U.S. pet owners said the pandemic caused them to shop for pet products online more; and since then, the share of owners buying pet products almost or always online has risen to 18%, up from 7% before the pandemic.

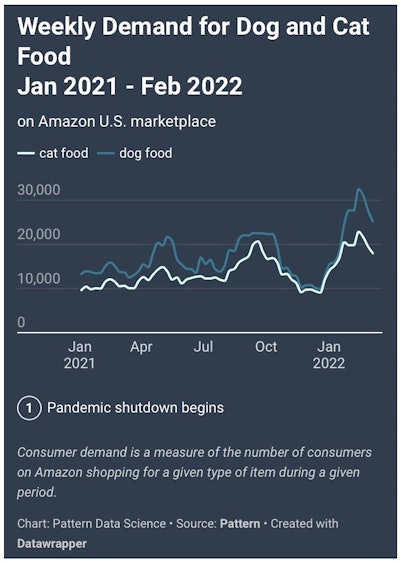

The largest e-commerce platform, Amazon, has also seen significant growth for pet food and pet product purchases. According to new data from e-commerce experts at Pattern, demand for dog and cat food on the Amazon U.S. marketplace spiked in January 2022, following a general upward trend.

Do Amazon demand data reflect pet food supply concerns?

Pattern’s latest report shows U.S. Amazon demand for pet food from January 2021-January 2022. Demand varied throughout the period, rising roughly every two to three months—likely when pet owners restocked food for their pets, or perhaps their Amazon subscriptions were set for reorders.

Data from Pattern, an e-commerce firm, show ongoing demand for dog and cat food on Amazon. l Courtesy of Pattern

A little more curious was a noticeable dip at the end of the year, maybe due to a combination of owners having restocked in October, then being busy during the holidays? (Finally getting to celebrate holidays for the first time in two years.) After that decline, demand was bound to bounce back in January 2022, though the data show more than just a rebound, especially for dog food. More than 30,000 consumers shopped for dog food that month, much higher than at any point the previous 12 months.

I have to wonder if concern over products not being available due to supply chain disruptions led some dog owners to replenish at more than their normal levels? Or perhaps owners who do still buy dog food at brick-and-mortar stores turned to Amazon when their local retailers were out of their chosen brands.

Cat food demand was also higher than in any previous month during the period, though not as dramatically, with nearly 23,000 consumers shopping for cat food in January 2022.

Dog food shoppers nearly doubled in one year

Coming out of January, the demand data indicate a falloff; it will be interesting to see the trend line going forward as more data becomes available. But bottom line, the demand at the end of January 2022 was decidedly higher than in January 2021: 25,154 shoppers for dog food on Amazon vs. 13,902 (almost doubling in 12 months) and 17,998 shoppers for cat food in 2022 vs. 10,405 in 2021. This likely reflects an increased number of pets needing to be fed, as well as the continuing rise of online shopping for pet food.